US indices have been gaining daily since the beginning of May. They have found strength amid relatively weak job reports and quite upbeat quarterly earnings. The S&P500 and Nasdaq100 indices are just 1.5% below the all-time highs set in March.

The market downturn in the first three weeks of April has whetted bargain hunters’ appetite. Investors returned to buying on signs that the economy and labour market were cooling.

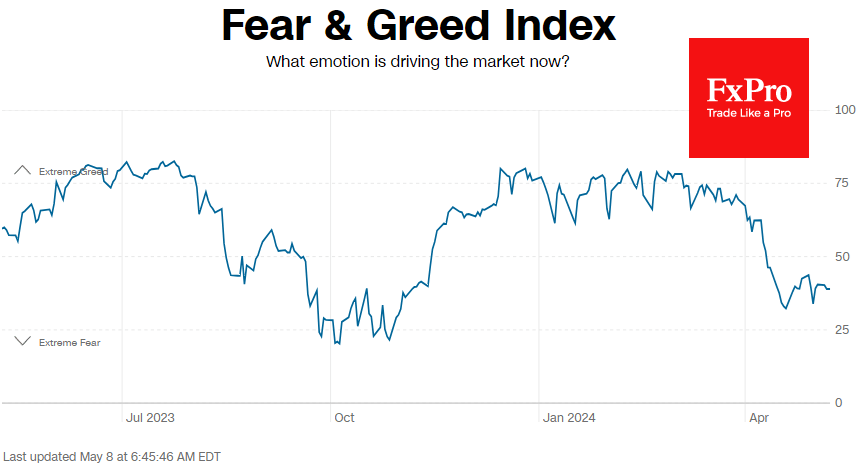

The decline in April effectively removed the overbought condition on the equity market, dipping into “fear” territory from the “extreme greed” seen in early March.

We see the return of all three key US indices – Dow Jones, Nasdaq100 and S&P500 – back above their 50-day moving averages as a technically important signal. A weak labour market report last Friday shifted the balance in favour of buyers.

While the Japanese market went out of favour with speculators last month, their attention seems to have shifted to Europe. Almost daily, the FTSE100 index is updating all-time highs, adding 8% to the lows of 19 April. Germany’s DAX40 has added 6% over the same time and is just 0.5% below its all-time high. These are indirect but rather important signs of risk appetite in global equity markets, which is also positive for the US market.

The S&P500 corrected in April to 76.4% of the rally from the October lows to the peak in early April. This is not a classic 61.8% Fibonacci retracement, but it is also quite common in strong bull markets.

Confirmation of this bullish scenario would be a rally of the index above 5300 with a renewal of the all-time highs. According to the Fibonacci extension, the next strong correction will only be in the 6000 area in the 6–9-month timeframe. Within this scenario, the bullish targets for the Nasdaq100 will be the territory above 21000.

The FxPro Analyst Team