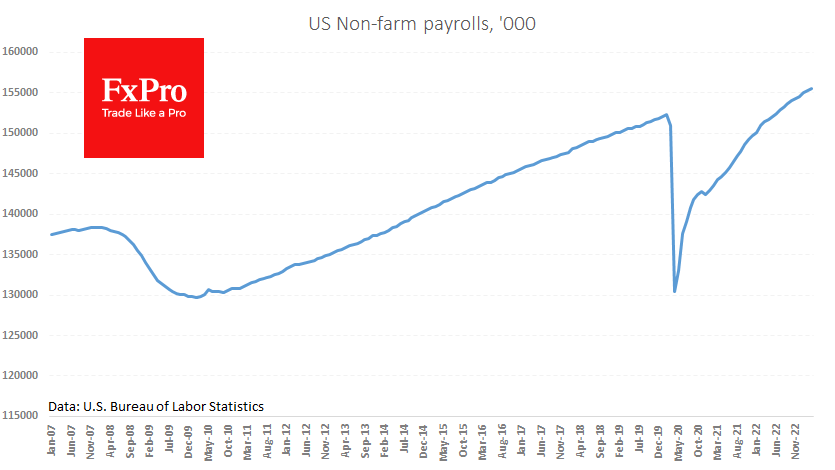

The US economy added 236K jobs in March, very close to the average forecast. The unemployment rate fell 0.1 percentage point to 3.5%, while the labour force participation rate rose from 62.5% to 62.6%, vs the expected fall to 62.4%.

Looking at this data, we can again see that the US labour market is in great shape, ignoring all the warning signs and threats. In the minutes following the release of the data, the interest rate futures market increased the odds of another Fed rate hike in early May from 50% to 70%. This should be good news for the dollar and not so good for the high-tech Nasdaq index, which is struggling to get a rate hike.

Digging deeper, however, the report is not so positive. The private sector added 189K jobs – the lowest number since December 2020. Construction and manufacturing saw net job losses of 9K and 1K, respectively. Not much, but it already looks like a turnaround, which often starts with these sectors.

The index of weekly wages paid has been stagnant since the beginning of the year, as has the index of hours worked, as employment growth is offset by a fall in the average working week. Except for the first COVID-19 lockdowns, a similar pattern was only observed in 2008 and ended with a sharp decline.

We also note that the growth in total employment is not warming up wages. Its growth rate has fallen to 4.2% YoY as growth in the service sector absorbs low-paid workers returning to the labour market (as we can see from the rise in the participation rate).

The FxPro Analyst Team