US and UK markets have returned to an uptrend

March 03, 2022 @ 13:00 +03:00

In times of crisis, after initial chaos and sell-off around the globe, the market quickly calculates the winners: both in February-March 2020 and last month, the market decline was general, but very soon the markets diverged in their dynamics.

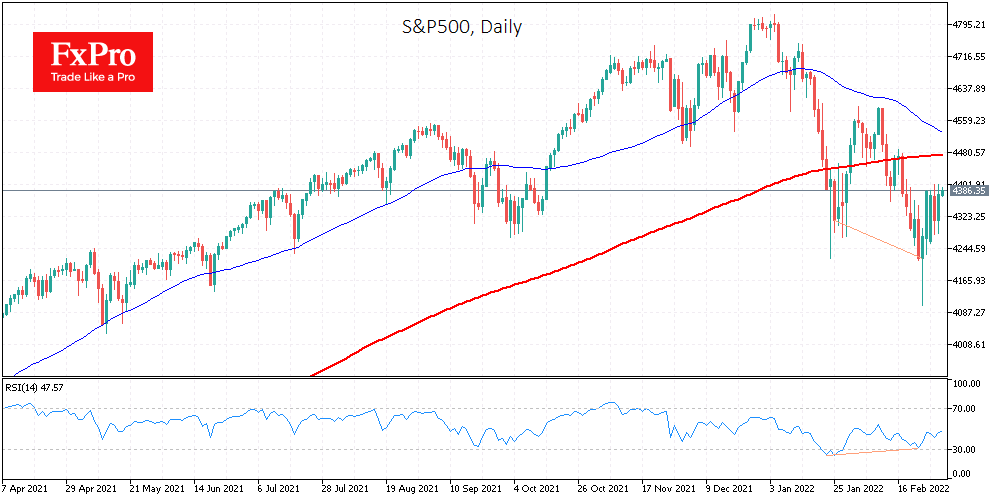

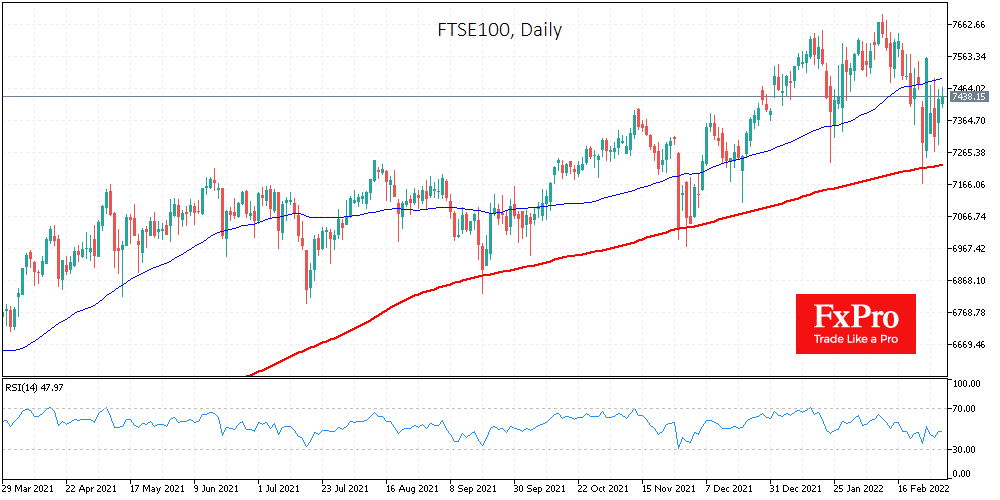

Events in Ukraine at the end of last month provoked chaos in the stock markets of all regions. However, the S&P500 and FTSE100 indexes already managed to find the support of buyers on the first day of hostilities. Since then, these indices have formed an upward trend.

The S&P 500 is testing the 4400 mark, above which it last traded solidly before Feb 17th. At the same time, futures are now 7.1% higher than the minimum point at which they were a week earlier. The FTSE100 is not gaining as much and is now up 3.4% from last week’s lows.

In both cases, we see an upward movement, albeit shaky. It is explained by the market’s less dependence on the state of affairs in Eastern Europe since the companies represented in the S&P500 are significantly diversified and removed from the epicentre of events.

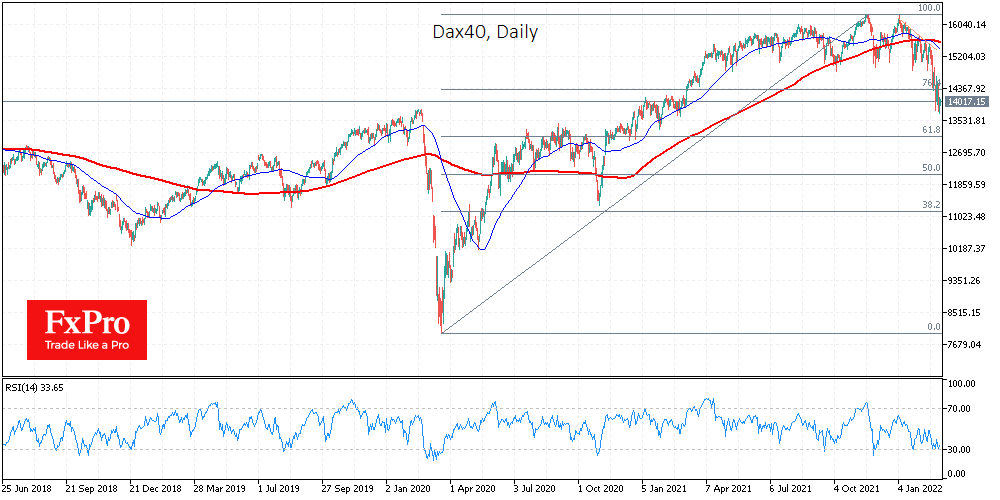

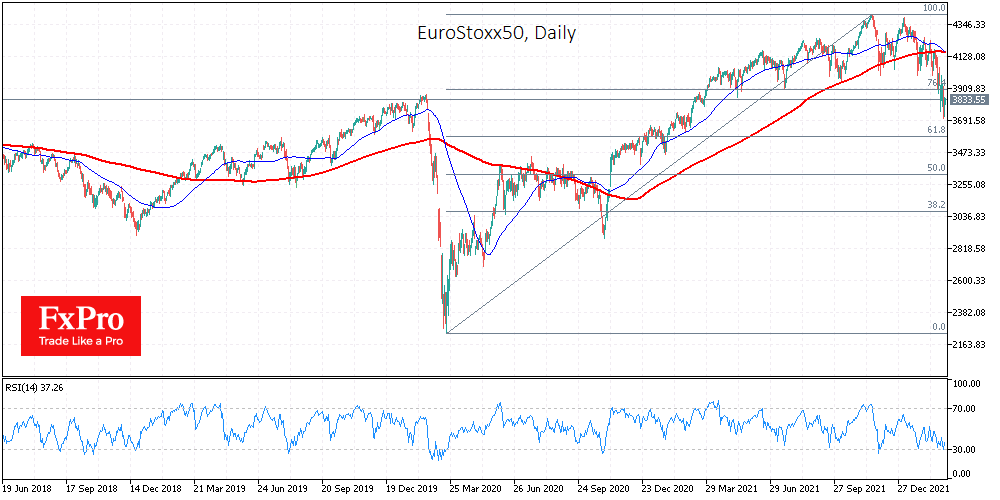

In contrast, the European Euro50 on the 1st of March fell to lows for almost a year. A similar pattern was observed for the German DAX. The charts of both indices have been dominated by sellers since the beginning of the year, and this trend has intensified sharply in the last two weeks. The DAX and EURO50 have about 7% more downside potential in the next few days before finding support.

In our opinion, central banks may now be on the side of buyers in Western Europe and the United States, which are likely to soften plans for tightening monetary policy, despite the rise in commodity prices.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks