The British Pound is losing ground against the US Dollar for the second day in a row as pressure mounts on fresh UK employment data.

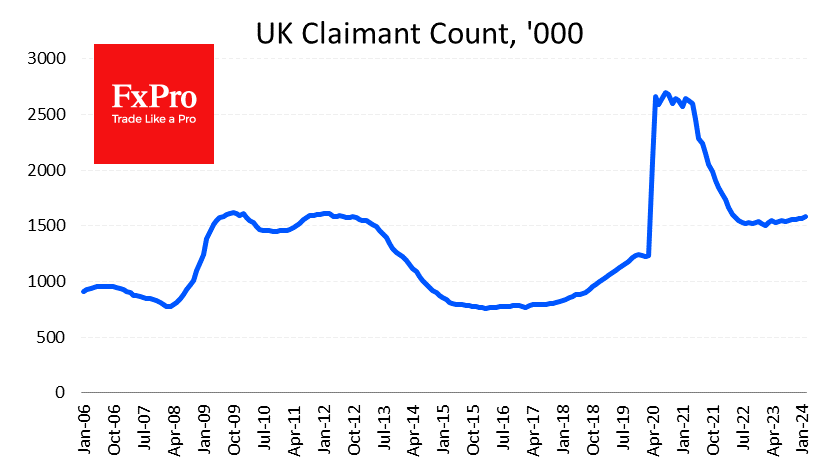

Data for February showed a rise in Claimant Count by 16.8K – the biggest since April last year. Overall, a moderate growth trend has now been in charge for a year, after almost a year of stagnation.

The pace of wage growth has continued to slow. Earnings growth, including bonuses, slowed to 5.6% in the three months to January from 5.8% previously. This is the lowest rate in a year and a half and below the forecast of 5.7% but well above the historical average of 3.3%.

At 3.9%, unemployment remains close to lows not seen since the mid-1970s.

On balance, the labour market indicators allow the Bank of England to ease monetary policy at a much earlier date while not fuelling speculation of an imminent or imminent economic contraction. Despite high interest rates, full employment is supporting domestic final demand, which accounts for over 80% of the UK GDP.

The FxPro Analyst Team