UK inflation went below expectations

October 20, 2021 @ 12:43 +03:00

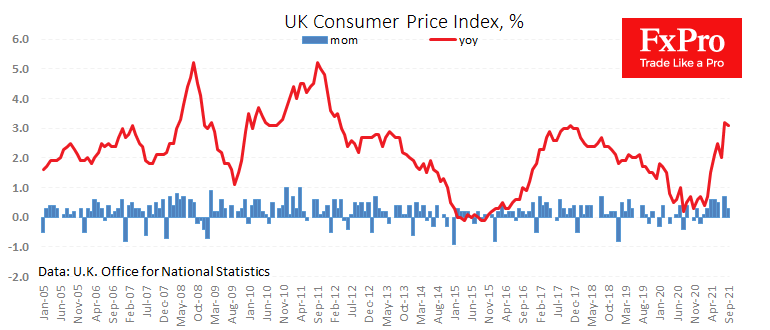

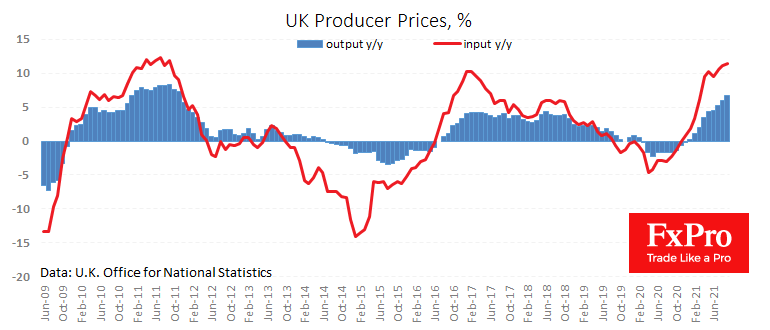

UK inflation data surprised with weakness, with the year over year price growth slowing to 3.1%. Looking back at the rate of producer price performance, it would not be surprising if the pullback in inflation was temporary and illusory, as we have already seen in July. Most likely, the peak is yet to come as it will take a few more months before the double-digit rise in Input PPI is passed down the chain to consumers.

However, the signals of easing inflation pressure cannot be overlooked. Producer input prices rose by only 0.4% MoM, the smallest monthly increase since last October. The YoY growth rate rose to 11.4%, but the chart of PPI shows a plateau, which suggests that the price growth rate is stabilising. It is still too early to talk about a slowdown in inflation, so the current figures should not be seen as a signal for the Bank of England to stop raising rates as early next month, which would make them the first of the G7 to do so.

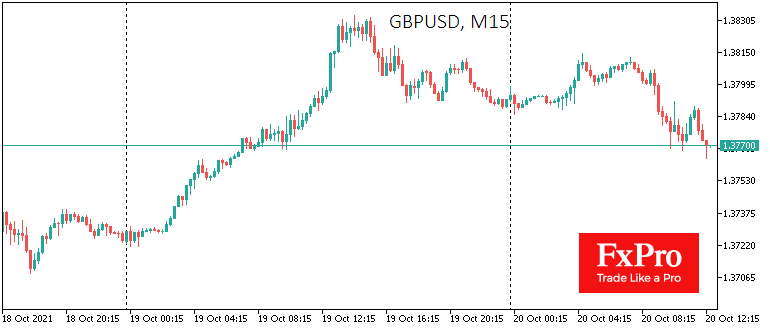

The pressure on the pound at the start of Wednesday shouldn’t be attributed to lower-than-expected inflation. It is more a reaction to rising yields in the debt markets, which is boosting interest to the dollar, keeping risk demand in check, and preventing the FTSE100 from updating its post-pandemic highs.

The FxPro Analyst Team