According to a data set released on Friday, the UK economy performed better than expected across a wide range of indicators in June. GDP rose by 0.2% in the second quarter and 0.4% in the same quarter a year earlier. Expectations had been for growth of less than 0.2 percentage points.

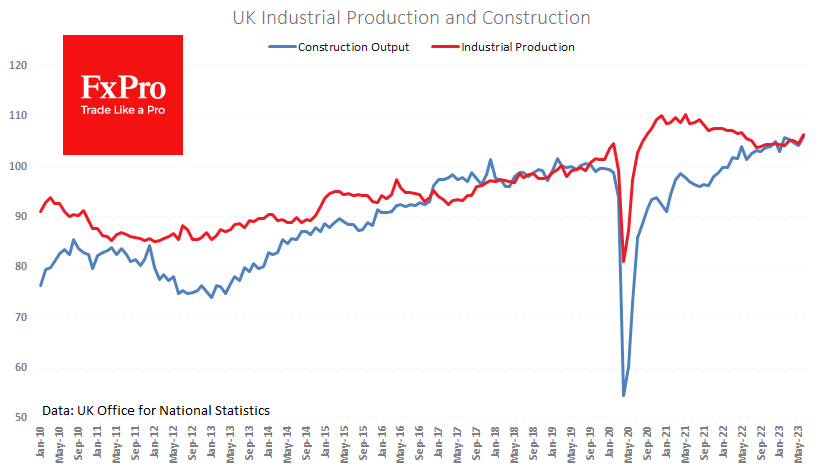

An impressive 1.8% m/m jump was recorded in industrial production, with manufacturing output rising by 2.4%. After many months of sluggish performance, the industrial production index is at its highest level since May 2022.

Activity in the construction sector did not lag, rising by 1.6% m/m and 4.6% y/y. The uptrend in these sectors contradicts expectations that high-interest rates are dampening economic activity.

Such robust data encourages the Bank of England to step up its fight against inflation without stopping to raise interest rates in the coming months. And that’s good news for the Pound, which rose almost 0.5% against the Dollar to 1.2735 on Friday after three weeks of declines.

Strictly speaking, a smaller trade deficit than expectations and previous data is also positive for the Pound. However, the decline in exports and imports indicates weak demand and could be an early indicator of economic weakness.

The GBPUSD has fallen more than 3.5% from its peak of 1.3120 set about a month ago. The Pound’s momentum in August increasingly suggests that the almost year-long rally is entering a correction phase. The trajectory of the correction suggests a pullback to 1.2420 or further to 1.2060 before the speculative appeal of sterling buying returns.

The FxPro Analyst Team