The Swiss franc’s uncomfortable altitude

December 22, 2023 @ 18:19 +03:00

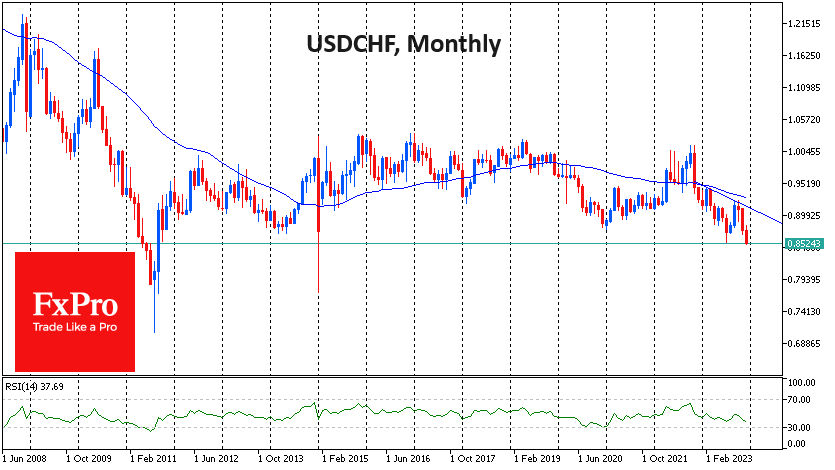

The Swiss franc hit nearly nine-year highs against the dollar on Friday, adding over 6.2% YTD and 8% YTD. If we exclude the period of abnormal volatility on 15 January 2015, EURCHF rewrote historic lows, falling just a couple of pips short of 0.9400.

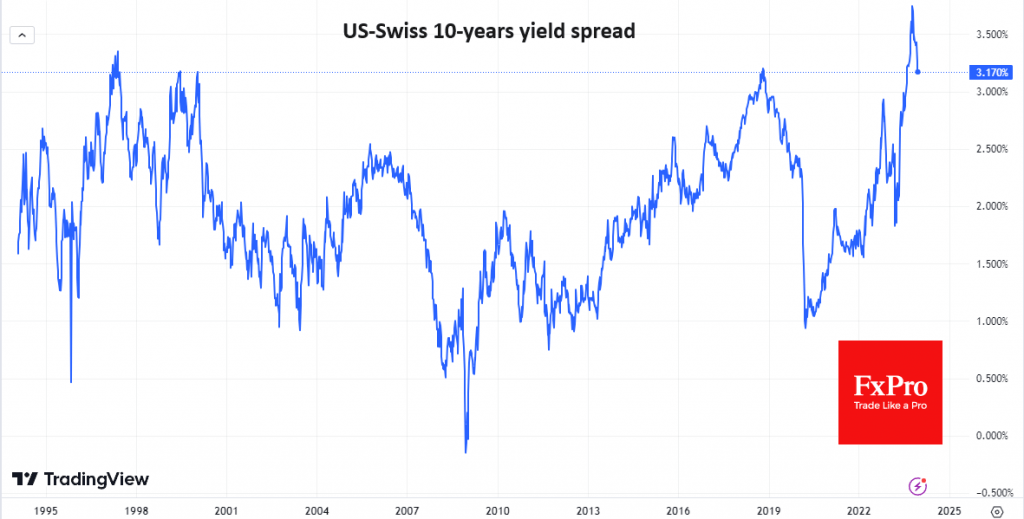

The Swiss franc has been the strongest performer since the start of the year, with the most pronounced acceleration in recent months. The falling US and eurozone government bond yields are on the side of the franc. From its peak in early October, the spread between US and Swiss 10-yr yields fell by 0.6 percentage points to 3.17%, and between the Eurozone and Switzerland by 0.53 points to 1.2. The pronounced decline in US and European yields increased the relative attractiveness of investments in Swiss debt instruments.

The narrowing of yield spreads is explained by the fact that the small mountainous country is not expected to cut rates as aggressively as the Fed or ECB.

However, we are cautious about the prospects for further franc growth. The yield spread of 3.2 percentage points is still higher than it has been at its peak since 1999, and in 1997, the reversal was near 3.34. That is to say, the yield differential between Swiss and US bonds remains in favour of the latter by historical standards.

Another reason is the dissatisfaction with the exchange rate dynamics on the part of Switzerland itself. Consumer inflation has already rolled back to 1.4% y/y in November, while producer prices were losing 0.9% in November and 1.3% in the same month a year earlier. The appreciation of the franc in recent months promises to put even more pressure on inflation, which already looks excessive.

The Swiss National Bank sounded very conservative on monetary policy last week in contrast to Powell’s dovish reversal. However, it is worth realising that the SNB has an impressive history of interventions to weaken the national currency. It is much more comfortable for the Central Bank to conduct them by buying dollars and euros for the reserve fund than to contain the weakening of the exchange rate by selling off assets.

The FxPro Analyst Team