The pound fell on ‘selling the fact’ trade

April 06, 2021 @ 19:07 +03:00

The British FTSE100 is gaining 1.3% to a three-month high, on enthusiasm from Prime Minister Johnson’s announcement that coronavirus restrictions will be lifted as early as next week.

Interestingly, the British Pound, on the other hand, came under pressure in European trading. GBPUSD lost 0.7% intraday, returning to levels at the end of last week. The currency market appears to be “selling the facts”, selling off the Pound after a prolonged rally since the start of the year.

The Pound has rallied since the start of the year on a relatively successful domestic vaccination campaign, in stark contrast to the Eurozone. However, it cannot be ruled out that we are now seeing a reversal of the trend that has set the Pound apart from its biggest competitors.

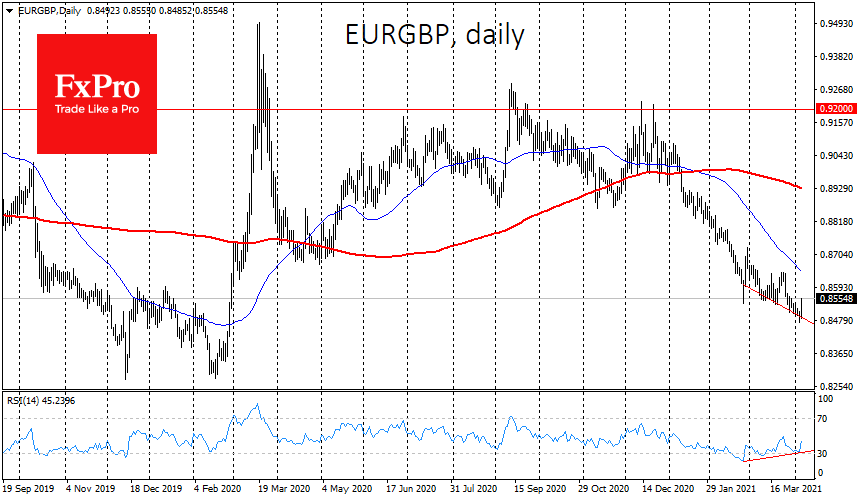

This rally was particularly pronounced against the Euro with 6.7% this year. But this now may be over. The EURGBP pair is adding 0.7% to the weekly highs, hitting a wall of buy orders for the Euro against the Pound. The buying of the Euro against the Pound should also be linked to ambitious plans by the EU to achieve collective immunity by the end of July.

From the lower end of the trading range of the last 4 years, EURGBP is capable of a quick reversal to the area of 0.9200 before the end of this year, i.e. to the upper end of the range.

The FxPro Analyst Team