Stock markets are under moderate pressure on Monday morning. To clarify, “moderate pressure” translates into a fifth consecutive session of declines for the S&P500, dumping the index by 1.6% from record levels. Meanwhile, the sell-off in long-term bonds continues, causing yields to rise. Investors’ exit from long debt securities is a reflection of investors’ demand for higher yields due to inflation fears.

Such fears of inflation are a breeding ground for rising commodity prices. And there are several reasons for this, which also have strong macroeconomic underpinnings.

Firstly, the coronavirus restrictions have dealt a severe blow to services, but not to production. Industrial production has recovered to pre-coronavirus levels, but ultra-soft monetary policy, big relief packages from governments and logistical problems are pushing producers to compete for scarce resources, pushing up the price.

Secondly, traders in the markets do not have much of a choice of assets to hedge against inflation. It appears much safer to bet on standardised exchange-traded commodities than to choose individual companies. The global economy is just starting its recovery, so the uncertainty is significantly higher than the average in recent years, which can hardly be seen as dull.

Thirdly, ‘cheap’ money is now an opportunity to buy oil, gas, industrial metals and agricultural commodities well ahead of a full-blown return in demand. These seem like sensible stock market speculations in the current environment.

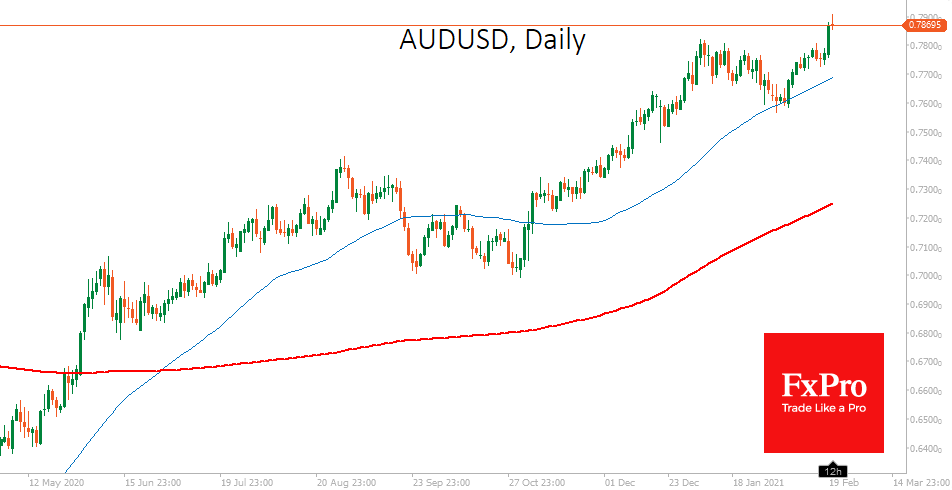

An important sign from the market is that the Australian and Canadian dollars have broken through their established trading ranges. Betting on their rise seems like a logical result of the growth in commodities. Developments in industrial metals and energy prices set the stage for a repeat of multi-year gains in AUD and CAD, which have appreciated against USD by more than 60% and 45%, respectively, through 2001-2008.

Soft monetary policies in these countries have long left investors hesitant to buy these commodity currencies. However, expectations that commodity export revenues will be the first to recover and get the economy back in shape push these currencies higher on speculation that central banks will consider policy normalisation, thanks to strong footing and trade balance surplus.

The FxPro Analyst Team