The markets reassured Italian government; Powell is trying to persuade markets

October 03, 2018 @ 10:46 +03:00

The single currency restores a part of positions in morning on Wednesday after a publication in the newspaper Corriere Della Sera that the government intends to reduce the budget deficit to 2% by 2021 following the turbulent reaction of markets during the week and criticism from the European Parliament. The common currency is trading at 1.1585, while yesterday it fell to 1.1505 at some point. The markets welcomed this news as a sign that Italy agrees to follow the general rules. It would cost more for the Italian government to stick to the initial objectives of the budget deficit of 2.4%, as the yields growth to 4-year highs promised a significant increase in debt service costs exceeding 132% of GDP.

Despite some restoration of the single currency position, it is hardly to expect that the populist government of Italy has took a lesson that the markets gave to it. Such outbreaks from the Italian assets can become a commonplace in the coming quarters. The shares of the banking sector of the country could stay particularly vulnerable.

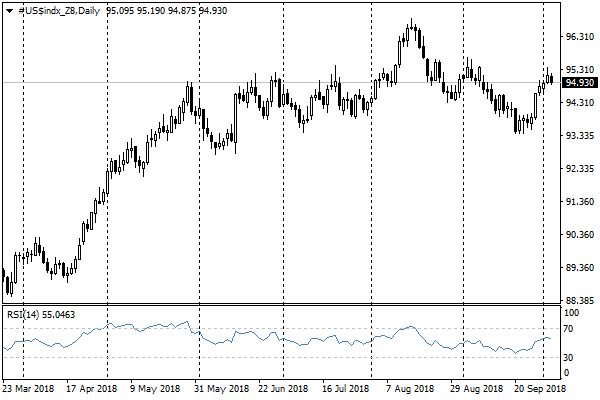

The dollar index has been declining this morning for the first time since last week due to the impulsive reaction of the euro, but the U.S. currency still has chances to develop its offensive. Powell, the Fed Chairman, noted a “remarkably positive outlook” for the U.S. economy, capable of postponing Trump’s attempts to undermine the established World Trade order.

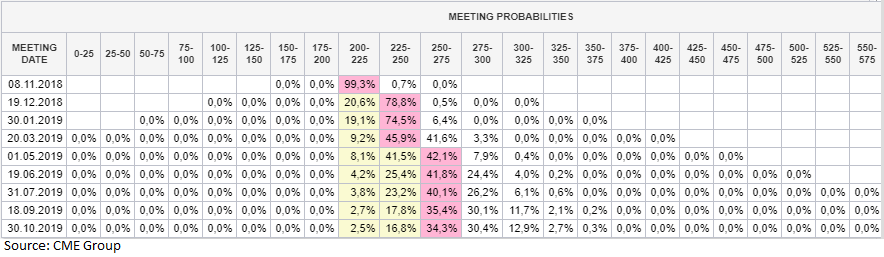

Powell’s confidence is mostly ignored by the markets. According to the CME’s Fed Watch tool, market participants expect (80% chance) just one increase in December this year and only one more (36%) in the next 12 months, against 2-3, which are predicted by FOMC members. Apparently, Powell’s hawk rhetoric is aimed at changing these expectations.

In turn, these changes are a strong potential support factor for the dollar. Earlier this spring, we watched the dollar rally, when the markets increased their expectations from 2 to 4 raise rates, in line with the initial FOMC expectations.