The Dollar made a crucial technical breakdown the previous week following a public admission from the Fed of a policy reversal. The Fed’s comments and subsequent press conference pressed the Dollar index under its 200-day moving average. The decline continued on Thursday as neither the Bank of England nor the ECB acknowledged that they were ready to cut rates as the Fed.

As a result, the dollar index collapsed 2% in two days, the sharpest sell-off since July. Back then, it was the final chord of the Dollar’s fall before the start of a long climb. There is no slight chance that a bottom will begin to form in the Dollar near current levels and a subsequent reversal to growth.

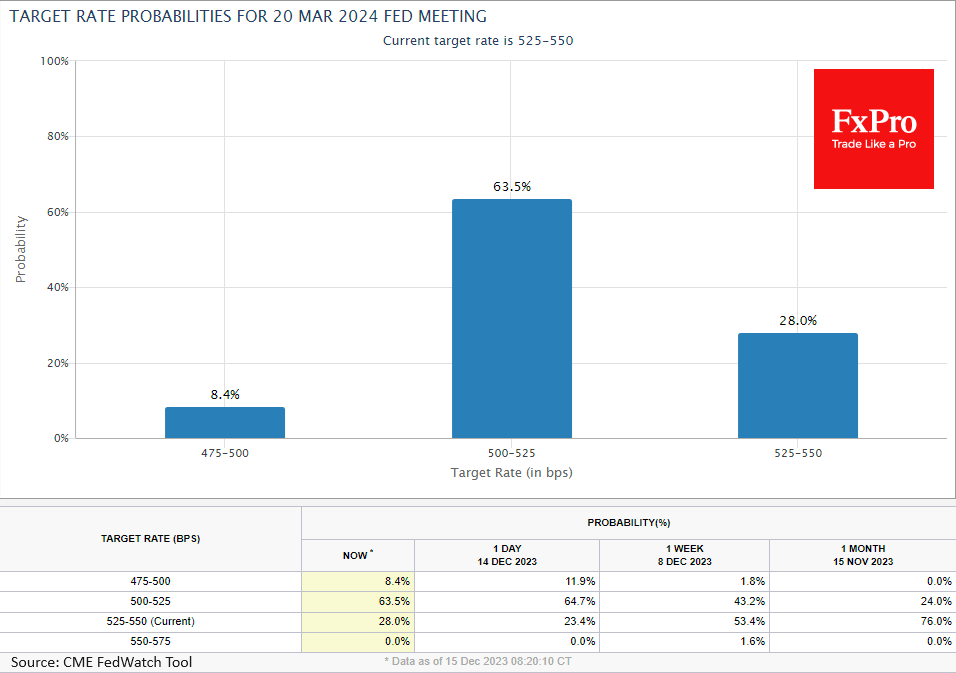

The fundamental reason for the dollar’s sell-off was a powerful reassessment of interest rate expectations. As soon as the Fed agreed with the markets to build 3 rate cuts into the forecasts in 2024, the markets demanded twice as many – six rate cuts. According to FedWatch, futures are pledging a 15% chance of a rate cut on 31 January and an 80% chance on 20 March 2024. Two months ago, when the dollar index was forming a peak, it assumed a 40% chance rate would be higher than current rates in March and a 50% chance in January.

Six rate cuts are hard to justify against a background of an economy growing beyond expectations: retail sales are increasing, wages are rising faster than inflation, and jobs are being created at a healthy pace.

It’s more likely that the ‘rate expectations’ are the result of technical factors at work, as too many investors sold US government bonds before October but have found them attractive in recent weeks. The speed of recovery in US equity and bond markets has created an environment of not just FOMO but shorts’ destruction, intensifying amplitude, and helping markets jump above headwinds or reasonable macroeconomic valuations.

We may well see a normalisation of expectations in the coming days and weeks, which will work for the Dollar and probably deflate excessive optimism from the equity market. Added to this is the difference between how badly Europe is doing (except for the pace of wage growth) and how well the US is doing (except for housing sales). The current situation can be compared to the recovery from the financial crisis, when the chronically weak growth of the Eurozone crystallised with the very buoyant growth of America, forming a long-term trend of strengthening the dollar index since 2011.

The FxPro Analyst Team