The market is seeking a haven

February 20, 2026 @ 12:59 +03:00

- JPY and EUR are giving back their safe-haven status to USD.

- USDJPY is rising amid slowing Japan inflation.

Growing geopolitical tensions in the Middle East and the Fed’s reluctance to resume its cycle of monetary expansion are driving the US dollar towards its best weekly performance in four months. According to a Wall Street Journal insider, Donald Trump is weighing a military strike on Iran to force it to sign a nuclear deal. If that doesn’t work, the US will launch a large-scale regime change campaign.

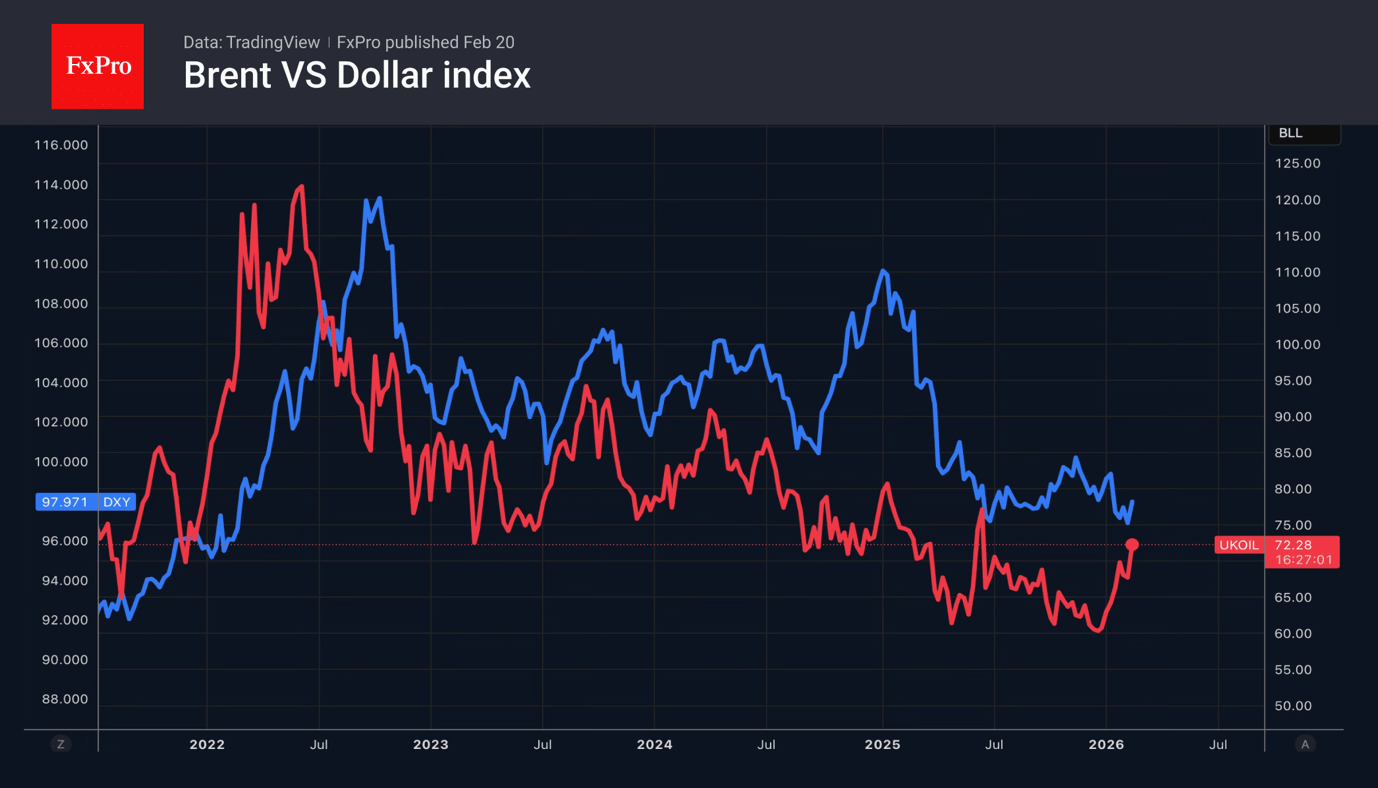

Fears of an escalation of the Middle East conflict have pushed Brent prices to six-month highs. Investors are rushing to buy safe havens. Suddenly, on Forex, one cannot find a better option than the US dollar. The yen and the euro are unable to compete with the greenback. The rise in oil prices will hit Japan and the eurozone, which are heavily dependent on energy imports.

Meanwhile, the drop in jobless claims has become another argument in favour of stabilisation in the US labour market. According to Stephen Mirman, the economy looks better than he had expected, so the Fed might lower rates by 100 bp this year to 2.75%, not by 150 basis points. San Francisco Fed President Mary Daly believes that the Fed should not hold back the economy with high interest rates. However, it should not lower them too much due to still high inflation.

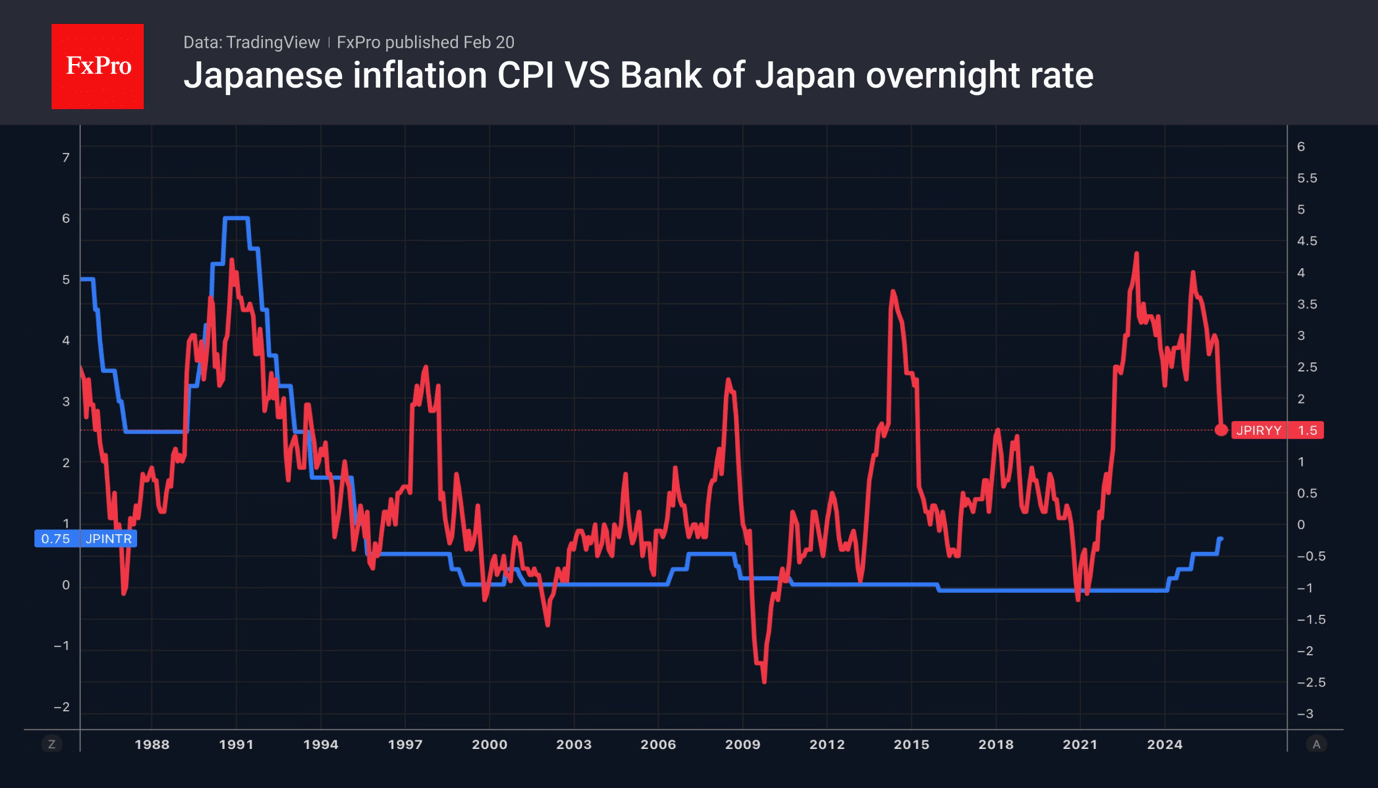

The fall in consumer prices in Japan to 1.5%, the lowest level since March 2022, added fuel to the USDJPY rally. The slowdown in inflation allows the central bank to take its time with raising rates. At the same time, this gives Sanae Takaichi a free hand in expanding fiscal stimulus. The prime minister intends to address parliament and outline her economic policy. Investors fear that excessive stimulus will revive the “Takaichi trade” and sink the yen.

Gold is behaving unusually. It rose on the back of the hawkish surprise in the minutes of the January FOMC meeting, the strengthening of the dollar and the fall in US Treasury bond yields. At the same time, the escalation of the geopolitical conflict in the Middle East is not particularly inspiring for gold bulls.

The volatility of the precious metal remains excessively high, and it is awaiting an influx of speculative demand from China after the Lunar New Year celebrations.

The FxPro Analyst Team