The Canadian dollar collapsed by more than 1.4% against the US dollar after Trump threatened to impose new 25% tariffs on goods from Mexico and Canada and to increase tariffs on China by 10% immediately after taking office.

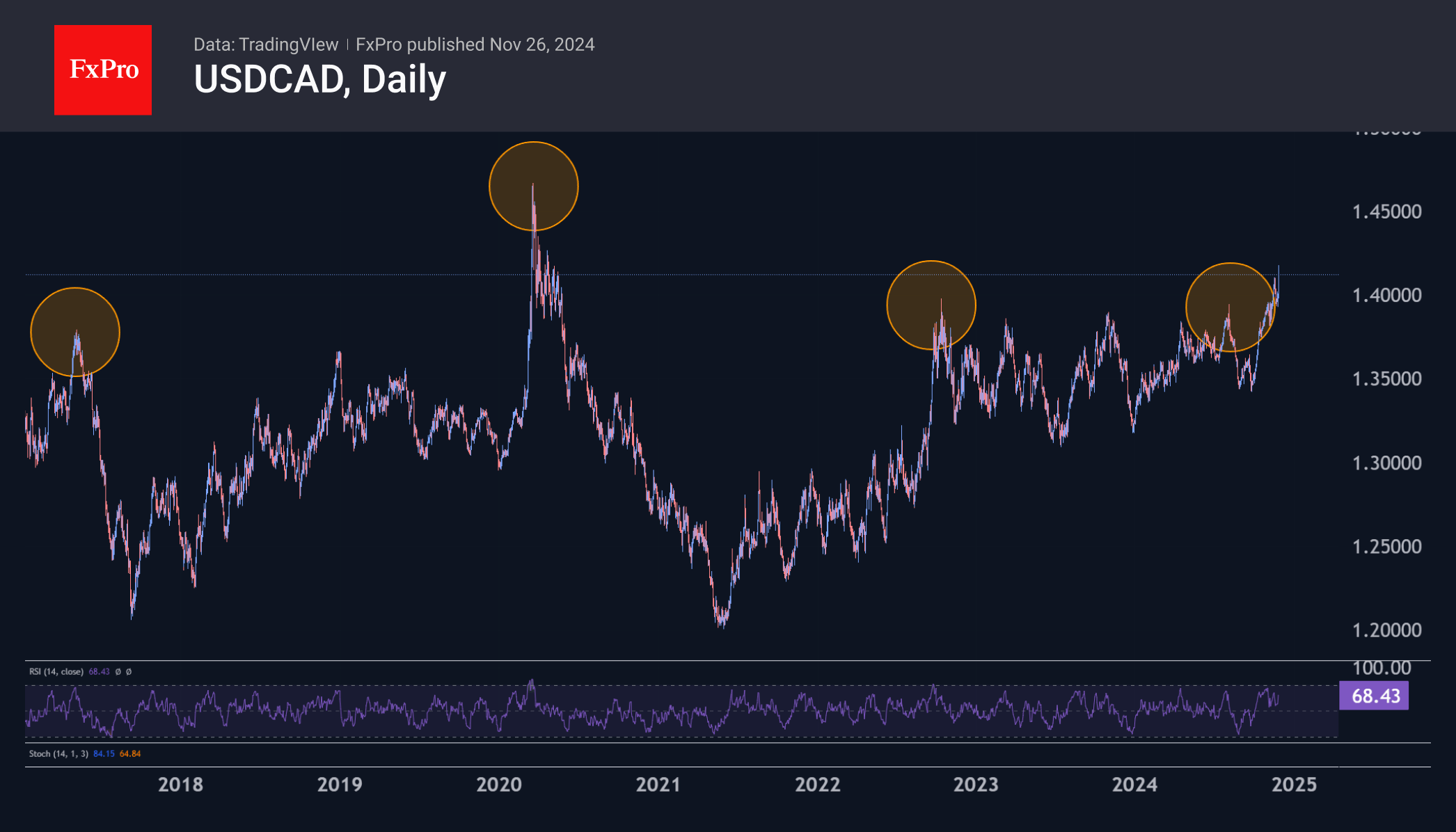

Following the announcement, USDCAD jumped to 1.4170, a high since 23 April 2020. The context is interesting in this case, as a few days earlier, the price of oil went into negative territory for the first time in history. Previously, the highest price of the pair was recorded in early 2016, when oil fell below $30. So, these were periods of extremely low oil prices compared to current oil prices.

Over the past 20 years, USDCAD has only reached these levels during periods of turbulence, trading above 1.4100 for only a few dozen days cumulatively in the two episodes of 2016 and 2020. However, the phrase “period of turbulence” could well apply to the currency market for much of the Trump presidency, with sudden announcements and outbursts which are then dramatically reversed by periods of warming and de-escalation.

Historically, the Canadian dollar depreciated steadily against the US dollar between 1997 and 2003. This was also due to a period of extremely low energy prices caused by rising supply and the Asian crisis.

USDCAD has now reached levels above 1.4000, with oil prices much more comfortable. A further fall in ‘liquid gold’ prices could be the anchor that pulls the Canadian Loonie down. However, there is a positive side to this relationship: the Republican Party often supports the interests of companies involved in the production of conventional hydrocarbons.

Investors face a fork in the road here. The first path is to create the conditions for an increase in the price of oil. This could be done by increasing purchases into the Strategic Petroleum Reserve or by lobbying for the interests of US companies abroad through tariffs and sanctions.

The second way is to try to maximise overall profits by increasing production, the so-called “drill, baby, drill” that was so expected from Trump’s policy.

So far, we see more chances of the first scenario unfolding, which could be good news for the Canadian dollar in the long run. In the short term, however, the period of turbulence could continue, suggesting that the best time to open USDCAD shorts is yet to come.

On the daily timeframe, the pair is far from the overbought conditions that reversed the momentum earlier and could well slip into the 1.4500 area and higher before peaking.

The FxPro Analyst Team