Asian markets opened trading on Monday with a jump in trading, adding 0.6% to the MSCI Asia Pacific Index. Futures on the S&P 500 rose by the same amount at the start of trading as hopes returned that the aid package would be accepted before the election. In addition to the aid package, the growth is driven by Pfizer’s hope to make the vaccine available to US residents by the end of the year.

The positive trend in Asia’s indexes does not seem sustainable due to several weak data reports published amid trading. Monthly industrial production and retail sales data in China once again exceeded expectations, adding 6.9% YoY and 3.3% YoY, respectively.

At the same time, the more important quarterly GDP figures seriously failed to meet expectations. Third-quarter growth was 2.7% after a jump of 11.5%. Last year’s growth rate was 4.9%, which was noticeably weaker than the 5.5% expected. All clearly suggesting a marked weakening of the recovery momentum.

All this makes us look cautiously at the figures for the fourth quarter as more countries announce new infection records and partially regain coronavirus restrictions. As a global factory, China runs the risk of facing demand shocks and economic pressure, even with relatively strong domestic demand.

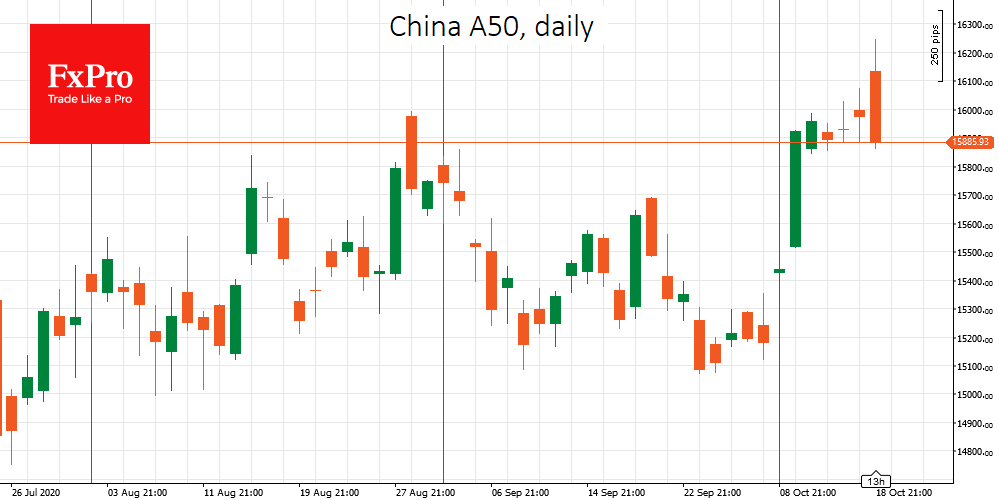

At the time of writing, the Chinese indexes have been in negative territory since the beginning of the day, suppressed by weak statistics. Separately from this, investors have yet to digest quite disturbing facts about the US and Europe.

New restrictions are being imposed in Europe, up to the closing of bars and restaurants and even stricter lockdowns in some cities or areas. Officials are still far from stopping the entire economy, as they did in March and April. However, even these measures can undermine the fragile recovery.

In the USA, even if there is a breakthrough in negotiations, we should not expect the support package to be implemented until after the elections. However, data from the USA already shows a reversal of the recovery and a new cycle of decline in individual sectors. Last week’s data showed a 0.6% increase in claims for benefits and a 0.6% decline in industrial production, against expectations of a 0.6% increase.

Against this backdrop, it will not be easy for markets to maintain a strong positive tone. This may be particularly true for the currency market, where it will be difficult for the single currency to rise from current levels around 1,1700. It is quite possible that the correction rollback of the single currency that started in September is not over. It will be possible to talk about this with certainty in case EURUSD fails at 1.1600. Until then, we can say that the situation is equally difficult in Europe and the USA, which spills over into the sidewall of EURUSD.

The FxPro Analyst Team