Worrying news on the Eurozone economy continues to come in, although this is not hurting the single currency so far, which is trading at fifteen-week highs at 1.0950.

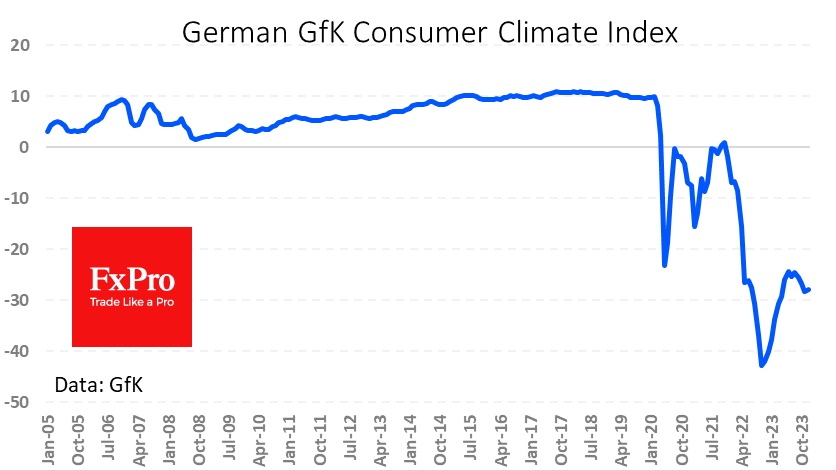

Germany’s business climate index rose from -28.3 to -27.8 in December but remains deeply negative. According to the report, Germans expect their incomes to decline slightly. Their propensity to spend is picking up slightly due to entrenched inflation expectations, but they struggle to reflect a rebound in consumer activity.

A separate report from the ECB noted a slowdown in loan growth in the eurozone to 0.6% y/y – the slowest in 8 years. However, the worst is apparently ahead for the indicator, judging by the dynamics of monetary aggregates. Trends in monetary aggregates M1-M3 are generally more than a year ahead of credit trends.

Monetary aggregate M1 is now 10% lower than a year earlier. It has been in negative territory so far this year. M3 in October was 1% lower than a year ago. In both cases, it is stabilising near historic lows, reflecting tightening financial conditions.

EURUSD’s strength is now driven by high hopes for a Fed rate cut soon, but the weakness in Eurozone indicators should set the mood that a policy change from the ECB could be earlier and deeper, not saying that the US already has higher rates. This is a long-term negative for the single currency. However, markets prefer to play down US policy changes first.

The FxPro Analyst Team