The DXY has gained more than 3.8% over the past month, fully retracing its losses from five trading sessions in early July after the NFP. This retracement carries extra weight; a sharp upward or downward from current levels would be an essential trend indicator.

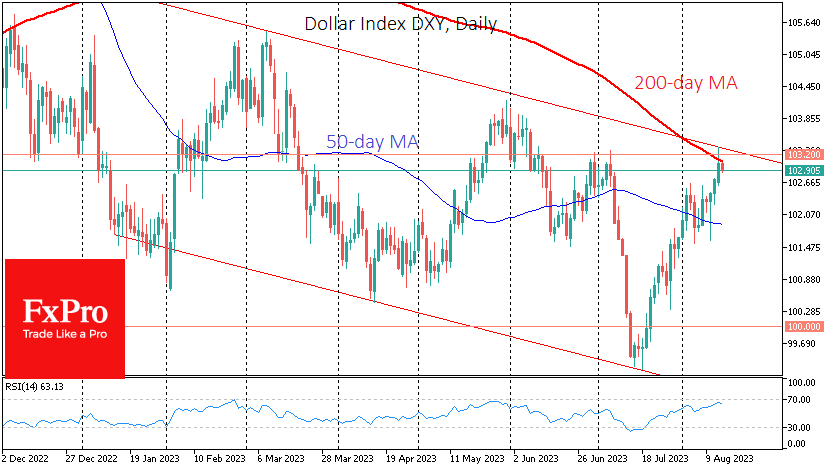

The Dollar Index is now approaching 103, where the local July highs, the 200-day MA and the upper boundary of the bearish corridor since last November are concentrated.

The downtrend was formed in the last quarter of last year when the Fed slowed the pace of its rate hikes following a decline in the annual price growth rate. Since then, inflation has continued to rise in other developed economies. As a result, the leading currency trade has been betting on a resumption of the dollar correction as the spread between US government bond yields and those of other major economies narrows.

This trend is now being tested as inflation in European countries has fallen at an accelerated pace. Meanwhile, economic data in the US is fuelling domestic inflation. As a result, yields on 10-year US government bonds are close to last year’s highs, fuelling interest relative to alternatives in other developed countries. These flows have contributed to the dollar’s rally over the past month.

The DXY has risen to the 200-day MA, a long-term trend indicator. Earlier this month, the dollar index consolidated above the 50-day MA, associated with a medium-term trend.

Further growth with consolidation above 103.2 will show that the downtrend has been broken and that the growth impulse to the 105.3-107.5 range will begin in the coming months.

Nevertheless, betting on further dollar growth seems premature before an upward reversal is confirmed. In the absence of such confirmation, the scenario of a continuation of the downtrend remains valid. The lower boundary of the working range is 4% below current levels, and the dollar could be there within a couple of months.

Therefore, the next few days will determine whether the dollar will decide to break its almost year-long downtrend or remain within its framework. Tomorrow’s release of the FOMC meeting minutes could provide an important clue as to the direction of travel. However, it is more likely that the dollar’s path will be determined at the end of next week during the Fed’s Jackson Hole symposium.

The FxPro Analyst Team