Friday’s US Non-farm Payrolls figures triggered a rally in the dollar. At the beginning of last week, the market also responded to the FOMC’s comments with dollar buying. In other words, the two main market drivers were working in the same direction. While the 1.3% rise in the Dollar Index after the NFP is hardly impressive, it could be the start of a trend.

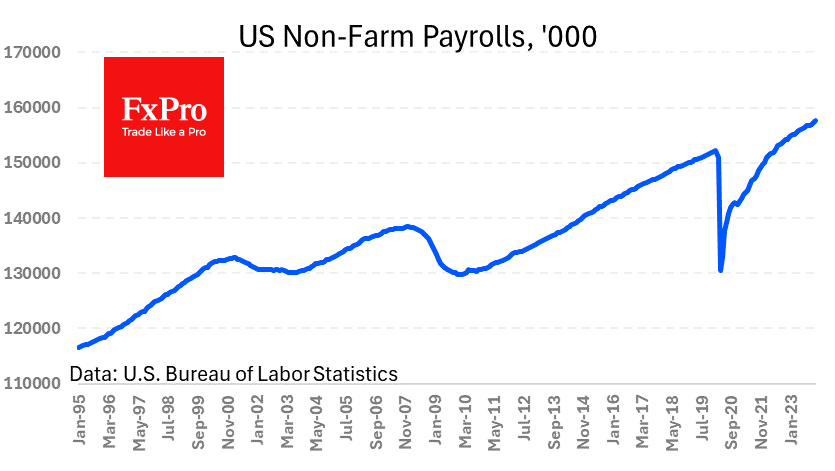

The US economy added 353k jobs in January after 333k in December. The gain was almost double the average analyst forecast. Average hourly earnings rose 0.6% last month after +0.4% previously. Year-to-date gains accelerated to 4.5% from 4.4%, instead of the expected slowdown to 4.1%.

Wage and employment gains are well above long-term growth trends, suggesting that the economy is overheating. Economics textbooks tell us that with such inputs, we should expect inflation to accelerate and monetary policy to tighten. But falling commodity prices have slowed inflation, and central bank officials expect it to slow further.

After Friday’s statistics, the market is pricing in only a 15% chance of a rate cut on 20 March, in stark contrast to 90% at the end of December and 80% three weeks earlier. Markets are now 95% confident that the Fed will cut rates by no more than 150 basis points, down from 40% on 12 January when markets were almost as confident of two more cuts.

So, robust macro data is combined with the Fed’s conviction that rates will be “higher for longer”. The labour market figures have markets anxiously looking for signs of accelerating inflation, but now beyond fuel and food.

The Dollar Index started its growth impulse twice last week from the same point near 102.8. On Wednesday, it was helped by Powell’s transparent hint that he did not expect a decline in March. A strong NFP supported Friday’s buying.

Just before the FOMC meeting and the day before the NFP, the US currency sold off on the renewed wave of problems in US regional banks, as it did almost exactly a year ago.

Technically, the 50-day on the Dollar Index acted as a strong support from which heavy buying began. The DXY crossed from below to above its 200-day moving average on Friday on the back of significant news and continued to rise on Monday. This looks like the start of a new uptrend after almost three weeks of consolidation. We should be prepared for the DXY to add another 1.5% to 105.7, a level we haven’t seen since early November, before the following inflation report on 13th February.

The FxPro Analyst Team