The aid package has supported the dollar

December 21, 2020 @ 16:13 +03:00

Despite widespread vaccine approval and the start of vaccination, so far there has been little to no effect on incident rates with most countries maintaining alarmingly high infection numbers, in some cases, even worsening.

There has been a sharp deterioration in the UK, which has entered the second-highest number of new daily cases. The surge in cases has forced the authorities to tighten restrictions yet again. This news, in addition to the stalemate in Brexit negotiations which reappeared over the weekend has added pressure on the British Currency.

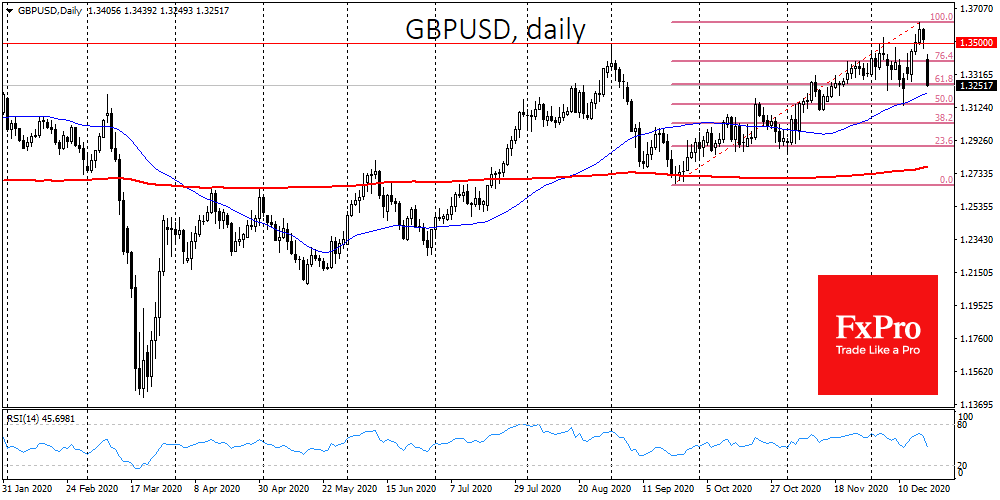

GBPUSD was the biggest loser among the major currencies on Monday morning, falling 2% to Friday’s closing level. Over the past two days, the Pound has had an almost complete Fibonacci retracement, giving up 38% of its rally since September.

However, it is essential to note the widespread fall in risky assets. This is disconcerting as the actual situation is now no worse than the week before. Part of the reason for such a nervous market reaction is the traditional demand for dollars at the end of the month and year.

Interest in the dollar was also fuelled by reports that US congressional leaders have agreed a $900bn bailout package. To implement the plan, the US Treasury will increase borrowing in treasuries, sucking liquidity from other markets.

In the short term, this is positive for the dollar and negative for other markets and currencies. In the spring this effect was offset by super-aggressive purchases of debt securities on the balance sheet, which injected liquidity back into the markets. Therefore, the impact of the dollar may be more significant now than earlier this year.

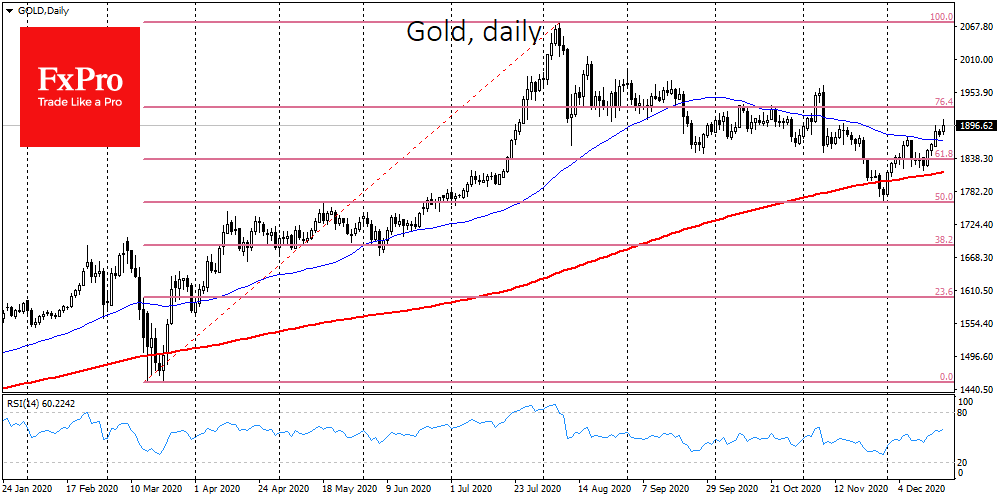

Demand for protective assets has caused increased pressure on oil but has again supported interest in gold, with the value of an ounce of this precious metal surpassing $1900. It is interesting that during the previous week, gold was rising just the other way round due to dollar decline and craving for risky assets.

The technical analysis is also temporarily on the gold bugs’ side, noting the strengthening support after touching the levels below the 200-day average below $1800 and a corrective pullback of 23.6% from the two-year rally, and 50% from the March-August rally.

The FxPro Analyst Team