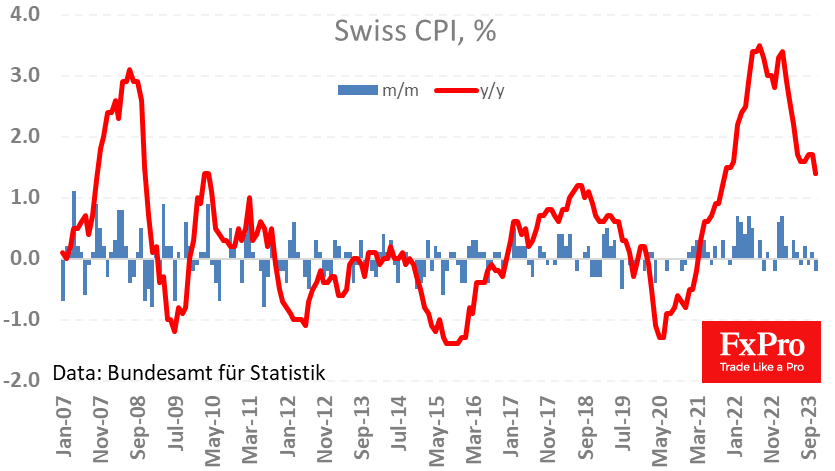

Swiss inflation is falling below expectations, and this may be a reason for the SNB to change its rhetoric next week. Consumer prices fell 0.2% in November, slowing the annual pace from 1.7% to 1.4%, while no changes were expected. This is a two-year low and down under the historical 101-year average (1.75%), although above the 0.6% average since 2000 when the SNB moved to inflation targeting.

The strong franc is one of the reasons why inflation is falling faster than in the US and the eurozone. By early December, the USDCHF pair was near the historical support line of 0.87, which has been in force for the last twelve years. EURCHF is also near historical lows, barring a brief collapse in January 2015. Other crosses with the franc (JPY, CAD) have also been near historical extremes over the past few days.

The slowdown in inflation triggered an impulsive sell-off in the franc, which lost around 0.5% but almost recovered the losses during the day. Markets are in no hurry to play down the news, preferring to wait until 14 December, when the Central Bank will present its critical rate decision and quarterly monetary policy estimates. However, today’s data is the last piece of the puzzle, as before the rate decision, there will be only the publication of the unemployment rate, which increased from 1.9% to 2.1% in six months.

The FxPro Analyst Team