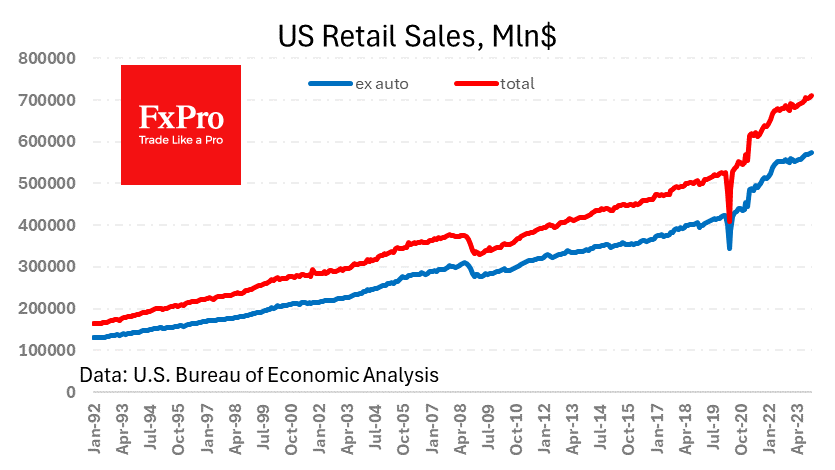

The US economy continues to surprise economists by beating retail sales forecasts for the sixth consecutive month. Reportedly, for December, the increase was 0.6%, compared to 0.3% in November and 0.4% expected. Sales excluding autos rose 0.4%, up from 0.2% a month earlier.

The currency market reacted with outright dollar buying as a hot economy reduces the chances of monetary policy easing soon. The odds of a rate cut in March fell below 60% immediately after publication, although they exceeded 80% last week, according to the FedWatch Tool.

The stock market, however, is in that part of the cycle where good news is bad news for stocks because of expectations of tighter monetary policy in the future. Such a phase typically doesn’t last long, but it has a high chance of remaining prevalent in the markets in the coming weeks, contributing to a correction in the year-end rally in stocks.