Strong UK retail sales pave the way up for Pound

February 18, 2022 @ 12:00 +03:00

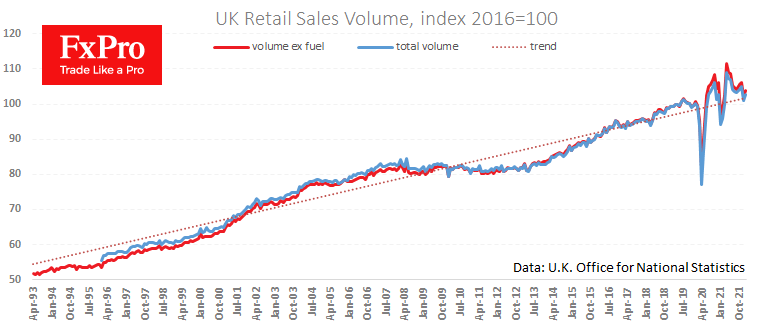

UK retail sales added 1.9% in January, following a dip of 4.0% a month earlier. By the same month a year earlier, the increase was 9.1%, as January 2021 saw a sharp tightening of the lockdown and the vaccination campaign had only just started.

The data came out slightly better than expected, supporting purchases of British currency against the dollar, but remains very volatile due to restrictions in previous months. Sales generally remained above multi-year trend levels, which is a good signal of the economy’s health.

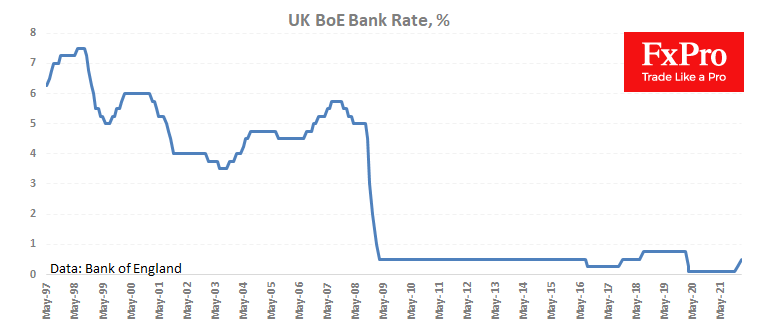

After the financial crisis from 2009 to 2016, there was a long period when sales were below the long-term trend line and were one of the obstacles why the Bank of England could not go ahead with a rate hike.

These days, the need to suppress inflation is combined with the ability to do so thanks to strong consumer demand and the labour market.

Sales were also boosted by pent-up demand for services and goods that were in restricted supply during the pandemic. This process may gain momentum in the coming months, painting a more colourful picture of consumer activity, but could lead to disappointment in the second half of the year.

The Bank of England should keep a close eye on the coming economic releases to avoid repeating the mistakes of the ECB, which rushed through a rate hike in May 2009, undermining the economic recovery.

On Friday morning, the British pound is testing the highs of February, rising to 1.3630. A rise to 1.3680 may be a development in the current momentum. However, a jump even higher would reflect a break of the downtrend since last June, anchoring GBPUSD above the 200-day average and setting the pair up to test previous highs.

The FxPro Analyst Team