A new batch of statistics from the US once again reminds us of the Goldilocks story, when one can have fun and not pay the price for it.

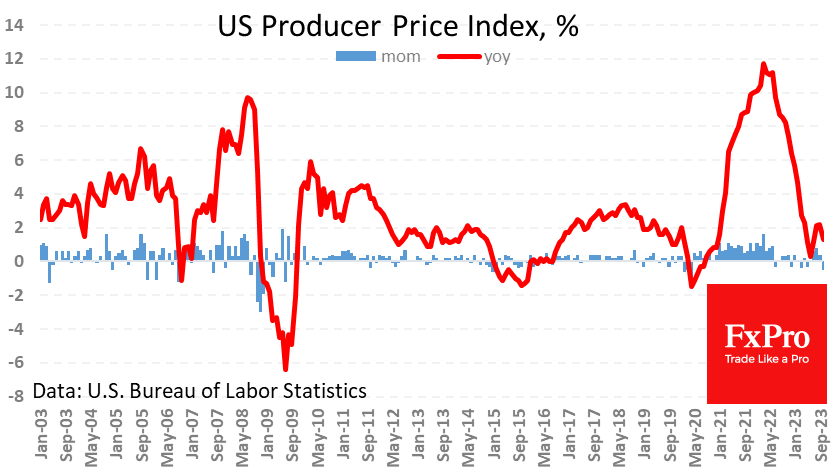

Producer prices fell 0.5%, against expectations for a 0.1% rise. And that’s a weaker report than expected after the release of consumer prices the day before. The annual inflation rate fell from 2.2% to 1.3%, against expectations of 1.9%. The core index, which excludes food and energy, was virtually unchanged for the month, and the annual growth rate fell to 2.4% from 2.7% expected. Had the market not overreacted the day before, such a report could have encouraged fresh dollar sellers and buyers of risk assets.

Another report showed that retail sales fell by 0.1%. This is a strong result, as a correction in spending was expected after a 0.9% rise the month before. Sales were virtually flat from September last year to March this year, but there was a strong rebound in sales last summer. Interestingly, this coincided with a pause in policy tightening by the Fed. This acceleration in spending is probably a concern for the regulator, so it is in no hurry to take the option of further policy tightening off the table.

The Empire Manufacturing Index jumped from -4.6 to +9.1 – much better than the expected -3.3 – and the highest since April.

Theoretically, this should allow retailers to join the battle for profit (not market share) by passing costs through to prices. In practice, however, producer prices fell sharply, giving retailers more room to manoeuvre.

The FxPro Analyst Team