Stocks Surge to 3-Week High on Easing Virus Toll

April 07, 2020 @ 12:45 +03:00

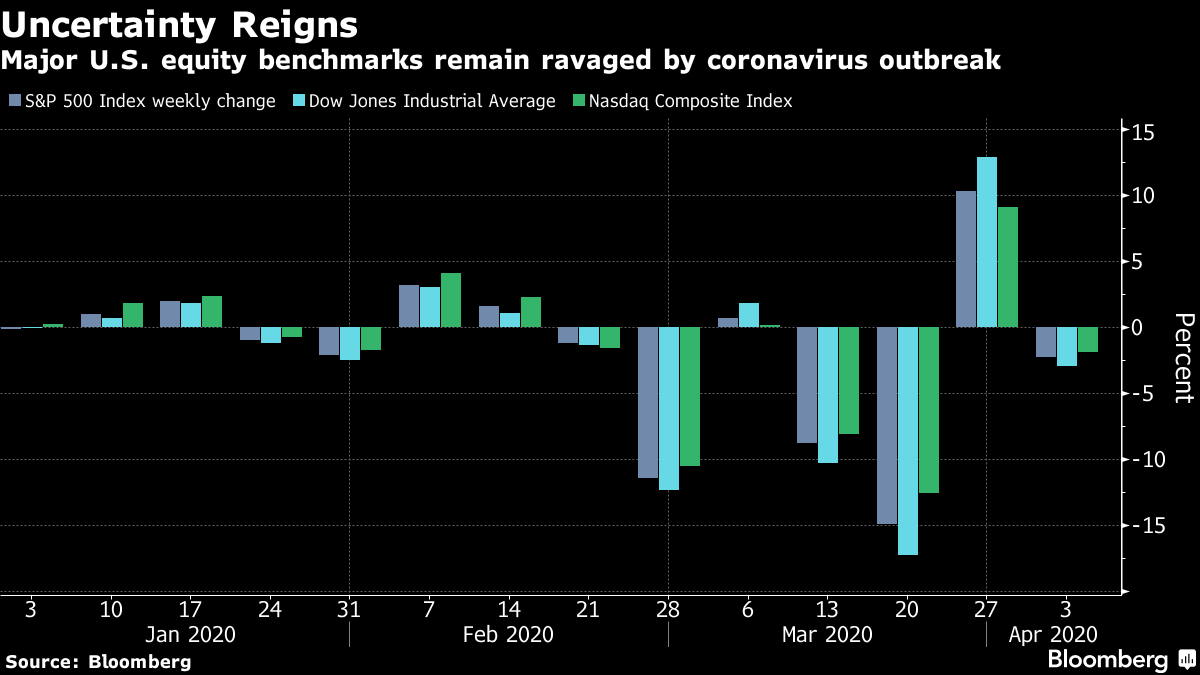

Stocks surged the most in almost two weeks after the reported death tolls in some of the world’s coronavirus hot spots showed signs of easing. The yen weakened and Treasuries fell.

The benchmark S&P 500 Index surged late in the trading session to finish up 7%, closing at the highest level since March 13. New York Governor Andrew Cuomo said earlier that deaths were showing signs of hitting a plateau in the state that has become the epicenter of the U.S. outbreak. Italy had the lowest number of new coronavirus infections in nearly three weeks and France reported a continued leveling-off of cases, helping to send European and Asian shares higher.

The number of deaths in the U.S. is still expected to peak on April 16, though the cumulative number of Americans likely to die from Covid-19 was revised downward to 82,000, from an estimate of 94,000 less than a week ago. But its apex, 3,130 Americans will die per day, up from the previous estimate of 2,644.

The pound weakened after British Prime Minister Boris Johnson was taken into a hospital intensive care unit for treatment for coronavirus after his condition worsened. The mostly upbeat tone in markets followed another negative week, and the mood among investors remains divided. Bulls are pointing to more attractive valuations, unprecedented stimulus and now slowing death rates in several major countries. Bears are fretting the continued spread of the disease, dismal economic data and the rising corporate costs of the pandemic and subsequent shutdown.

In Asia, Japan’s benchmark ended almost 4% higher even as that country moved closer to declaring a state of emergency. The yen dropped as haven demand receded. Shares in Hong Kong rose while Shanghai was closed for a holiday. Elsewhere, crude oil fell on signals that a glut is growing at America’s key oil storage hub, offsetting earlier support from signs that Saudi Arabia and Russia are making progress toward a supply-curb agreement.

The S&P 500 Index increased 7% to 2,663.68 as of 4:14 p.m. New York time, the highest in more than three weeks on the largest climb in almost two weeks. The Dow Jones Industrial Average increased 7.7% to 22,679.99, the highest in more than three weeks on the biggest climb in almost two weeks. The Nasdaq Composite Index increased 7.3% to 7,913.24, the highest in almost four weeks on the largest climb in almost two weeks. The MSCI All-Country World Index increased 5.5% to 448.84, the highest in more than three weeks on the biggest climb in almost two weeks. The Bloomberg Dollar Spot Index declined 0.1% to 1,267.59. The Japanese yen depreciated 0.5% to 109.12 per dollar, the weakest in more than a week. Gold strengthened 2.8% to $1,665.97 an ounce, the highest in four weeks on the largest climb in almost two weeks. West Texas Intermediate crude declined 7.3% to $26.26 a barrel, the biggest drop in more than a week.

Stocks Surge to 3-Week High on Easing Virus Toll: Markets Wrap, Bloomberg, Apr 7