Stock markets profit-taking thrust can support the dollar in the coming days

August 29, 2018 @ 12:46 +03:00

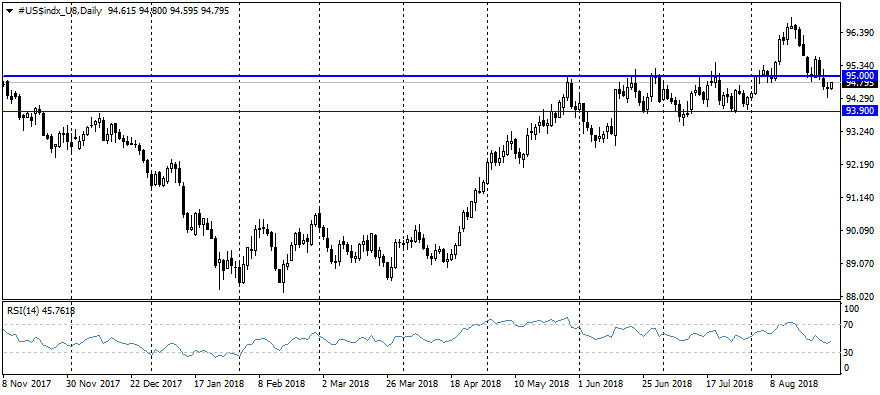

The dollar is almost unchanged to the major currencies in the past 24 hours; it managed to recover the losses incurred on Tuesday morning. The dollar index fell to 94.35, the lows since August 1 following the surge in demand for risky assets on the news about the start of the U.S.-Mexico trade negotiations.

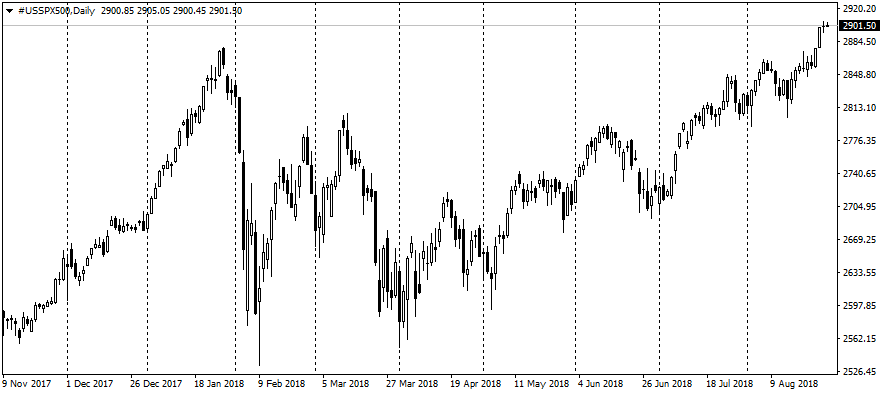

However, the market has returned to the safe-haven demand quite quickly: EM currencies fell under pressure, and the participants of the U.S. stock exchanges fixed the profit after S&P 500 grew to 2900 level. The index earlier this week has finally overcome the downturn since the beginning of the year and has added 2.7% this month, renewing historical highs.

This is a considerably strong movement, so it is reasonable to expect some traction to the fixation of profits by major participants on final days of the month.

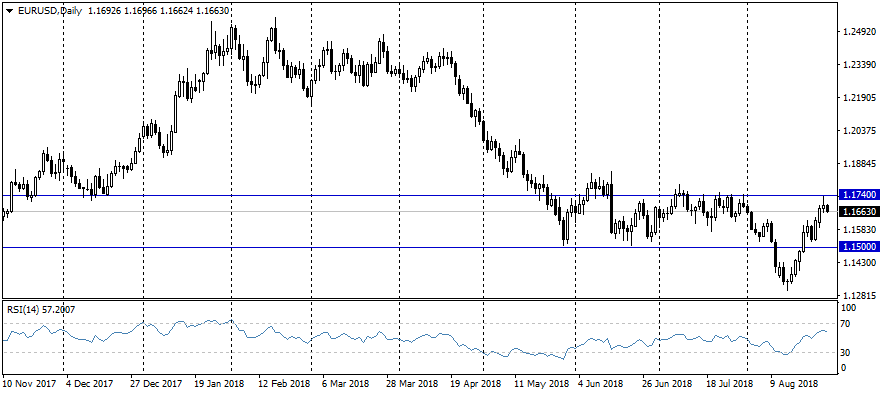

In this case, the dollar can get some support after two and a half weeks of decline. In addition, the single currency returned to the area of resistance, having reached the 1.1730 of dollar, after which the pair turned to decline and is traded now at 1.1680. The British pound, the Japanese yen and the Australian dollar were decreasing on Tuesday to the US dollar. Crude Oil and Gold were losing the part of their earlier gains as well, hitting the wave of profit-taking.

The Mexican peso lost on Tuesday 1.8% to 19.07 per dollar after the details of the bilateral agreement had been announced. With regard to the automotive industry, it provides the U.S. President with the possibility to introduce 25%-tariffs for the import of cars above the level of 2.4 million, which is solely one third higher than the deliveries of the year 2017. The lowering of the peso was reinforced by a general sentiment of currencies weakening in the developing countries during trading on Tuesday.