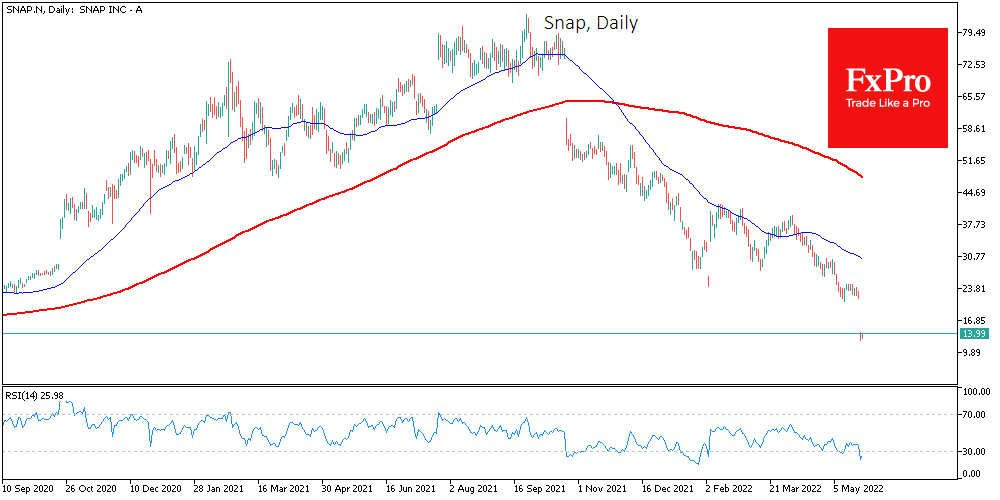

On Tuesday, Snap shares lost 43% of their value, bouncing back to $13.5, their lowest level since April 2020 and losing more than 80% of their peak valuation last September.

The stock looks extremely oversold now. Given the business’s relatively stable performance and that the stock’s major blow has come from a deterioration in the near-term outlook, investors are tempted to rush to ‘buy the bottom’.

However, practice suggests that this may not be a good idea. A sharp fall of more than 15% in less than a day is a sign of a breakdown in investor sentiment. Giants such as Amazon, Twitter, Facebook, Netflix, and Roblox, losing on weak reporting since the start of the year, remain under pressure from sellers to date, significantly increasing their losses.

These companies, which now clearly include Snap, are switching from Darling to Pariah mode. The next stage in such cases is often ‘‘forgetting’’, where the company’s shares drop off the current interest list of significant funds, and retail investors then avoid them for a long time afterwards.

The pessimistic scenario means that investors will generally continue to sell Snap shares, using the short-term rebound to exit slightly higher. Overall, market participants should be prepared for the IT sector to be a key driver of growth for a long time, as it was from 2011 to 2021, giving way to other industries and trading ideas.

The FxPro Analyst Team