The stock market currently acts like a tired climber, moving up in smaller and smaller steps while resting more often. This dynamic can easily be attributed to poor preparation, given how many unprofessional retail investors have entered the markets in recent months.

Most of the market upturn at the start of the week was due to buying shares in a few large companies. For example, Apple shares made a new all-time high of 157.26 early in the week, but yesterday the bulls’ efforts were not enough to withstand the sellers’ onslaught as it comes from the periphery to the centre.

The American dollar retraced to the levels of early September, which created a headwind for the equities market. On a separate note, Turkish and Brazilian assets were on the sell-off in emerging markets, as their currencies lost over 2.5% since September 7th. This move quite logically complements the 12% collapse in Bitcoin over the same time frame. Large investors, when nervousness increases, offload the riskiest assets first.

Not improving investor’s sentiment is a new batch of inflation data from China. Producer prices accelerated to 9.5% y/y in August, markedly higher than the forecasted 9.1% and 9.0% a month earlier. Consumer prices, meanwhile, slowed from 1.0% to 0.8%. Companies in the world’s second-biggest economy are facing the steepest rises in product costs since August 2008 but are shy to start passing them on to consumers. This threatens to send Chinese companies’ profits plummeting.

But the same situation is worth extrapolating to other major economies of the world, whose data will be released later but which correlate pretty closely with the Chinese data.

Only dovish statements by central bankers can lift the cloud that is gathering over the markets. Today it is worth paying attention to the ECB’s rhetoric regarding the outlook for QE and its view on the inflation outlook. On the US side, influential New York Fed President John Williams said that he doesn’t see the “substantial” progress in the labour market needed to reduce the massive asset purchases on the Fed’s balance sheet.

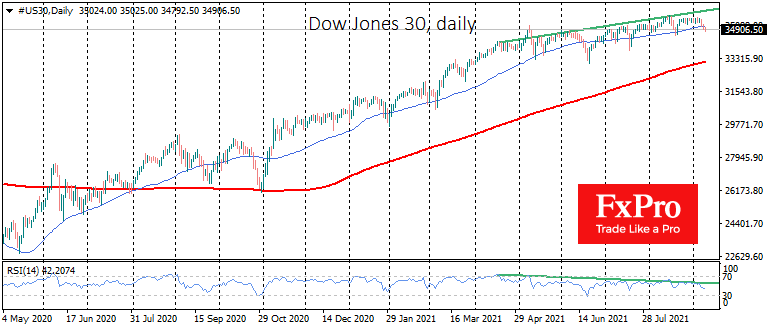

So far, we are seeing more signs of pressure building up on risky assets, which is increasingly moving from the periphery to the ‘centre’, causing the leading European and US indices to fall. The Dow Jones 30 and DAX 30 closed Wednesday below their 50-day averages, falling into the August lows area.

The FxPro Analyst Team