WTI crude oil is under pressure for a third day despite rising global market risk appetite and solid US economic activity data.

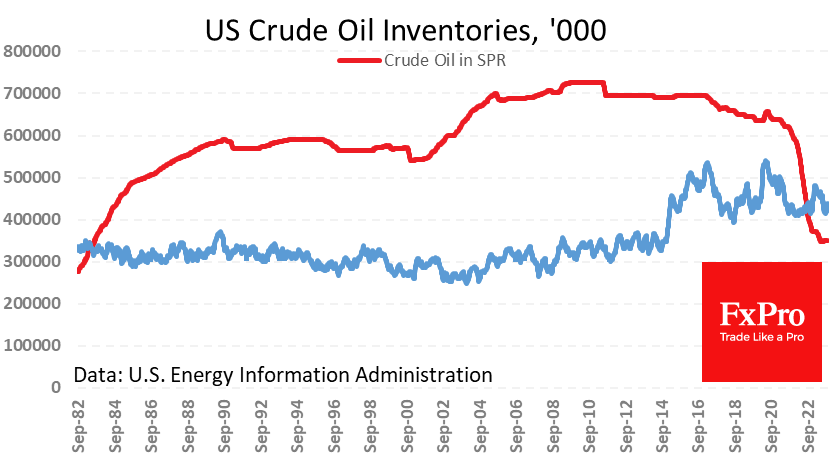

The night before, the EIA released two weekly reports on commercial inventories and oil production after a pause. Average production has remained at 13.2 million bpd for the past month and a half. The Strategic Petroleum Reserve has remained at the same level of 351.27 million barrels for the same period.

However, the situation with commercial reserves has changed significantly. They rose by 17.5 million in two weeks, four times more than expected. This jump in stocks confirmed the upward trend. Reserves remained within the range with a lower boundary of 400 million established over the past eight years and are up 0.9% on last year.

It looks as if the current US production level is sufficient for a smooth build-up of stocks and exports. This is a negative signal for oil prices, which earlier in the week made an unsuccessful attempt to break back above the 200-day average – a crucial bearish signal. It could also signal that domestic consumption growth is not too robust, which is negative for prices.

A drop below $75 per barrel opens the door for a drop to the $67-70 area, where the price found support in May and June. In the event of a fall to this level, we could see a new series of verbal interventions from OPEC+, as happened earlier this year. Their absence on the other hand, as was the case in 2014, will increase the pressure on the price.

The FxPro Analyst Team