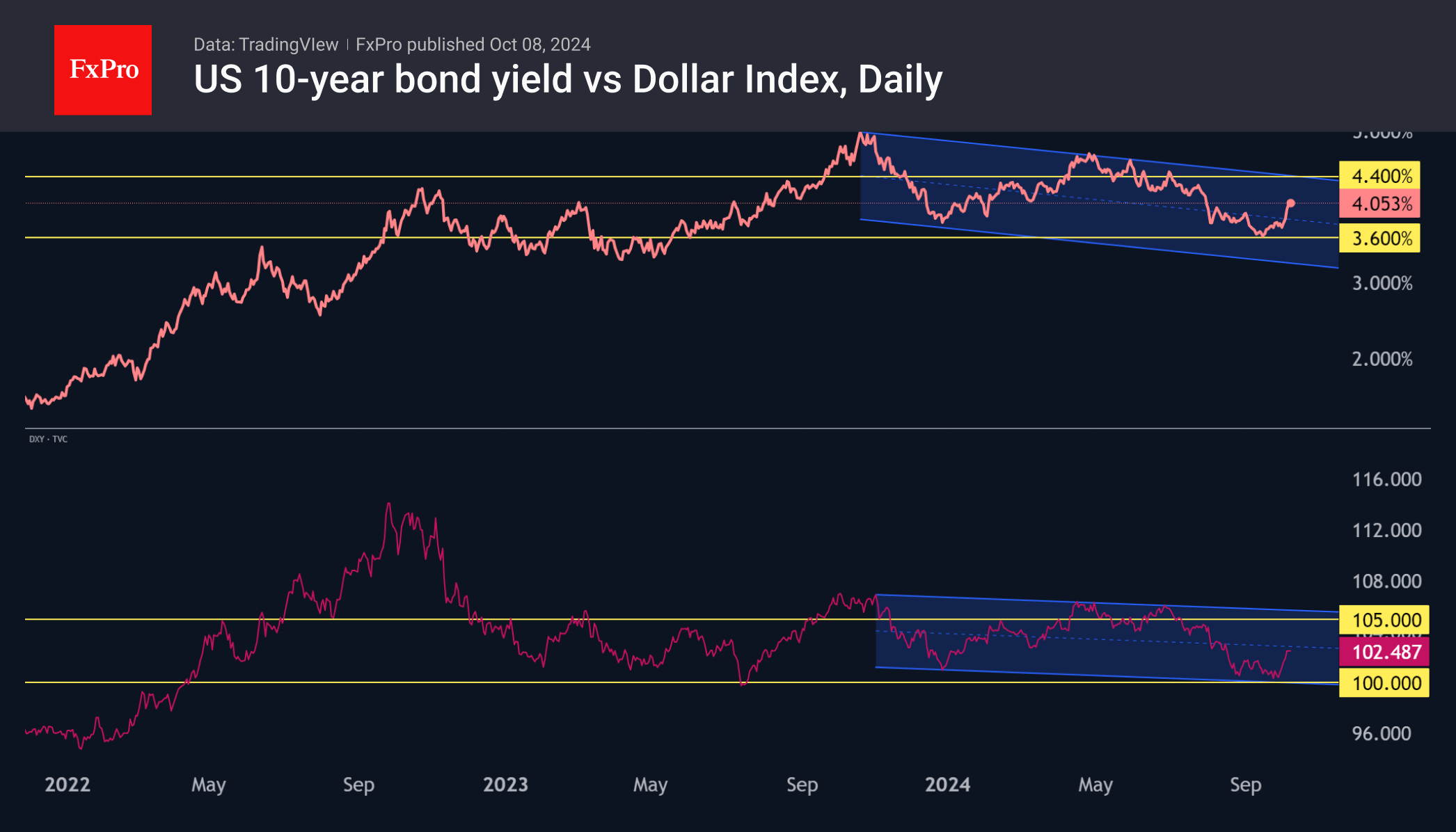

The dollar index has been on an upward trajectory since late September. Still, the currency market has been late in joining the move in US long-term bonds, where yields are rising following the Federal Reserve’s decisive easing. The idea behind this dynamic, while atypical, is quite simple: decisive interest rate cuts will boost economic growth and inflation in the long run.

Normally, bolder-than-expected monetary easing is a bearish factor. Hence, the typical reaction of the dollar index, which in the second half of September tested the psychological 100 level, below which it spent five days in July 2023 and has not traded consistently below since April 2022.

As is often the case, sustained one-way movements in the government bond market, the so-called smart money, cause other markets to follow the trend. Rising yields have reinvigorated dollar buying, accounting for the 2.5% rise in the DXY in just over a week.

10-year yields have risen above 4% from a local low of 3.6% last month. Technically, yields remain in a downtrend until they break above the 4.4-4.5% range. The market may not encounter significant resistance to these levels, but a break above 4.5% could trigger a strong deleveraging process.

Similarly, the dollar index has light resistance to 105. However, a break above would break the multi-month trend and could strongly accelerate the USD.

For now, the US equity market is in a wait-and-see mode, distracted by the start of the reporting season and hovering near the highs. However, a further rise in yields could well trigger a sell-off in equities, like what happened from July to October 2023.

The FxPro Analyst Team