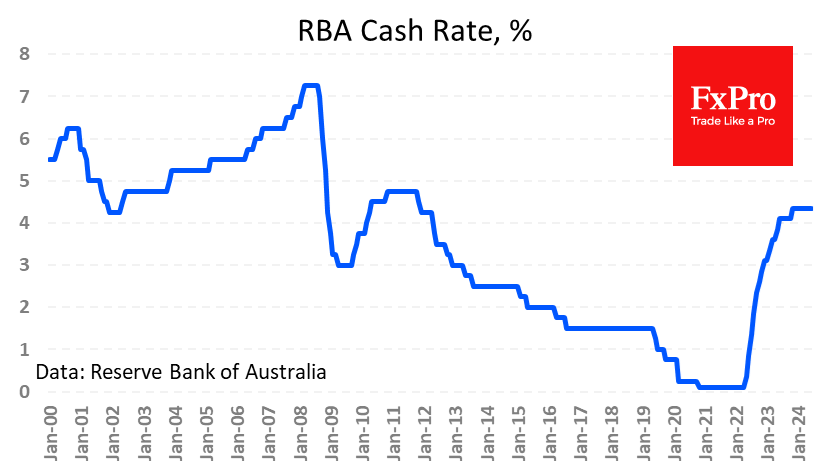

The Reserve Bank of Australia kept its key rate at a 12-year high of 4.35%. The market widely expected the decision, so it did not cause a spike in volatility. However, we note that the RBA warned that it was ready to raise the rate.

In its commentary on the rate decision, the Australian central bank emphasised that inflation is roughly at the same level as in December, at 3.6% y/y overall and 4.1% y/y with the exclusion of volatile goods.

Despite the normalising trend, the economy remains in excess demand; employment is above sustainable full employment; wage growth is above productivity gains.

A “wait-and-see” approach is reasonable in this situation. However, the RBA still notes a shift in risks towards pro-inflationary risks and indicates a willingness to change the rate in either direction — an important shift from the dovish rhetoric of the second half of last year.

While we haven’t seen a meaningful reaction from AUDUSD, it is performing better than its major peers. It is losing 0.5% this month against the dollar index, which is strengthening over 1%.

The Aussie has not dipped below 0.66 for long since early May, making the 50-day moving average an active support line, and is steady above the 200-day average. Both curves are pointing upwards, emphasising the positive trend.

AUDUSD has been recording higher yearly lows for the past two years, marking increased buying interest on downturns.

The strength of the US Dollar this month is making it harder for the AUD to rise, hindered both by strengthening the denominator and by impacting the price of commodities and metals that Australia exports.

Potential buyers are probably better off waiting for AUDUSD to break above 0.67, where we saw a reversal last month. It would also break the sequence of lower local highs seen over the past three years and at an even higher level since 2011.

A reversal in the tone of monetary policy has the potential to feed AUDUSD buying, adding to the local positive picture. The ability to break the long-term downtrend could attract even more buyers, launching a rally.

The FxPro Analyst Team