The US Dow Jones Industrial Average was one step away from the milestone of 40,000 on Thursday, having gained 3% in four days since the start of the week. Friday saw the traditional quiet pullback as traders took short-term profits.

This breakout to new highs marked the exit of a consolidation of around 39,000 that had been in place for almost a month.

The exit from the consolidation was firm, supporting the thesis that it was not wrong. Very similarly, the Dow Jones came out of a consolidation in January.

The rise of the last two months has not been like the rally we saw in November-December. But this smooth rise is a safe companion to a mature bullish trend that can last for months.

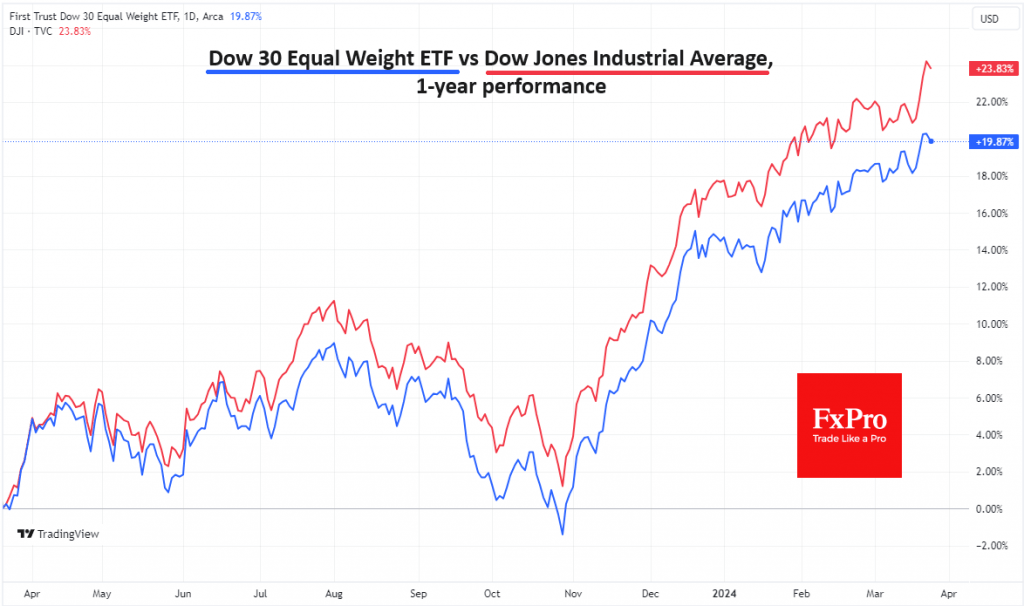

Further bullish confirmation comes from the index update, which gives equal weighting to all stocks in the DJI Composite. It also updates all-time highs but is in a smooth uptrend – a sure sign of expanding growth.

The FxPro Analyst Team