Powell stopped the Dollar’s rally, calming taper fears

July 14, 2021 @ 17:16 +03:00

Fed chairman Powell stands tall on the positions he has been voicing since at least the beginning of the year. At a congressional hearing, he repeated the mantra about the short-term and temporary nature of inflation and that the Fed is far from starting to roll back emergency measures to support the economy.

Earlier today, we warned that it would be surprising if the Fed dramatically changed its stance after the recent inflation surge report.

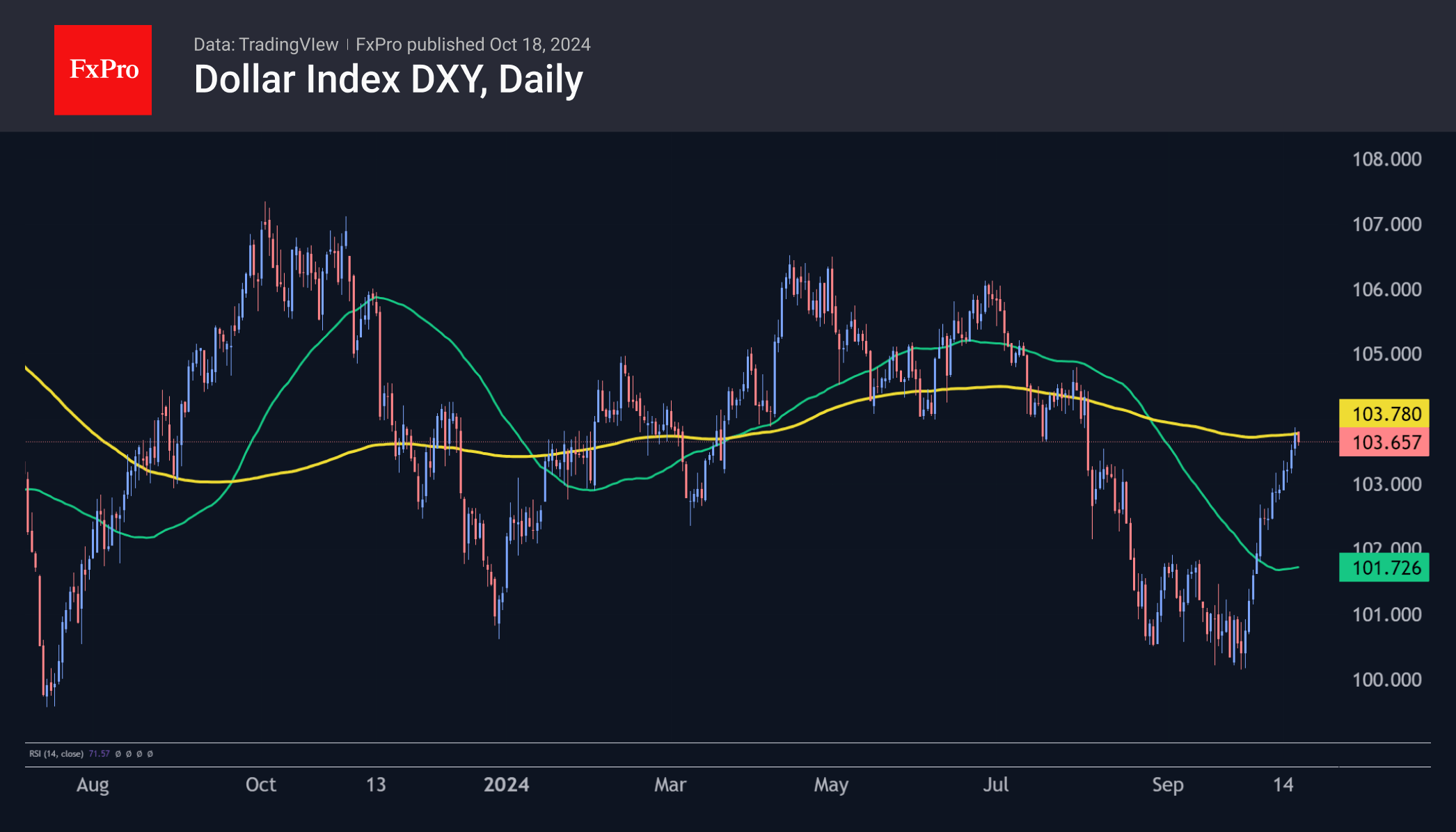

These comments put pressure on the dollar, which retreated deep into trading ranges, away from the local extremums set earlier this week.

These comments came just in time to break resistance on the dollar index. For the second time in a month, pulling back from 92.80, the DXY has a high chance of commencing a move towards the lower end of the trading range at 89.20-89.60.

The unambiguous nature of Powell’s comments suggests that specific plans to roll back QE will not be heard until after the Jackson Hole symposium on 26-28 August.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks