Powell causes dollar retreat but didn’t cross the line

August 30, 2021 @ 11:55 +03:00

At the end of the week, Powell’s speech removed fears of rapid stimulus cuts and interest rate hikes from the markets. The Fed Chairman reiterated that most of the conditions for starting QE cuts have been met, but the bar is higher for starting a rate hike. This bar has not yet been met, and these are not events that come one after the other.

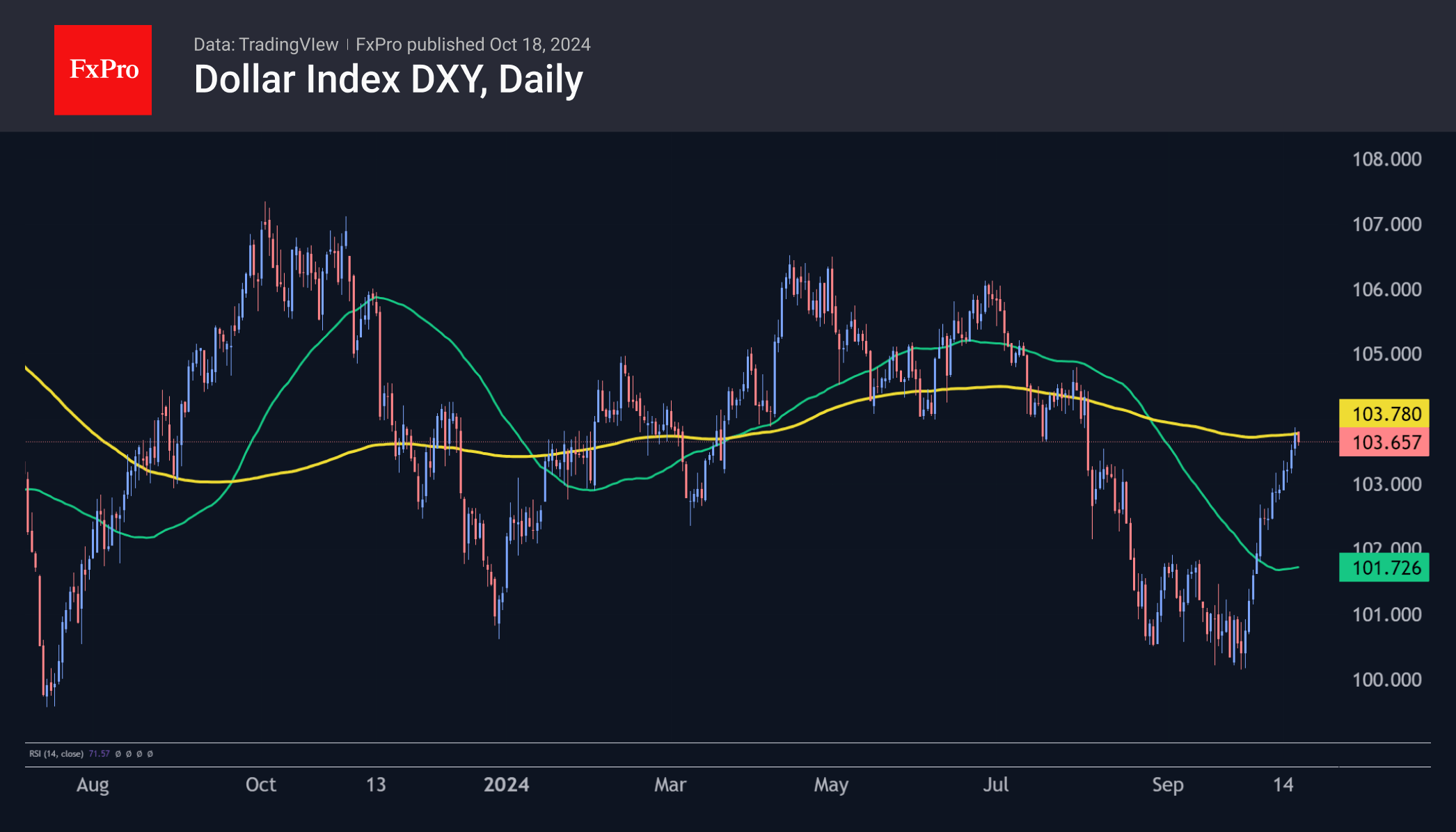

Powell’s statements supported purchases of risky assets and put pressure on the dollar. The move was not particularly strong, taking 0.4% away from the DXY, returning the dollar to a critical support level in the form of the 50-day moving average and former converging trading range resistance.

Powell’s comments delayed the acceleration of the dollar’s rally, but as long as the DXY remains above 92.50, a bullish scenario for the dollar remains in play. The muted response from the US currency suggests that the dollar bears have not heard what is essential for them to move into action.

Indeed, Powell agreed that conditions are ripe for QE purchases to be cut, confirming the fundamentals behind the dollar’s strength since June, such as high inflationary pressures and a strong labour market, as a reflection of the booming recovery in the economy.

Simply put, Powell’s comments slowed the dollar’s upward movement and maintained the status quo in stock markets, where investors continue to roll the rock uphill.

Those tuning in to the rising volatility in the currency and stock markets are now waiting with an increased focus for Friday’s US labour market data and other indicators of consumer activity to gauge the chances of a wind-down announcement in late September, or if it will be in November or December.

Strong data and optimism from companies and Americans could spur new trade ideas in the markets after the summer lull. And, as is often the case, if it is a rising dollar, it promises to be quite sharp. If it is a pessimistic scenario for the dollar, however, it will be a smooth slide.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks