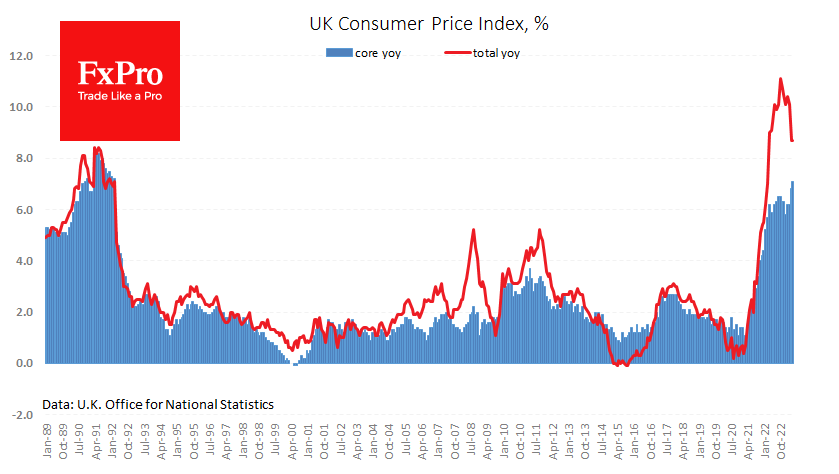

UK consumer inflation is in no hurry to recede. Fresh estimates for May showed prices up by 0.7%, following even stronger rises in the previous three months. Overall, the CPI rose by 4.2% between February and May. Year-over-year price growth stood at 8.7% in May. And the monthly rate of price increases does not give any hope that inflation is on the right track.

Core inflation continues to accelerate, reaching 7.1% y/y, the highest level since 1992. And this upward spiral is the most dangerous part of the inflation report, which overshoots the period of slowing inflation from January to March.

What is surprising is the continued slowdown in producer prices. Producer input prices in May were 0.5% higher than a year earlier but weaker than the 1.2% expected and last month’s 4.2%. Producer selling prices rose by 2.9%, against expectations of 3.6% and the previous month’s 5.2%. Over the month, prices are down 1.5% and 0.5%, respectively, but retailers continue to pass on the gains in final prices.

This is a very important inflation report ahead of the Bank of England’s interest rate decision tomorrow. Markets have priced in a 25-point rise to 4.75%. It is unlikely that the central bank will dare to surprise with a sharper tightening. However, it would be worth bracing for more hawkish rhetoric suggesting that the hikes are far from over. This could be a bullish signal for the GBP, but to maintain the uptrend in GBPUSD, the Bank of England will have to signal that its final rate level will be higher than that of the Fed.

The FxPro Analyst Team