Pandemic surge increasing market cautions

October 15, 2020 @ 11:43 +03:00

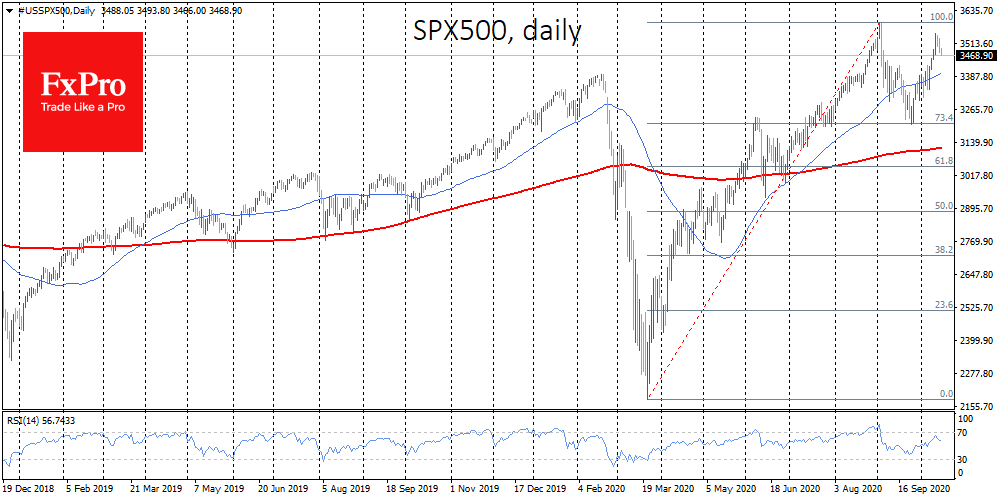

The US indexes stay under moderate pressure on the third day. The S&P500 lost 0.7% on Wednesday and futures on the index are down another 0.2% on Thursday morning. The broad Asia Pacific MSCI index is down 0.5% today.

Investor caution remains linked to the coronavirus spike and comments from US Treasury Secretary Mnuchin on diminishing hopes for a relief package deal, casting doubt on the expectation of reaching a deal before the November 3rd election.

China’s stock market indices are holding up much better than their European and US counterparts, this can be easily explained by the lower number of new infections, tuning the country for a more stable recovery of business and consumer activity.

China’s strict approach to controlling the movement of its citizens, as well as abundant testing, pays for itself with fewer coronavirus cases, which in turn affects business behaviour and moods, this has helped to avoid national lockdown.

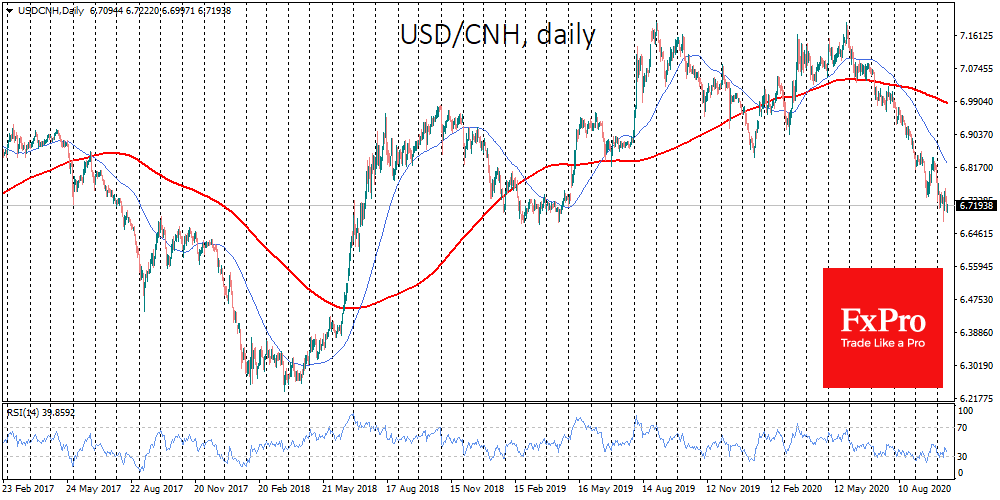

Currency exchange rates also very clearly reflect the difference in economic prospects due to differences in epidemiological conditions. USDCNH has remained at its lowest level since May 2019, despite the constant heat of trade disputes.

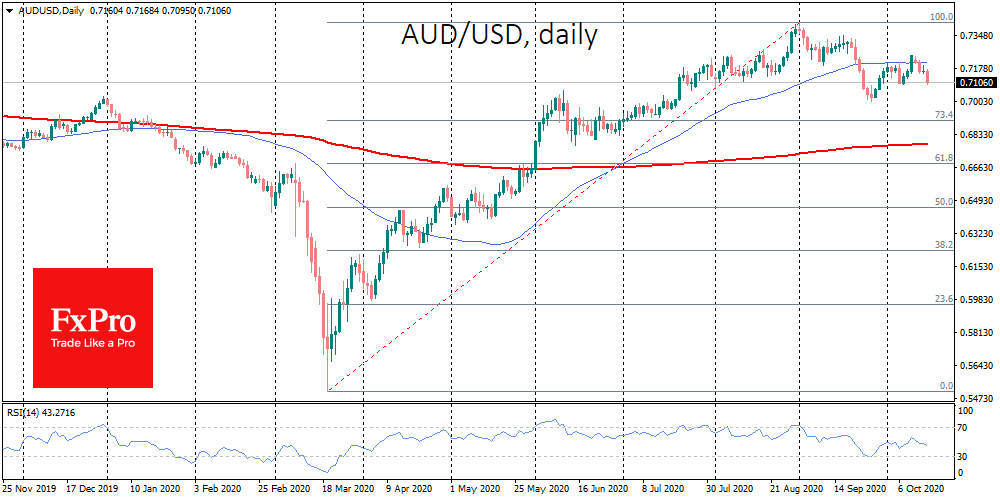

In previous months, a strong general recovery in activity in China and specifically the renminbi has helped the Australian dollar. Recently, however, this correlation has failed.

The RBA intends to increase its support to the economy further, hinting at its willingness to reduce the rate from the current 0.25% and expand QE. Australia, however, cannot boast a strong recovery in domestic demand due to repeated local lockdowns.

Thus, more developed countries are facing the need to increase financial and monetary support to the economy to mitigate the economic impact of the second wave of disease. All this has a significant effect on currency movements, as investors see increased signs of low rates for longer.

So far, we have seen a very moderate demand for protective currencies and a reduction in positions on risk-sensitive assets. All of this is causing a wave of profit-taking on the stock markets, but it is still far from determining mass sales. If demand for safe havens continues to pick up in the coming days, stock market volatility could increase sharply, potentially approaching levels in February but unlikely reaching those seen in March.

The FxPro Analyst Team