Market Overview - Page 98

August 9, 2022

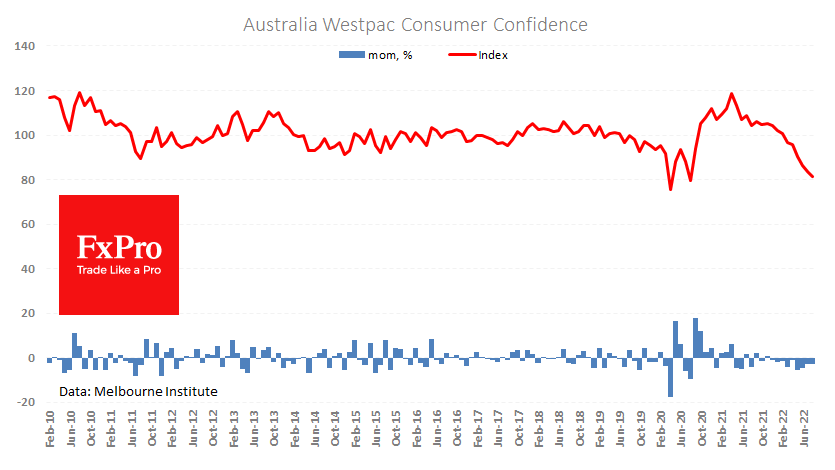

Australia’s Westpac Consumer Confidence Index lost 3% in August, developing a nine-month slump that took off 22.9%. The index was near current levels twice in 2020 during the worst periods of lockdowns and uncertainty and even earlier in 2008 during.

August 9, 2022

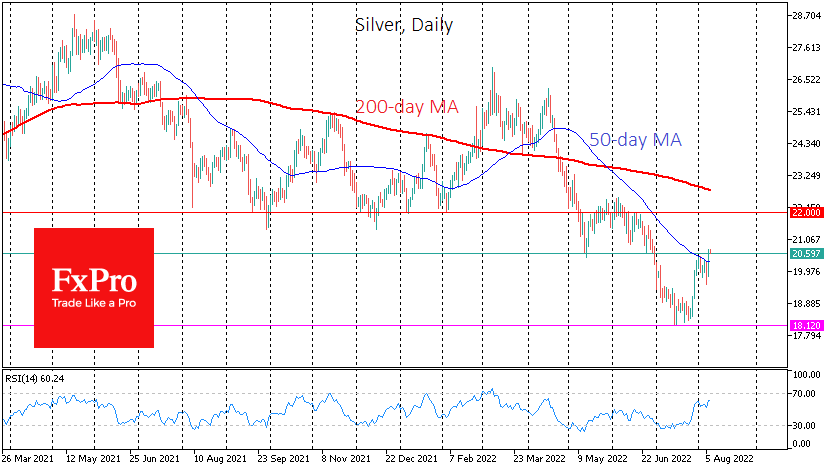

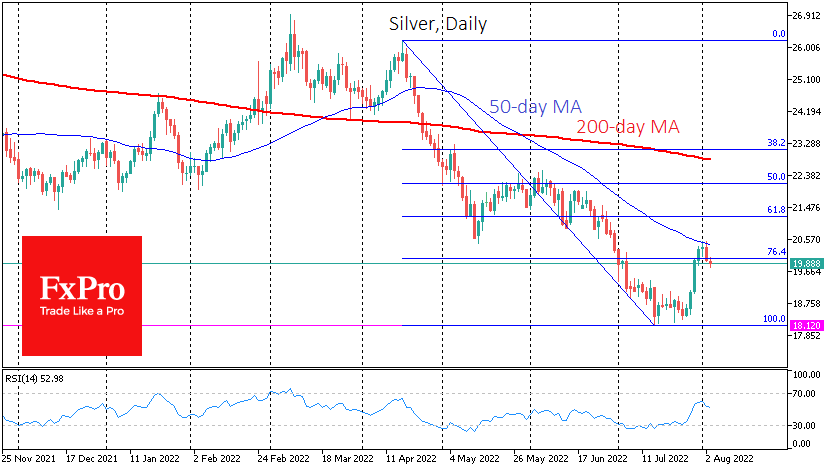

The precious metals are recapturing critical levels one after another, claiming a reversal to the upside after a two-year bearish trend. Silver made quite a move up on Monday, gaining over 4%. Palladium closed the day up 5.3%, and at.

August 8, 2022

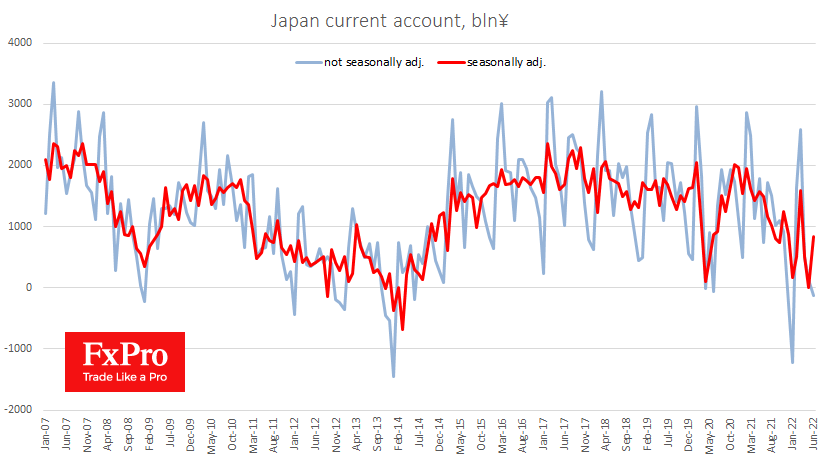

Today is a quiet day regarding data from Europe and the USA, allowing a look at data from Asia. Statistics from Japan indicate that the worst for the Rising Sun country may be over, and the weakness in the yen.

August 8, 2022

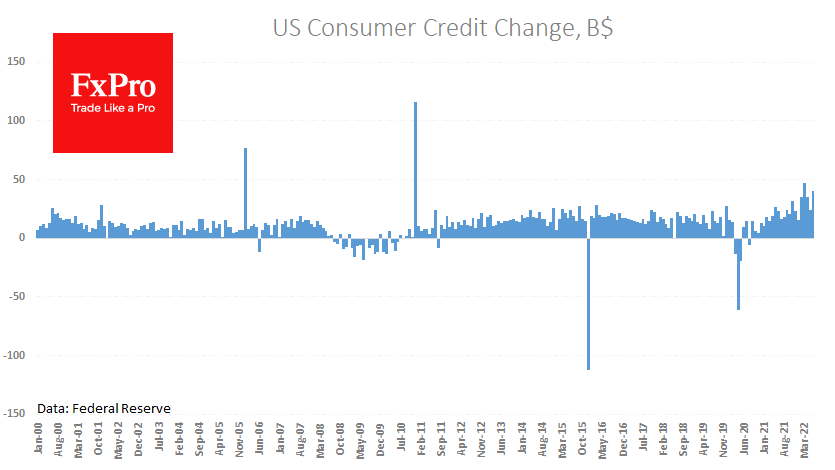

Markets were confused by Friday’s US labour market data, not knowing how to react to solid job growth. This is a negative for equities, as it makes us expect a third consecutive 75-point Fed rate hike at the next meeting.

August 5, 2022

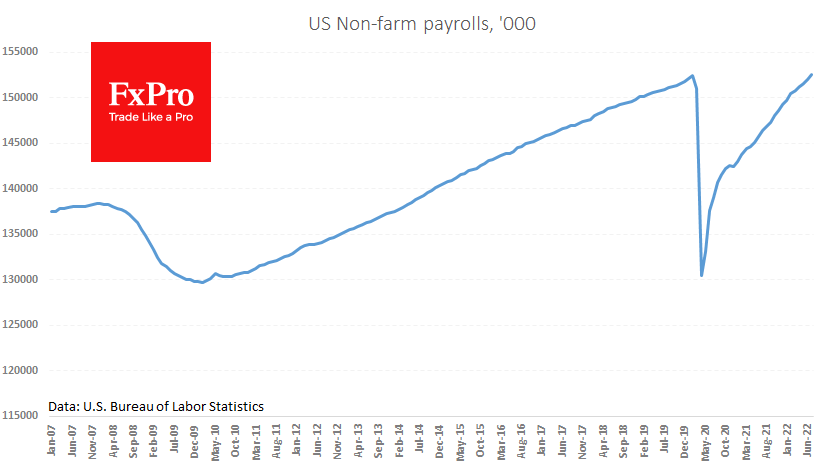

The US economy created 528K new jobs in July, doubling expectations and exceeding the peak employment level set before the pandemic. Notably, construction and manufacturing recovered, probably due to falling commodity prices in these sectors. The hourly earning rate has.

August 5, 2022

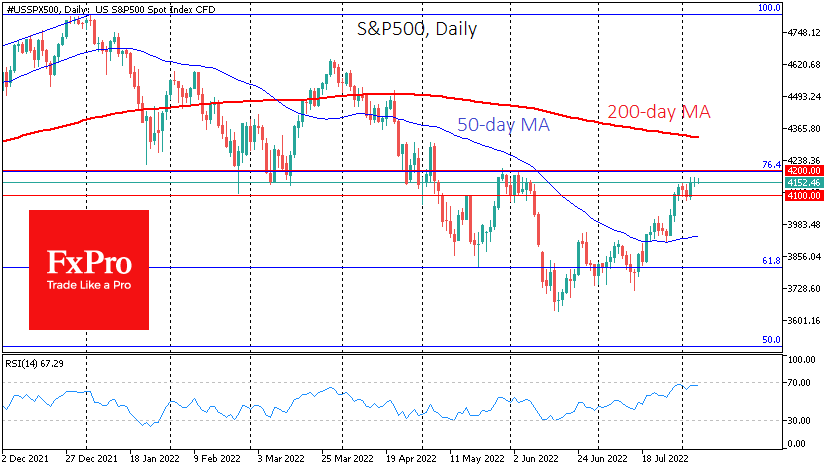

The S&P500 is at 4150, having returned to the rebound highs of late May. The direction of the breakout outside the 4100-4200 range will determine its future for the next days or weeks. In mid-June, the S&P500 halted its correction.

August 4, 2022

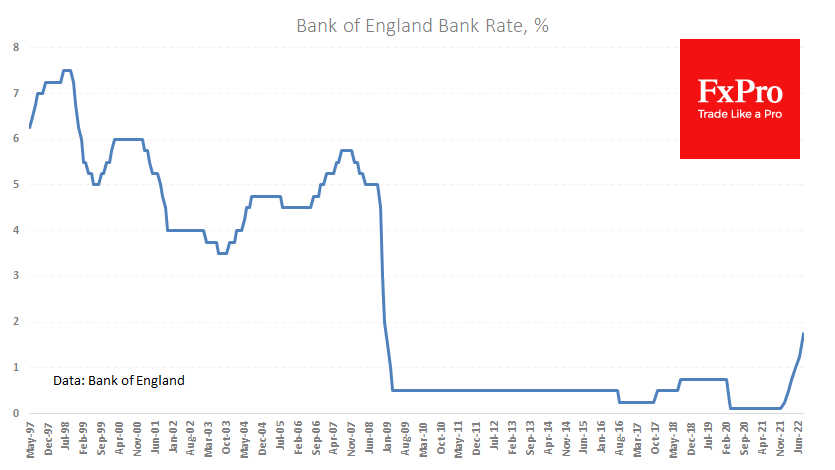

The Bank of England unanimously raised the rate by 50 points to 1.75%, which was widely expected by markets. In addition, the BoE announced that it would start quantitative tightening after the September meeting by selling assets off the balance.

August 4, 2022

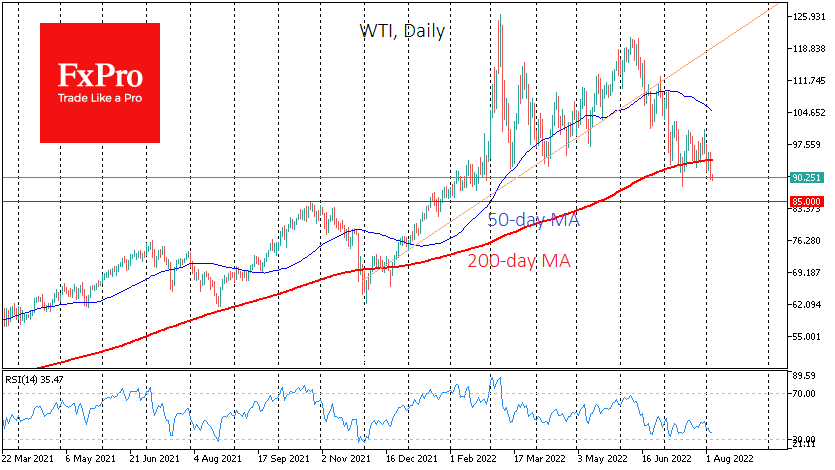

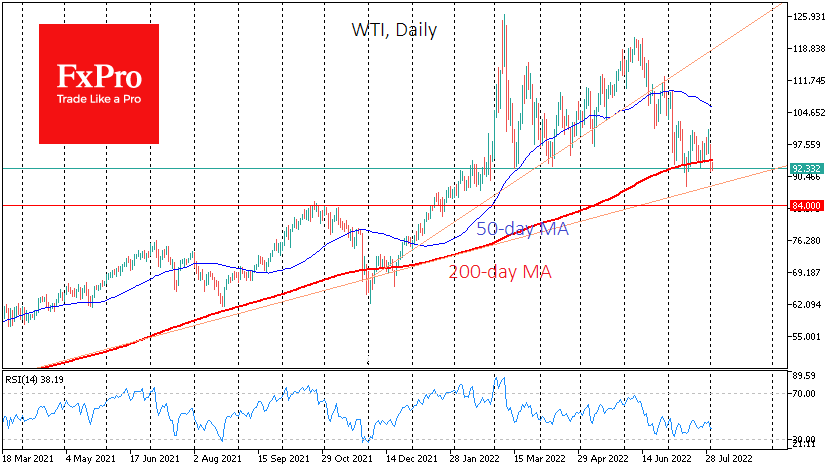

Wednesday proved to be a busy day for oil traders, but the bears emerged as winners at the end of the day. Following WTI, which surrendered a tactically important position, Brent is showing more and more signs of a bear.

August 3, 2022

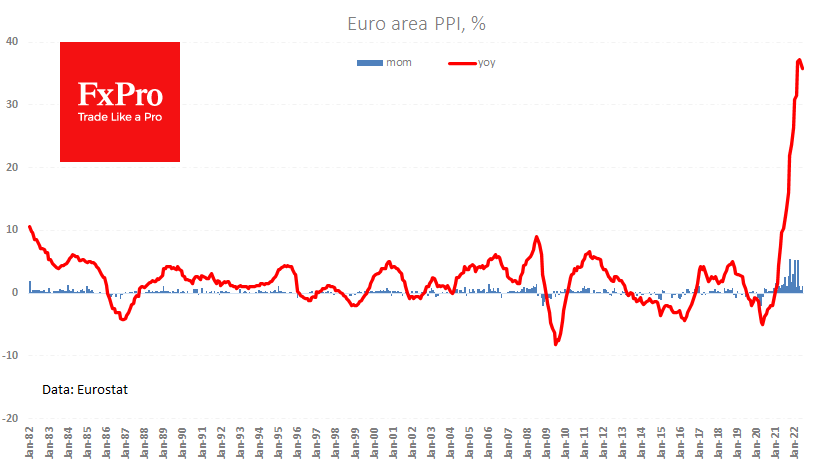

In contrast to many other countries and regions, the Eurozone recorded a slowdown in output inflation. The year-over-year PPI growth rate declined for the second month, showing a fall in June to 35.8% from 36.2% and 37.3% in the previous.

August 3, 2022

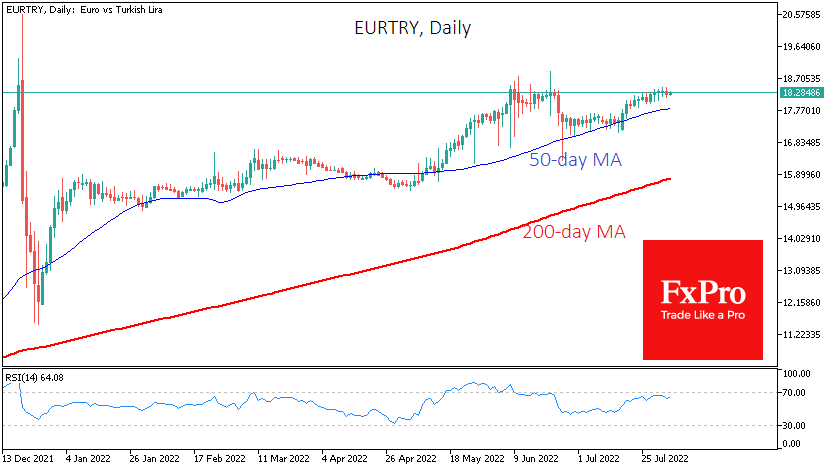

Inflation in Turkey continues to gain momentum. A fresh set of monthly statistics showed consumer inflation accelerating to 79.6% y/y and producer inflation to 144.6% against 78.6% and 138.3% a month earlier, respectively. The rise in the PPI rate is.

August 3, 2022

Silver has pulled back 3% in the last 18 hours, while Gold has lost 1.2% in the same time frame. The pullback came as some investors exhaled after China’s reaction to the Pelosi plane landing in Taiwan. Investors were banking.