Market Overview - Page 94

September 23, 2022

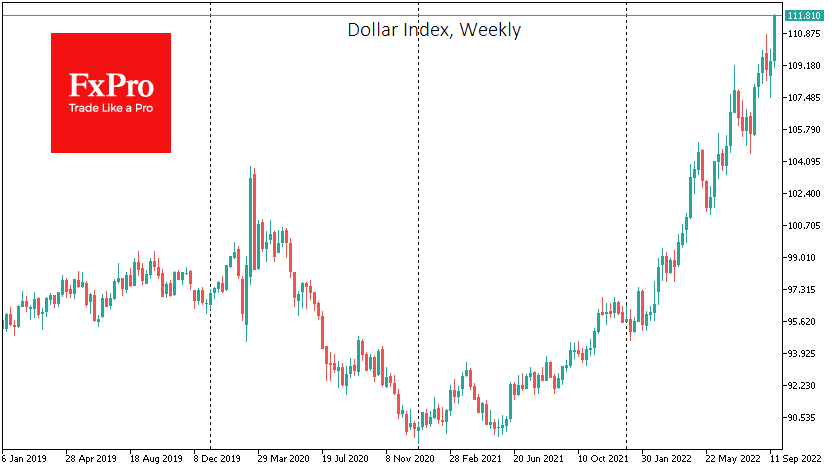

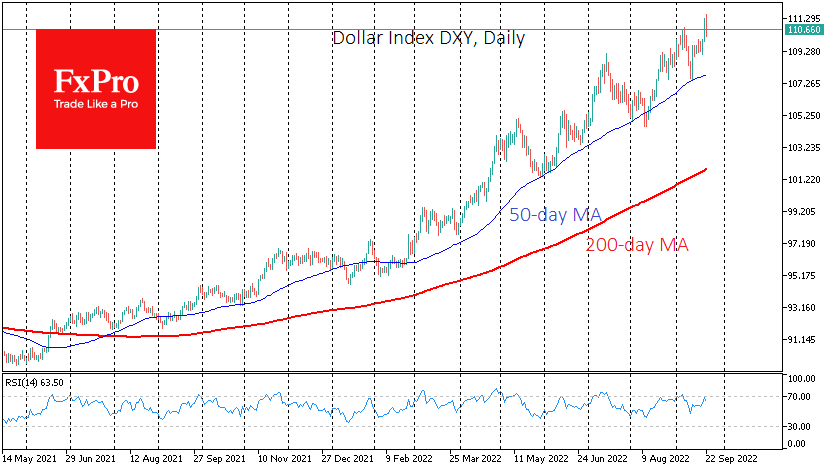

The dollar is developing its FX offensive, leaving it at highs against a basket of the six major currencies. The main driver of this rise remains the monetary policy differential, where the US has had the most hawkish stance amongst.

September 22, 2022

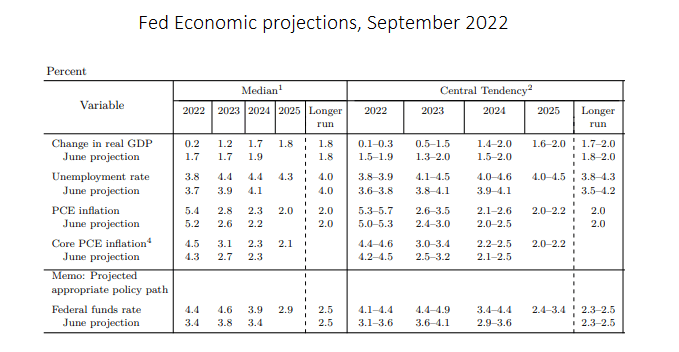

The Fed has launched a new wave of revised market expectations, simultaneously worsening its view of the macroeconomy while promising to raise rates longer and higher. All these factors are working to boost the dollar, reinvigorating its already protracted rally..

September 22, 2022

As most had predicted, the Federal Reserve raised the rate yesterday by 75 points to 3.00-3.25%. However, all participants’ attention was drawn to the accompanying comments and forecasts, a change that underpinned the latest market movements and may explain its.

September 22, 2022

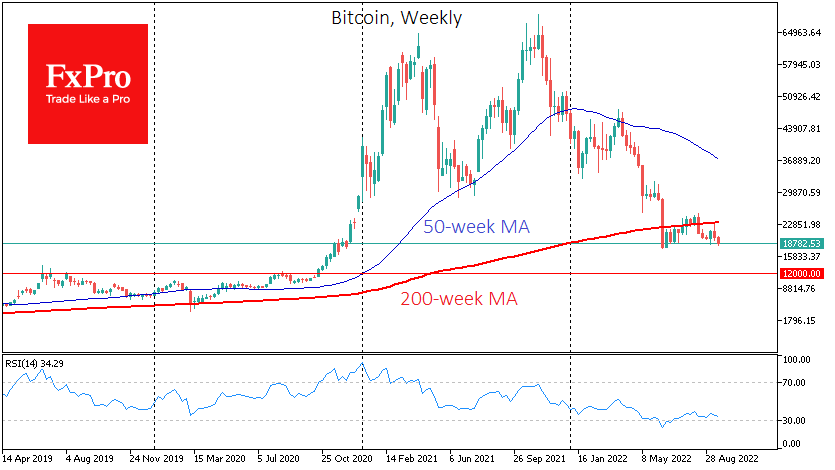

Market picture Bitcoin is losing 2% over the past 24 hours, hovering near $18.7K at the time of writing. Attempts at intraday gains have been shattered by the adverse market reaction following the Fed’s forecasts and comments. BTCUSD has been.

September 21, 2022

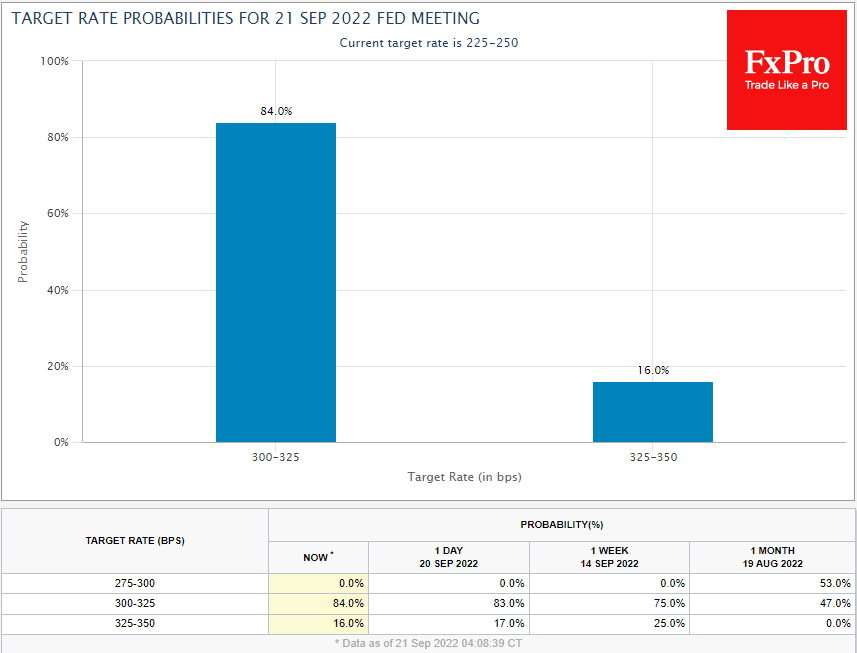

The markets are preparing for the next Fed decision, the publication of which and subsequent Chairman Powell’s comments have the potential to trigger sharp market moves and set the tone for the days or even weeks ahead. The rate futures.

September 20, 2022

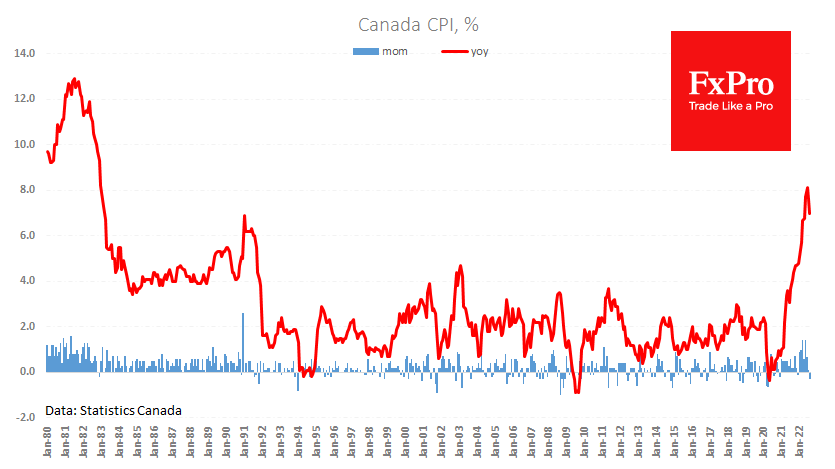

Canadian consumer prices fell 0.3% in August, the first decline this year and the strongest since May 2020. The annual rate of price growth fell from 7.6% to 7.0%. The USDCAD pair turned sharply higher a week ago after briefly.

September 20, 2022

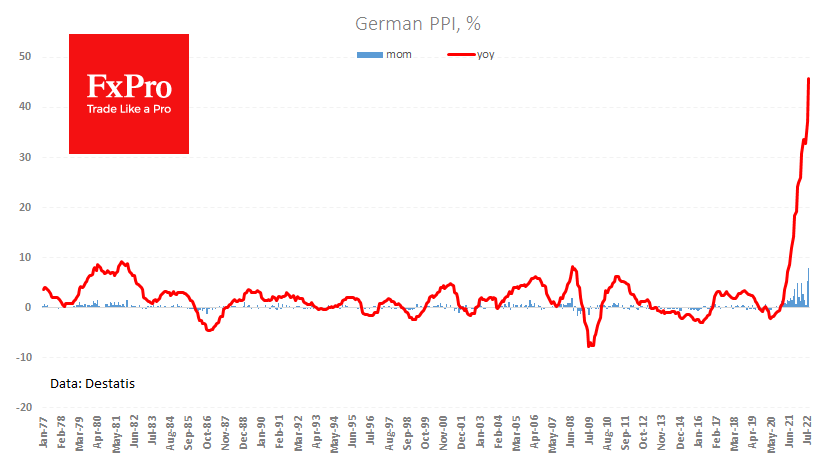

Inflation in Germany continues its hike far beyond the charts. The deceleration of the monthly price growth rate in May and June proved deceptive, followed by a surge of 5.3% for July and 7.9% for August. The annual rate of.

September 20, 2022

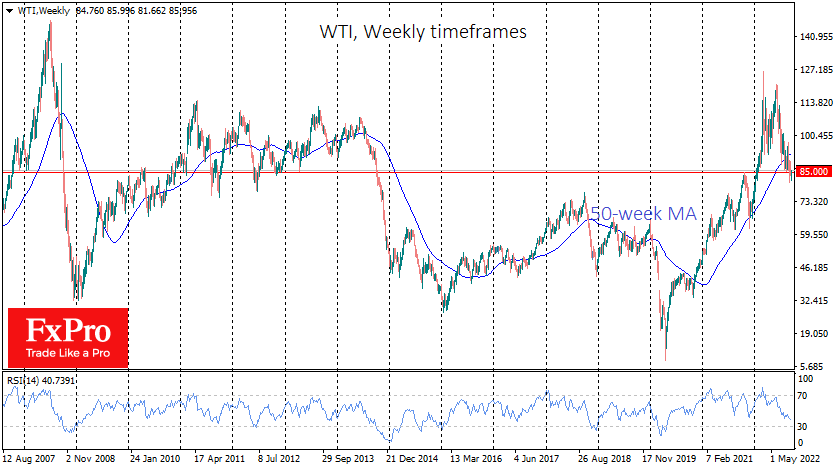

WTI oil suffered an intraday drop of more than 4.5% to $81.70 yesterday but managed to regain all losses by the end of the day, trading now at $85.40. The $85 area has repeatedly acted as the Rubicon since 2007..

September 19, 2022

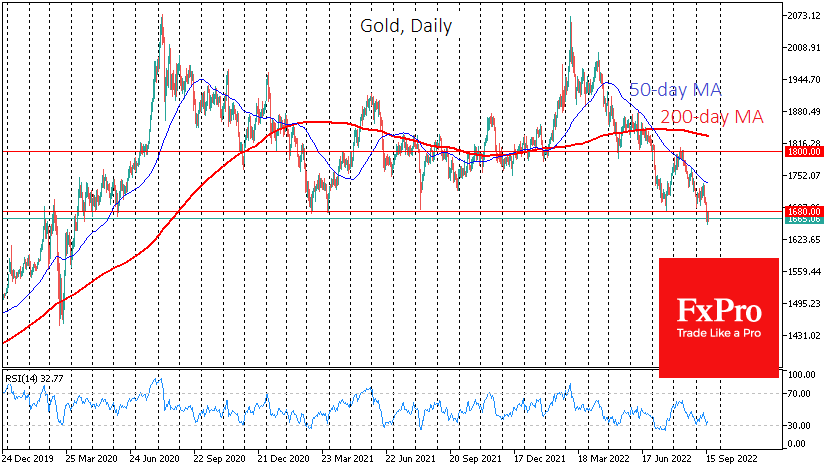

Gold’s timid attempts to push back from the lower end of a more than two-year range were foiled by a stiff market reaction to US inflation statistics. Gold plunged to $1660 on Friday, rewriting its low from April 2020, while.

September 19, 2022

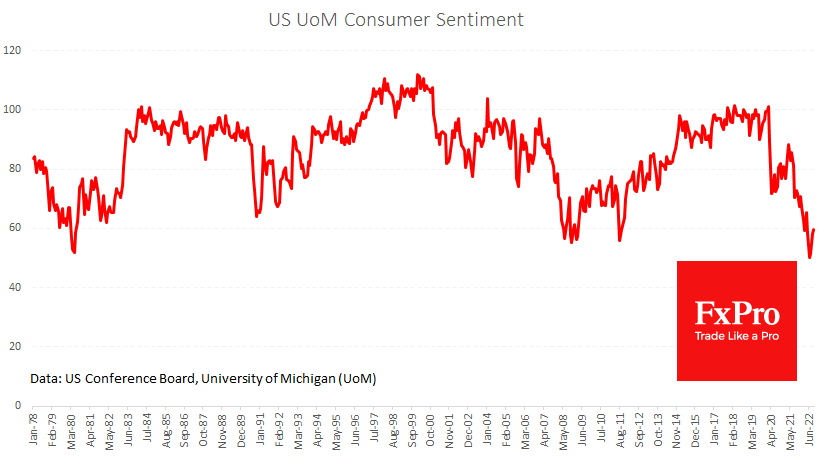

Preliminary estimates from the University of Michigan indicate that inflation expectations in the USA continue to normalise in September. Inflation in the “next year” is estimated at 4.8% compared to 4.8% a month earlier and a peak of 5.4% in.

September 16, 2022

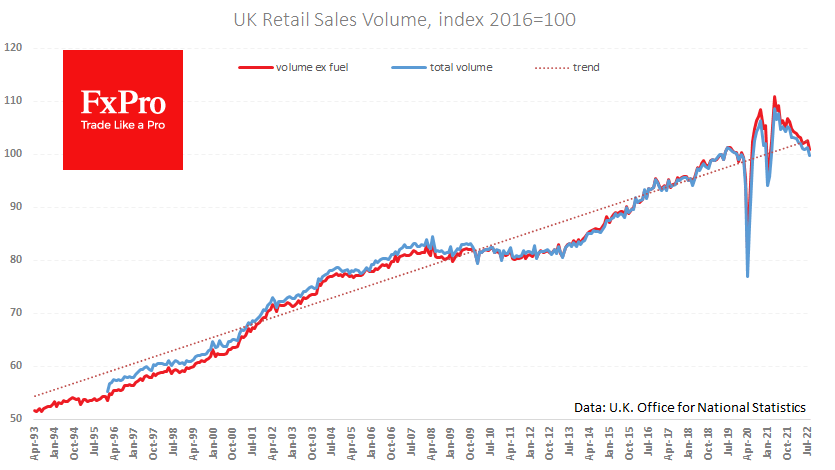

A package of retail sales statistics in Britain appears to have removed the last layer of support for the Pound, sending it into a dive. GBPUSD earlier today renewed its lows since 1985, dropping to 1.1350. Fresh data showed a.