Market Overview - Page 89

November 10, 2022

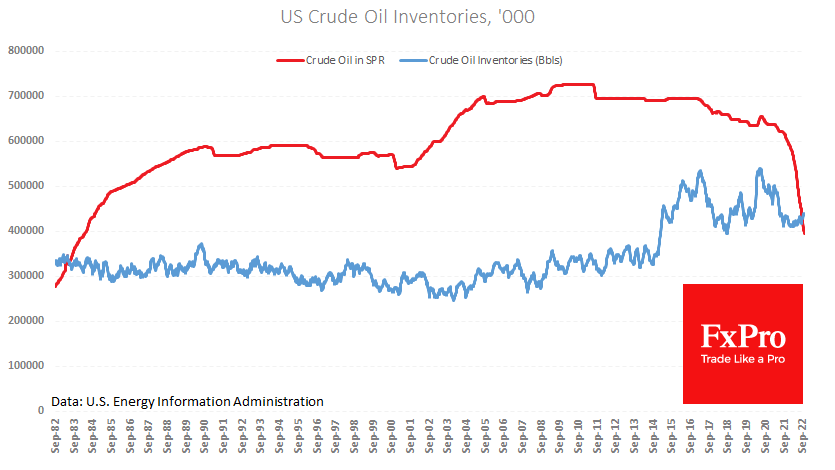

Oil has lost 7.5% since Tuesday, bouncing back to $84 for WTI. Pressure intensified on Wednesday after the weekly inventory report. Having failed to break above $93 for the second time in just over a month, oil appears to have.

November 9, 2022

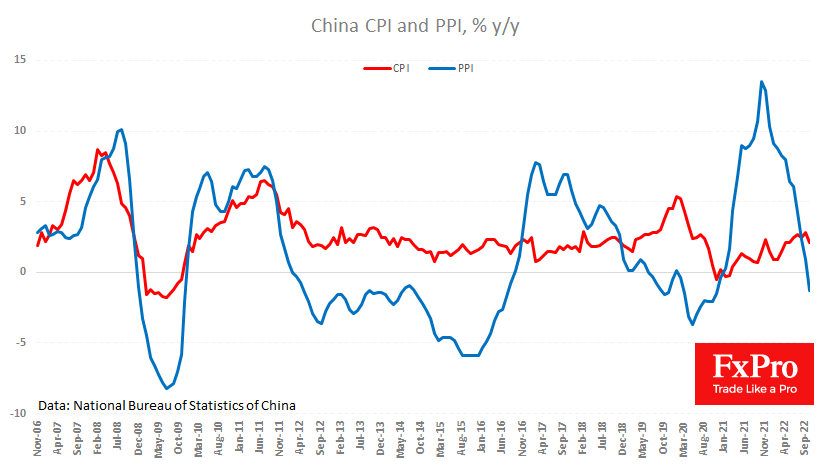

A slowdown in economic activity in China and beyond is putting pressure on consumer and producer inflation. The consumer price index slowed from 2.8% to 2.1% y/y in October, the lowest level since May. The producer price index was 1.3%.

November 9, 2022

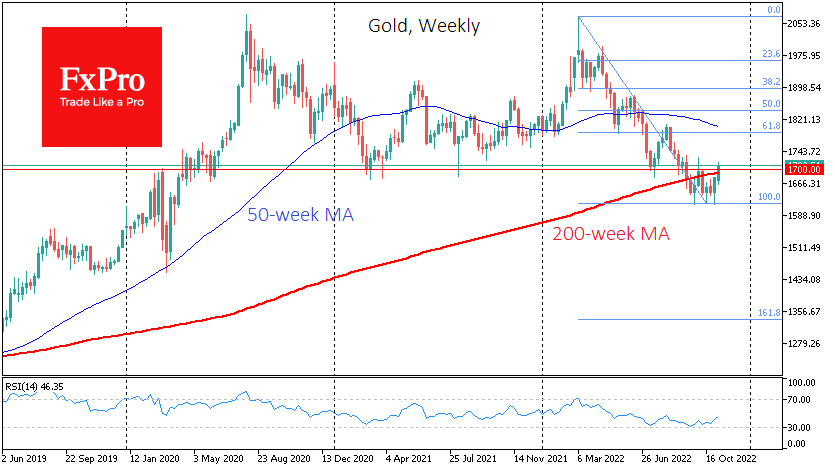

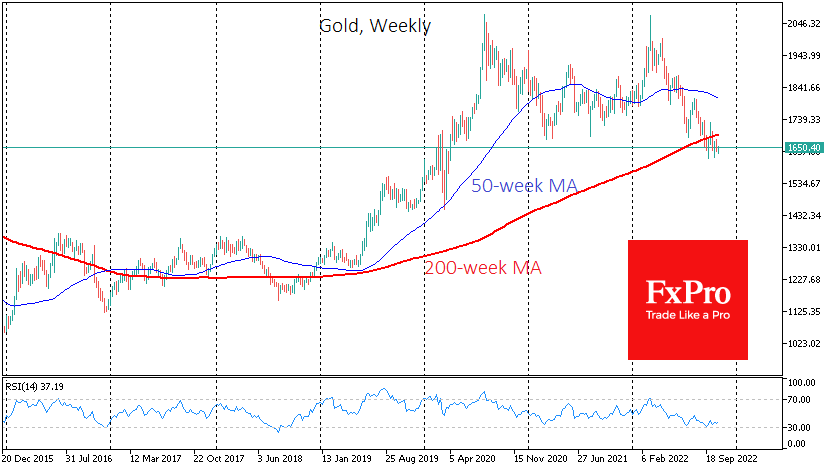

Investor interest in precious metals is shining with renewed vigour as some investors see them as a safe haven amid the storm of the crypto market. Having broken above $1700, gold is showing the first signs of breaking the downtrend.

November 7, 2022

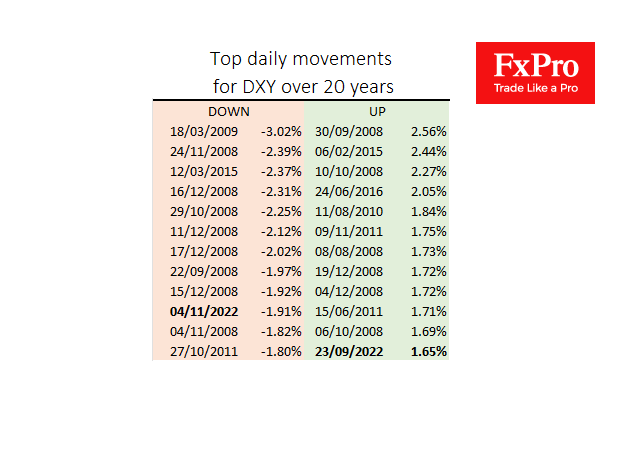

The dollar index lost over 1.9% on Friday, one of the ten most significant daily declines in the last 20 years. Given that the pressure on the dollar was throughout Friday and remained in place on Monday, dollar bulls are.

November 7, 2022

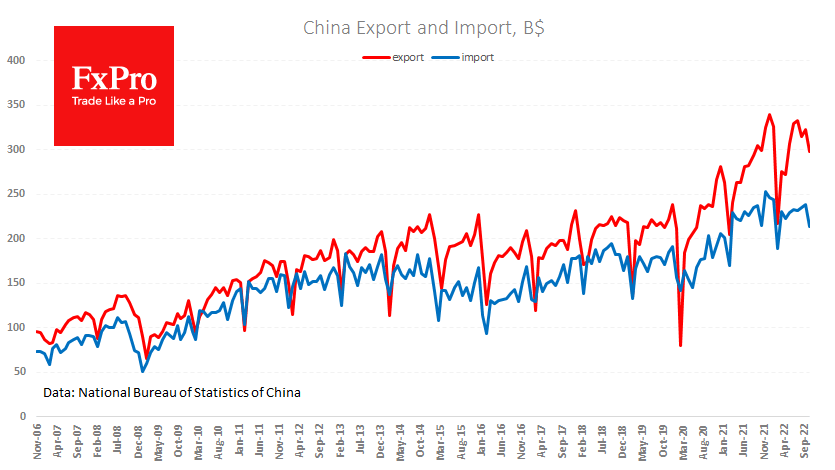

China’s exports contracted by 0.4% YoY in October, while imports lost 0.7% YoY in dollar terms. The foreign trade surplus rose to $85.7bn, lower than expected at $96bn. Most observers saw these figures as a signal of a slowdown in.

November 4, 2022

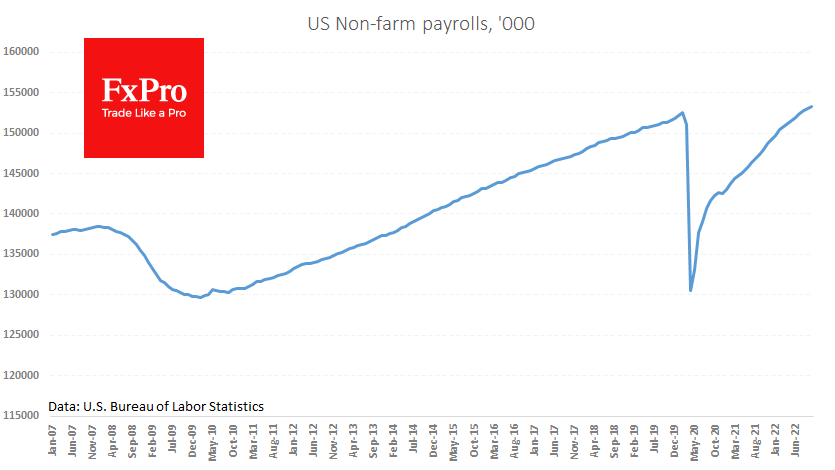

According to the latest BLS report, the US economy created 261K new jobs in October. These figures exceeded the expected 200K. Furthermore, last month’s estimate was significantly improved from 288K to 315K. The labour market thus continues to create jobs.

November 4, 2022

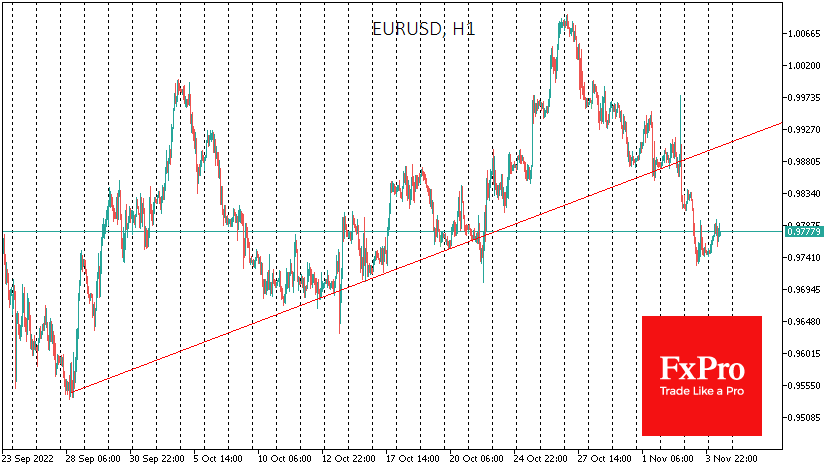

The market reaction to Powell’s comments on Wednesday has shattered the nice technical picture that has been forming in EURUSD for a month since late September. In this environment, the question of whether the dollar could renew the highs made.

November 3, 2022

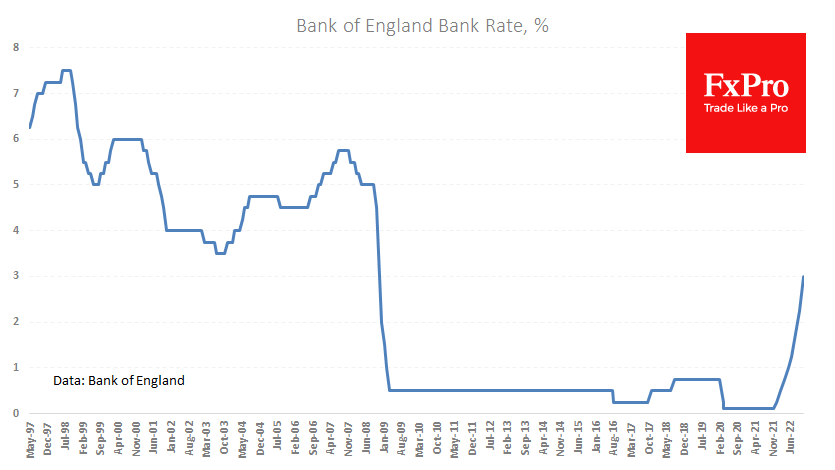

If you want to see how important interest rate expectations are to FX, look at the reaction of the Pound and the Dollar after their central bank meetings. The Bank of England raised rates by 75 points on Thursday, repeating.

November 3, 2022

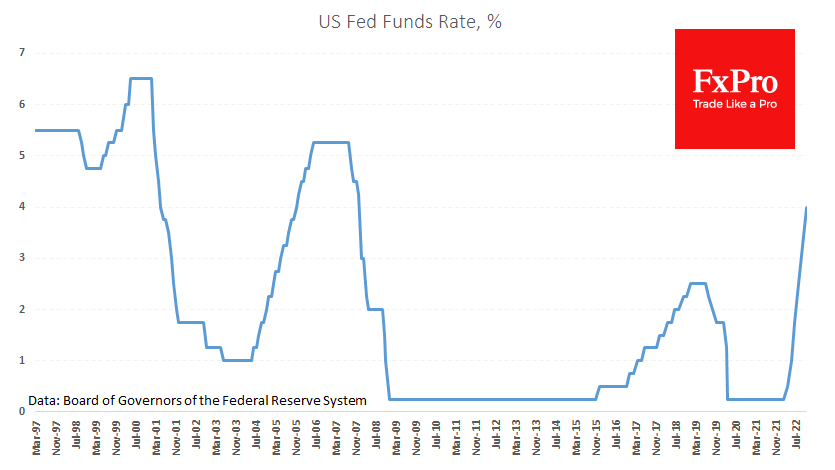

In recent months the Fed has repeatedly taken a more hawkish stance than the markets expect. However, the markets’ preparation for yesterday’s meeting and the signal we read in the official commentary were too strikingly different from the markets’ interpretation.

November 2, 2022

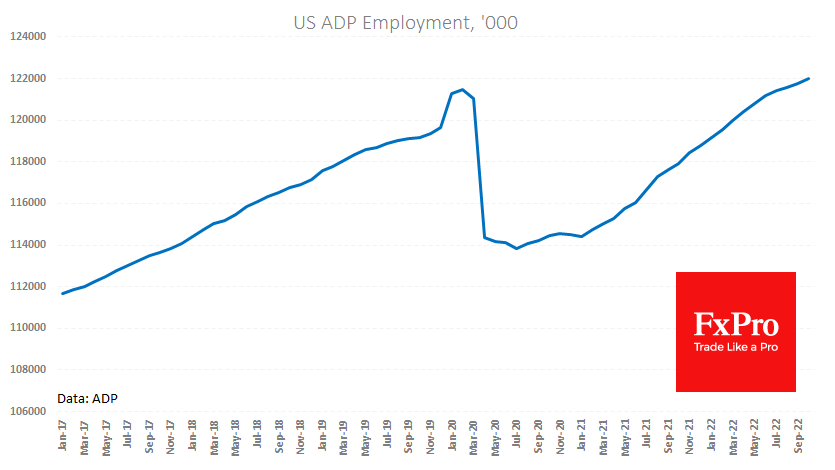

Fresh ADP estimates noted a 239K increase in US employment in October, showing more substantial job growth than in September (192k), contrary to the expected slowdown to 178K. This data primarily guides traders as the most similar indicator before the.

November 2, 2022

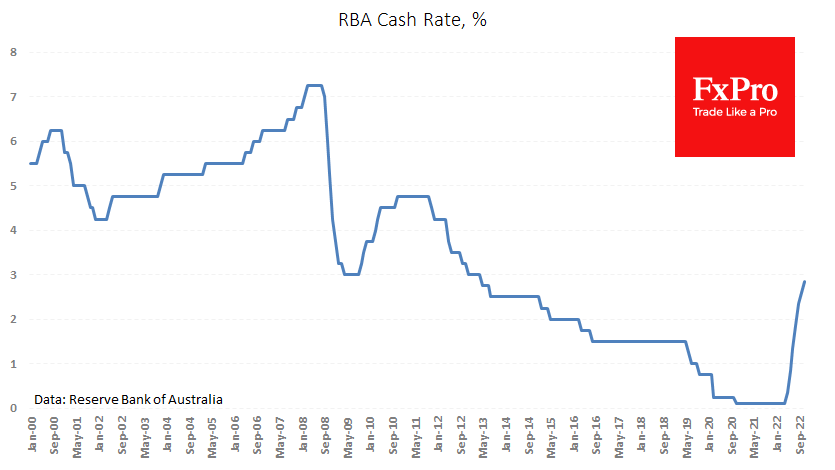

The Reserve Bank of Australia duplicated its move of a month ago by raising the rate by 25 points to 2.85%, in line with economists’ average expectations. This contrasts sharply with a 75-point rate hike from the ECB and expectations.