Market Overview - Page 88

November 16, 2022

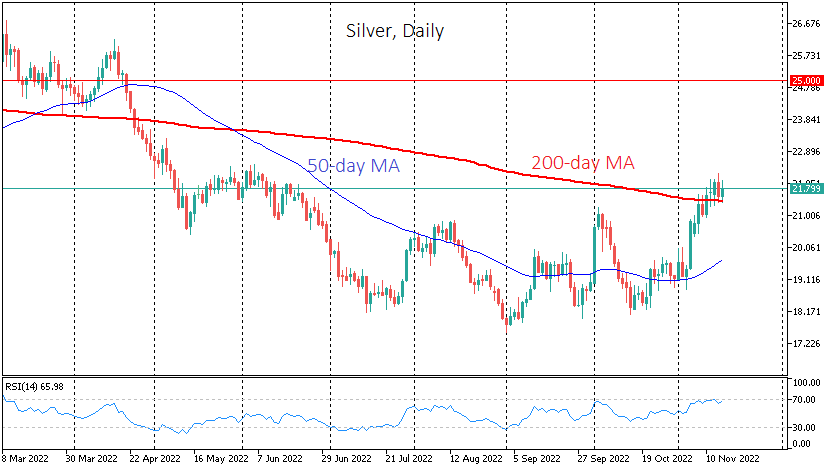

Silver is testing the $22 per ounce mark today and crossed it briefly yesterday. Although Gold marks the fifth consecutive session of back-to-back gains, Silver may have been one step ahead in this market cycle. In early November, the price.

November 16, 2022

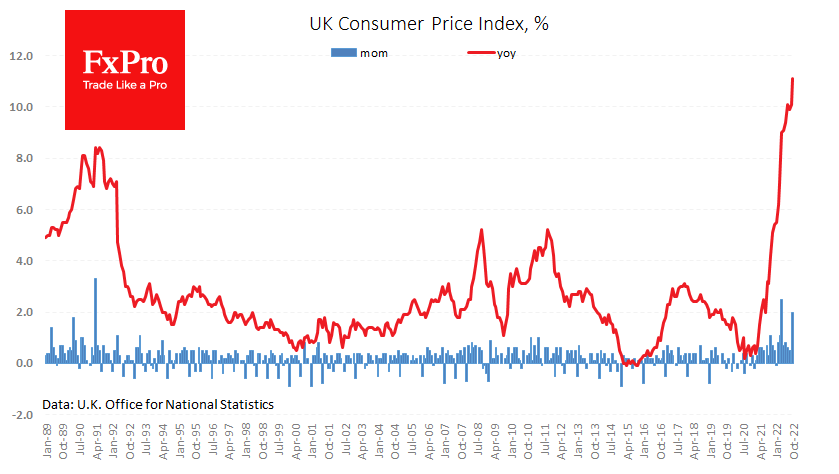

The UK Consumer Price Index delivered another “positive” surprise, adding 2% for October, above the average forecast of 1.7%. Annual inflation accelerated to 11.1% against 10.1% previously and the forecast 10.7%. Inflationary pressures are much stronger here than in the.

November 15, 2022

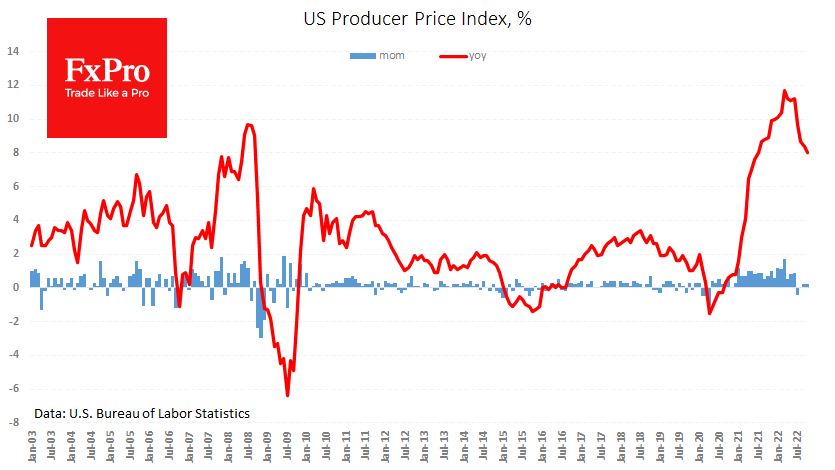

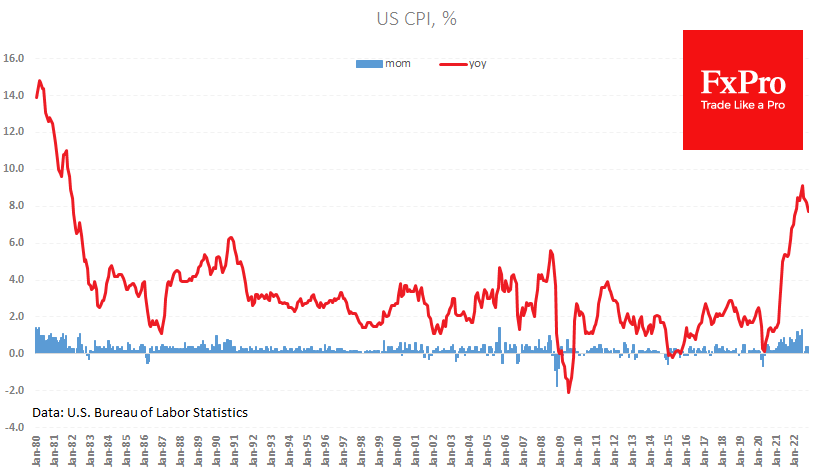

Inflation in the USA continues to slow faster than expected. In October, PPI showed a gain of 0.2% m/m and 8.0% y/y against expectations of 0.4% and 8.3%. Producer prices often leads consumer inflation trends. For example, CPI peaked in.

November 15, 2022

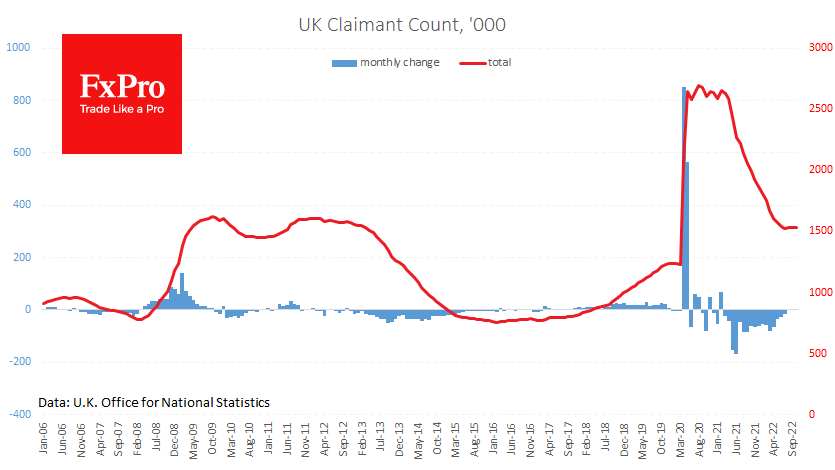

The British pound is on the offensive, having risen to a three-month high against the dollar thanks to a developing correction in the latter, market stabilisation following the change of government and pro-inflationary news. Jobless claims rose by 3.3K in.

November 15, 2022

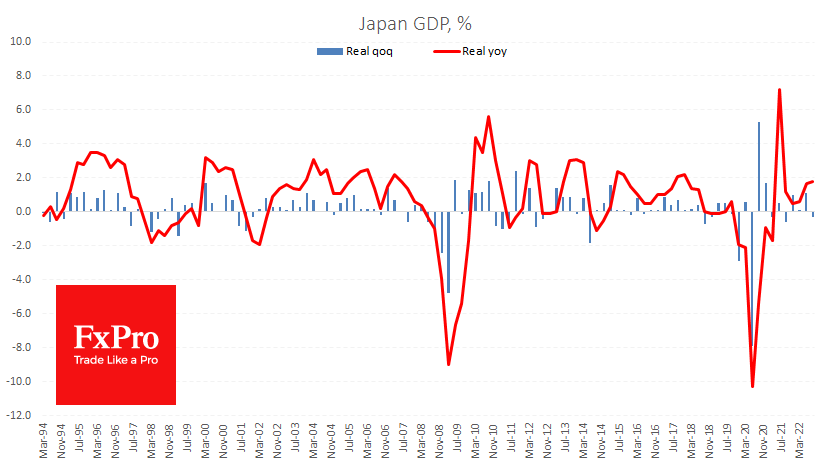

The statistics packages from China and Japan – the largest economies in the Asian region – came out below expectations, highlighting weak domestic demand and production. Japan’s economy lost 0.3% in the third quarter while it was expected to grow.

November 15, 2022

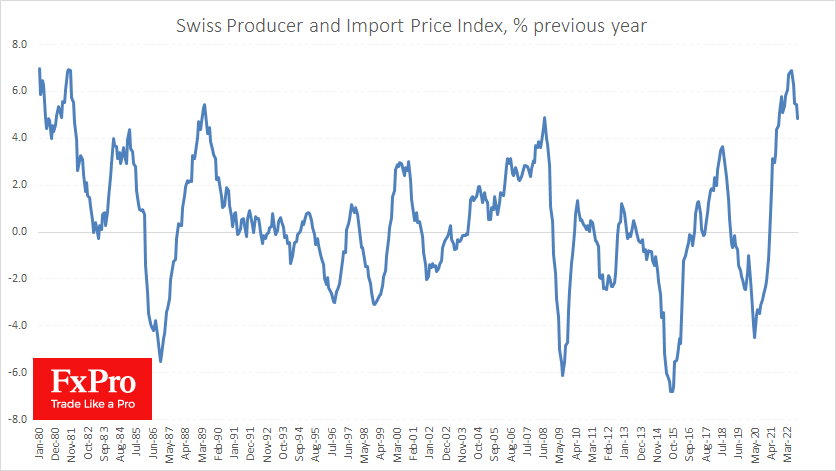

The Swiss Producer and Import Price Index was virtually unchanged in October, slowing down in annual terms to 4.9% against 5.4% a month earlier and against a peak of 5.9% in June. In contrast to its larger eurozone neighbours, the.

November 14, 2022

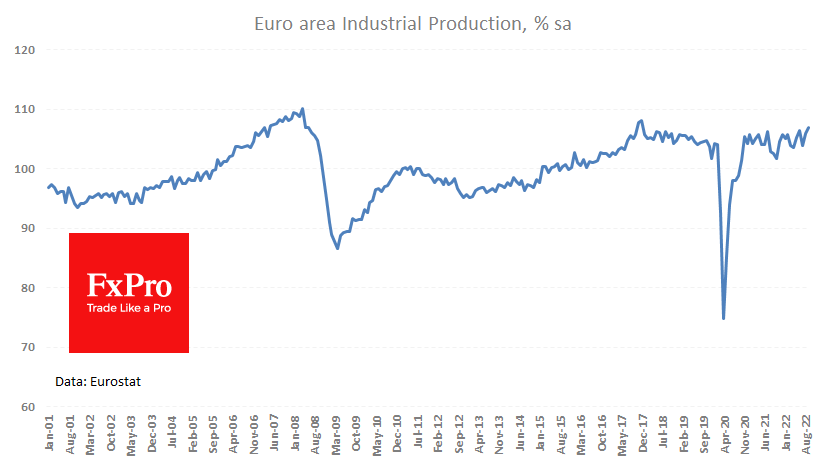

According to the latest estimates, Eurozone industrial production added 0.9% for September and 4.9% y/y. The figures are much better than the expected +0.1% m/m and 2.8% y/y, showing that the euro-region economy is in no hurry to slip into.

November 14, 2022

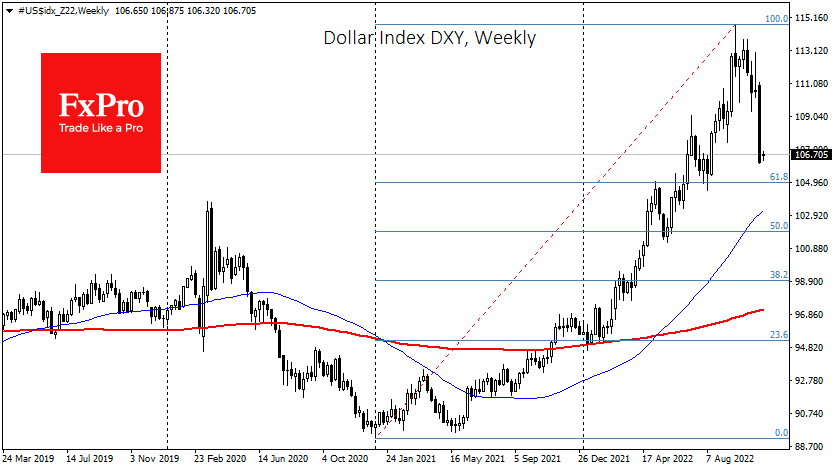

The dollar index lost 4% last week, the most significant drop since March 2020. Such powerful moves against the trend often signal a further trend reversal. However, it will probably be a slower pace of decline and not a one-way.

November 11, 2022

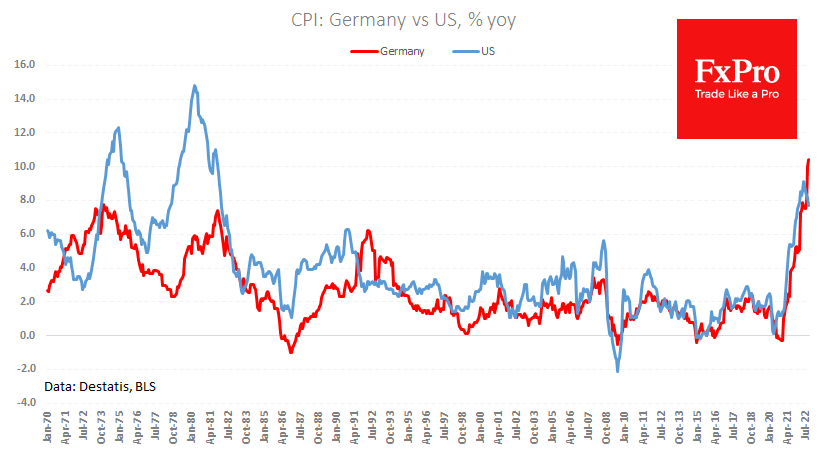

The final German inflation data continues to underline the divergence with the USA. This gives a chance for a further EURUSD recovery if the ECB has the strength to hike rates longer than the Fed. The official report today confirmed.

November 11, 2022

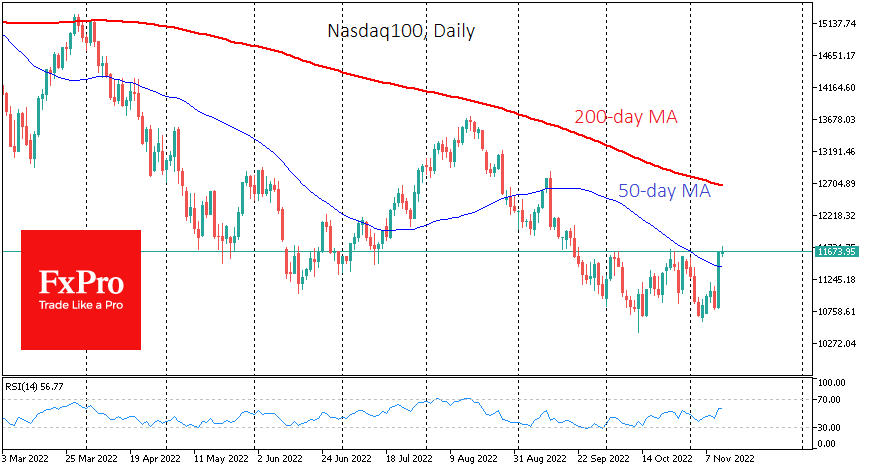

On Thursday, we saw one of the most significant intraday moves of the Nasdaq100, which added 7.5%. The move is very similar to what we have seen in November 2020, December 2018, and March 2009: a strong pullback from the.

November 11, 2022

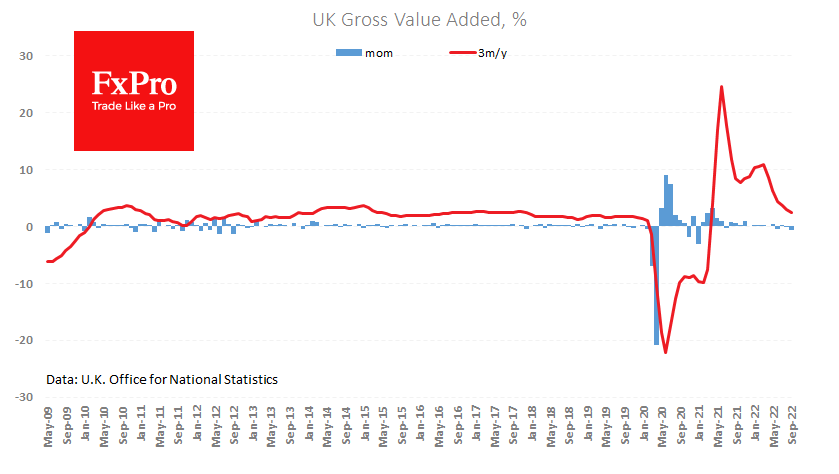

The pound rally gained new momentum on Friday morning, following a respite after the 3% rise in GBPUSD on Thursday. The British currency was supported predominantly by better-than-expected economic data and comments from the Governor of the Bank of England.