Market Overview - Page 8

November 19, 2025

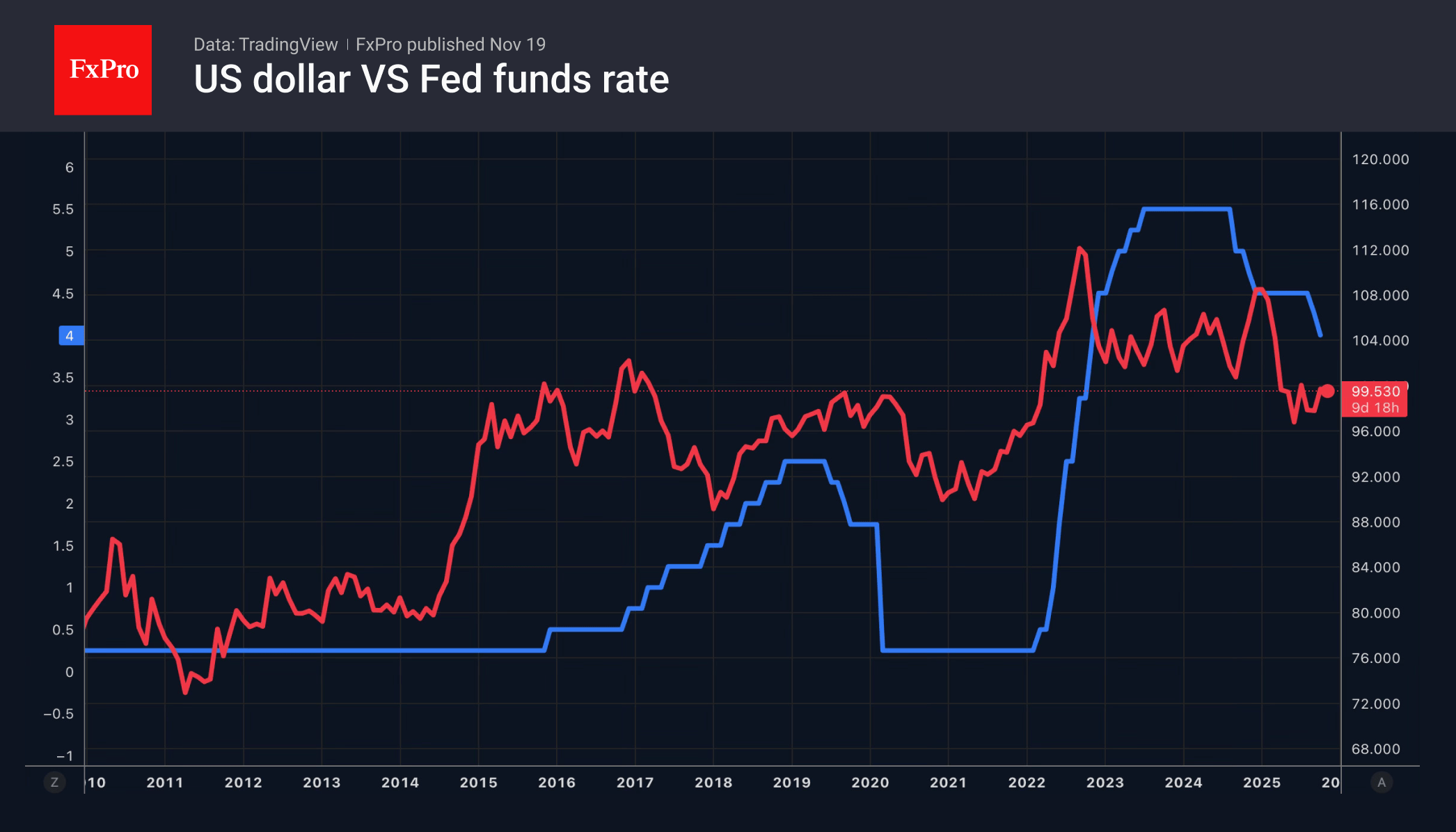

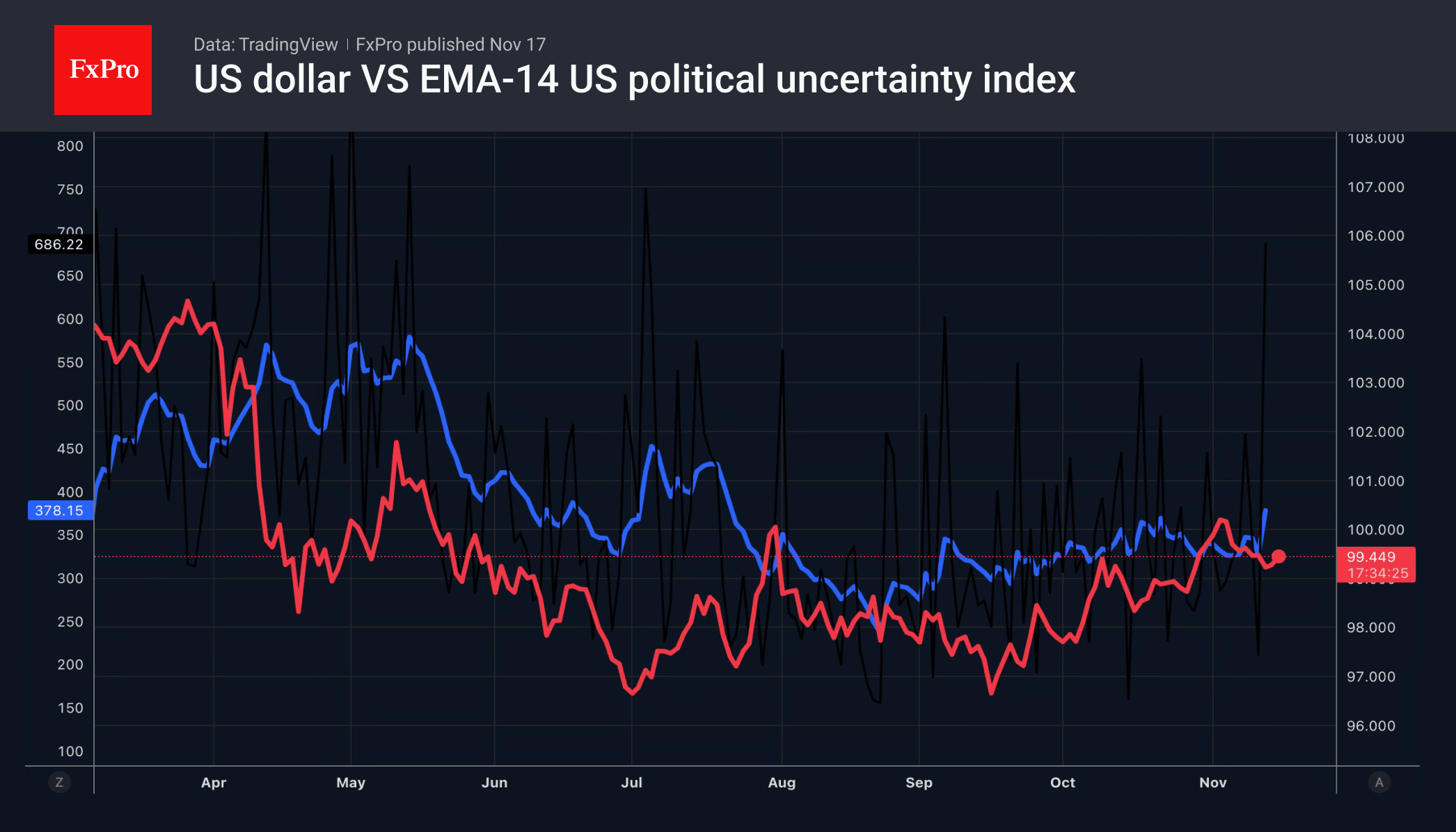

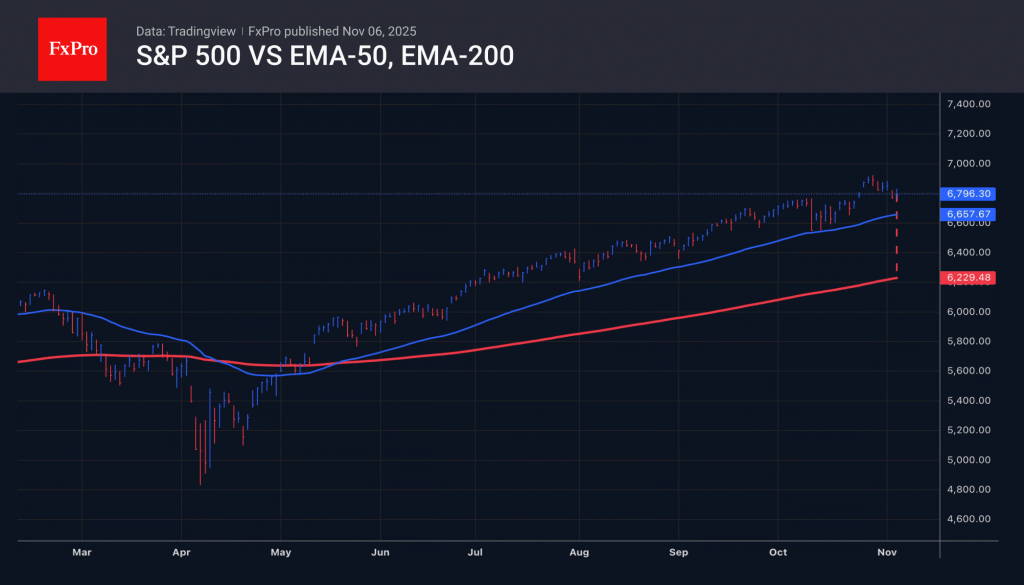

The US dollar is losing its safe-haven status, faces pressure over rates, and investors increasingly favour the yen for 2026.

November 18, 2025

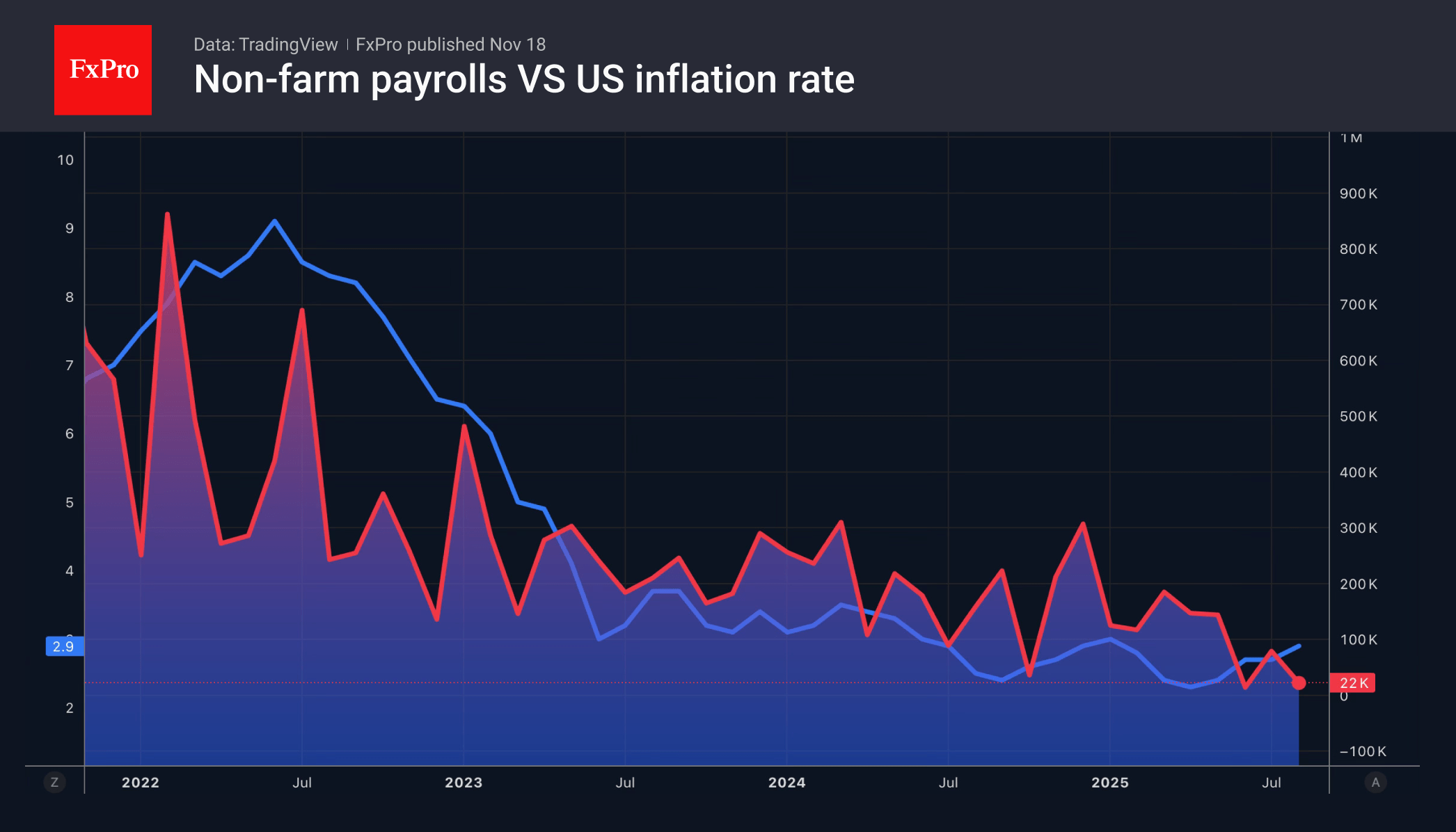

The Fed's hawks and doves clash as rate cut hopes waver; USD and CHF move on policy, inflation, and tariff shifts.

November 17, 2025

The dollar gains on lower tariffs and hawkish Fed, while pound and yen await key economic data for future direction.

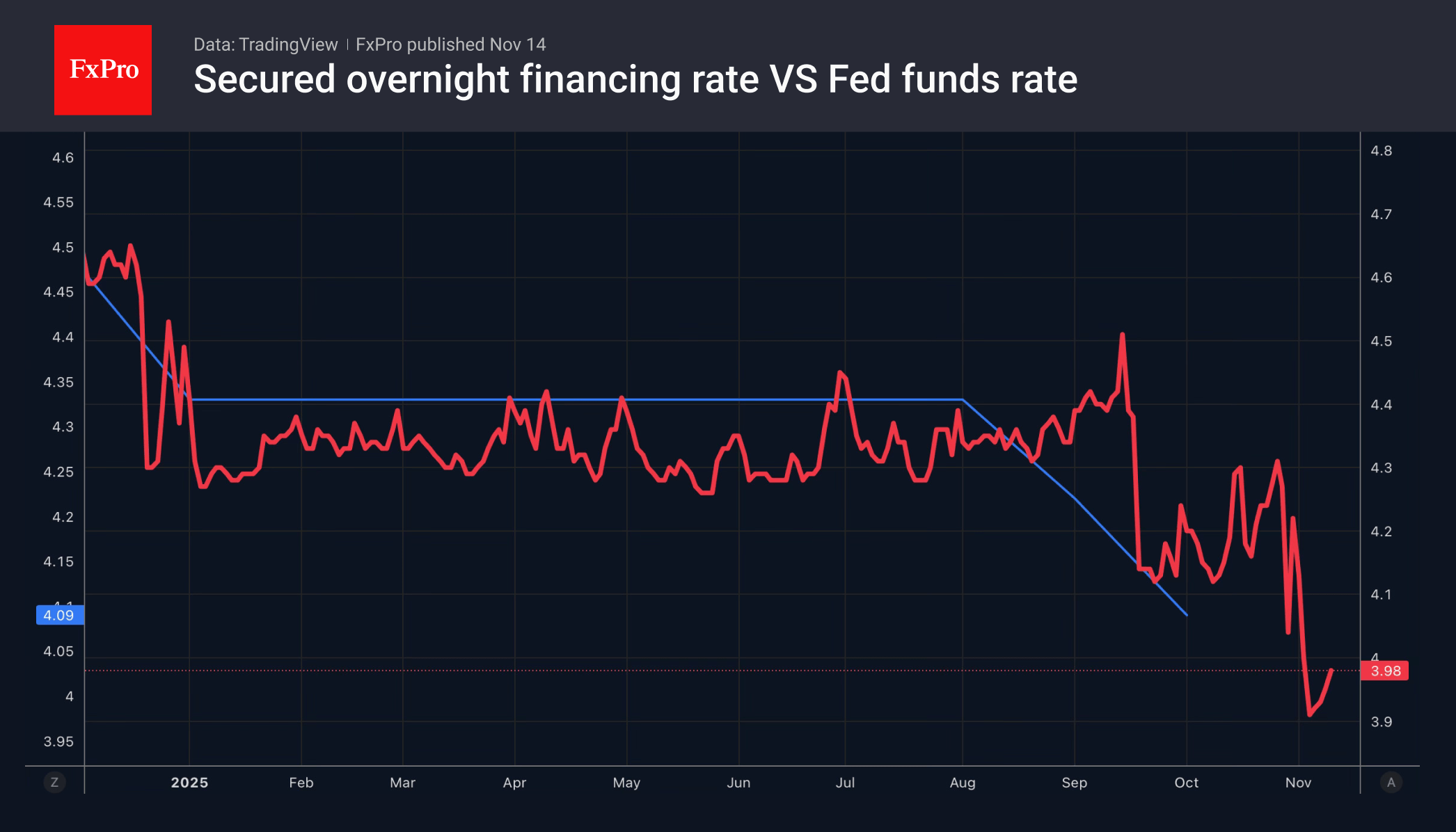

November 14, 2025

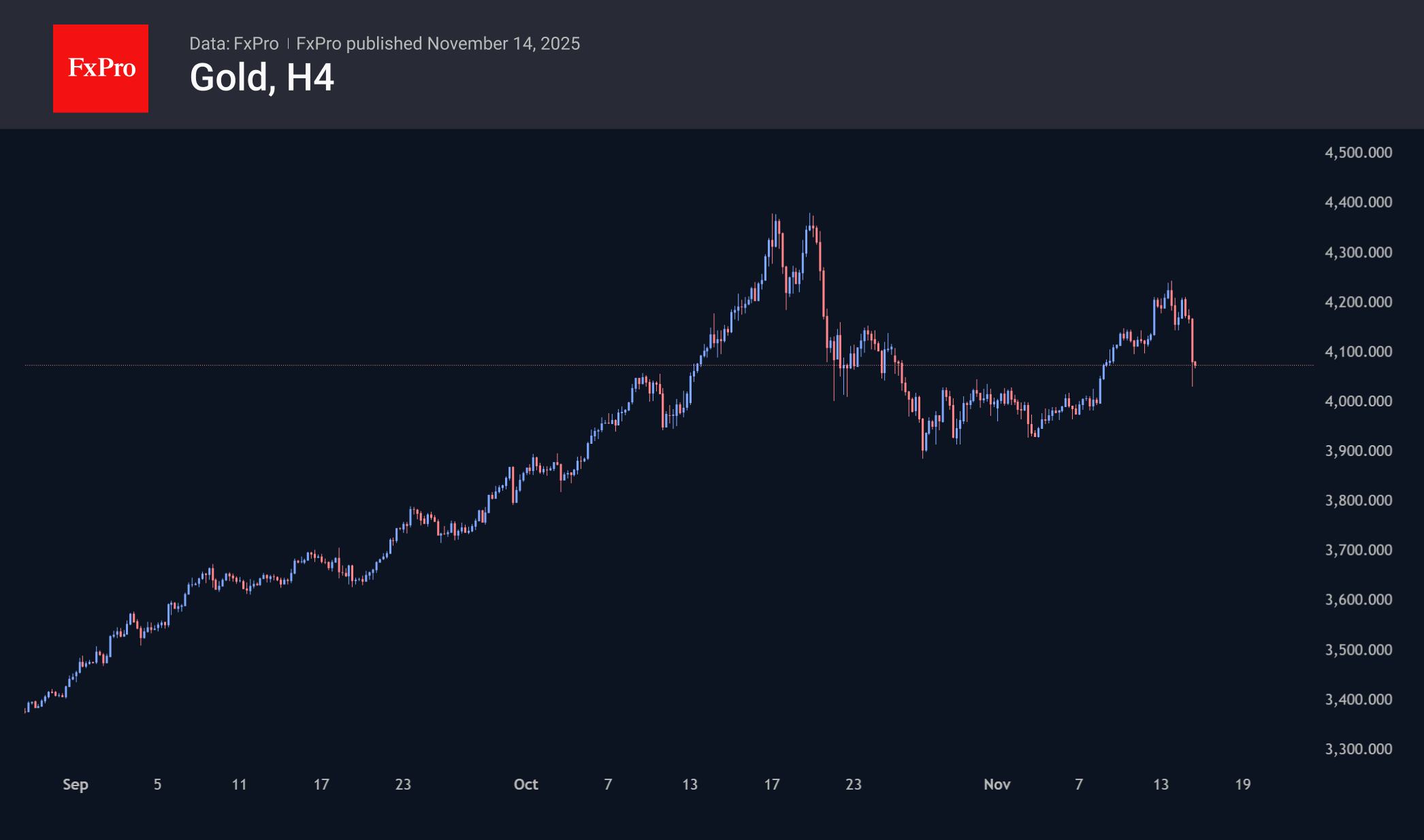

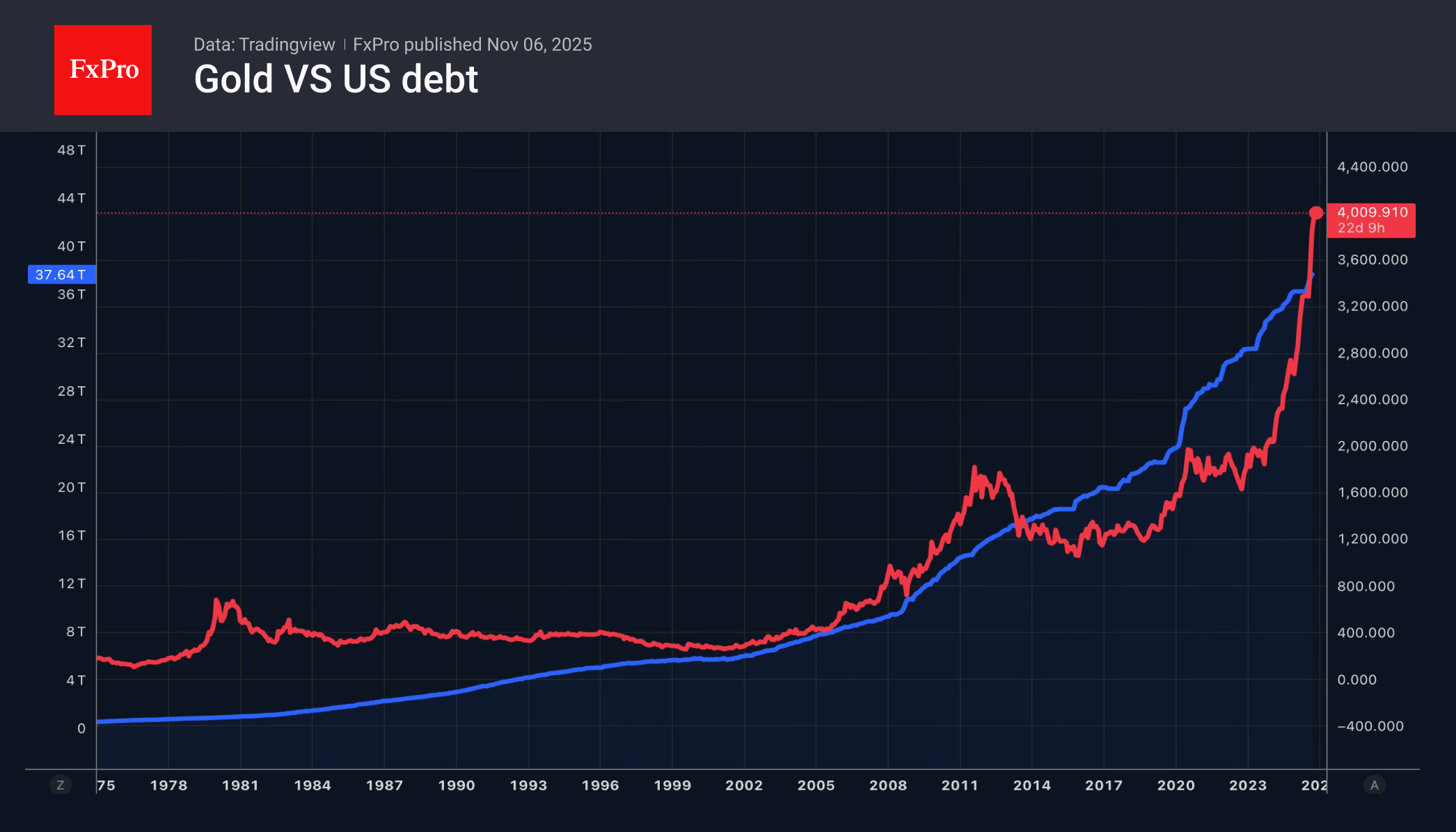

The weakness of the US dollar and rumours of the Fed resuming asset purchases have been catalysts for gold’s rise since the beginning of the week, but Thursday and Friday clearly showed that this is no longer a one-way street..

November 14, 2025

The US dollar weakens amid hawkish Fed speakers and unwinding of the carry trade; and rising odds of a BoE rate cut; Japan refrains from intervention.

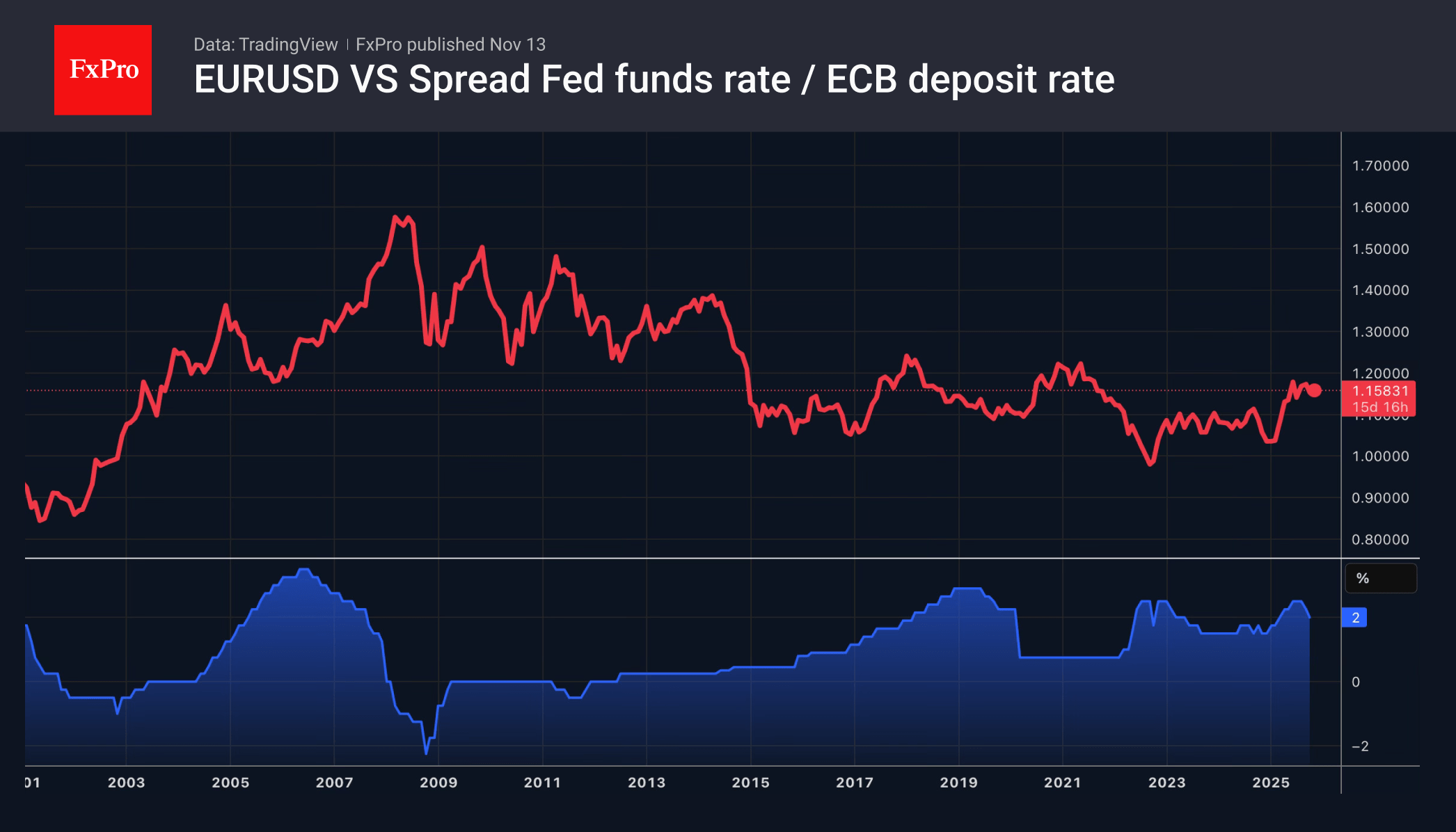

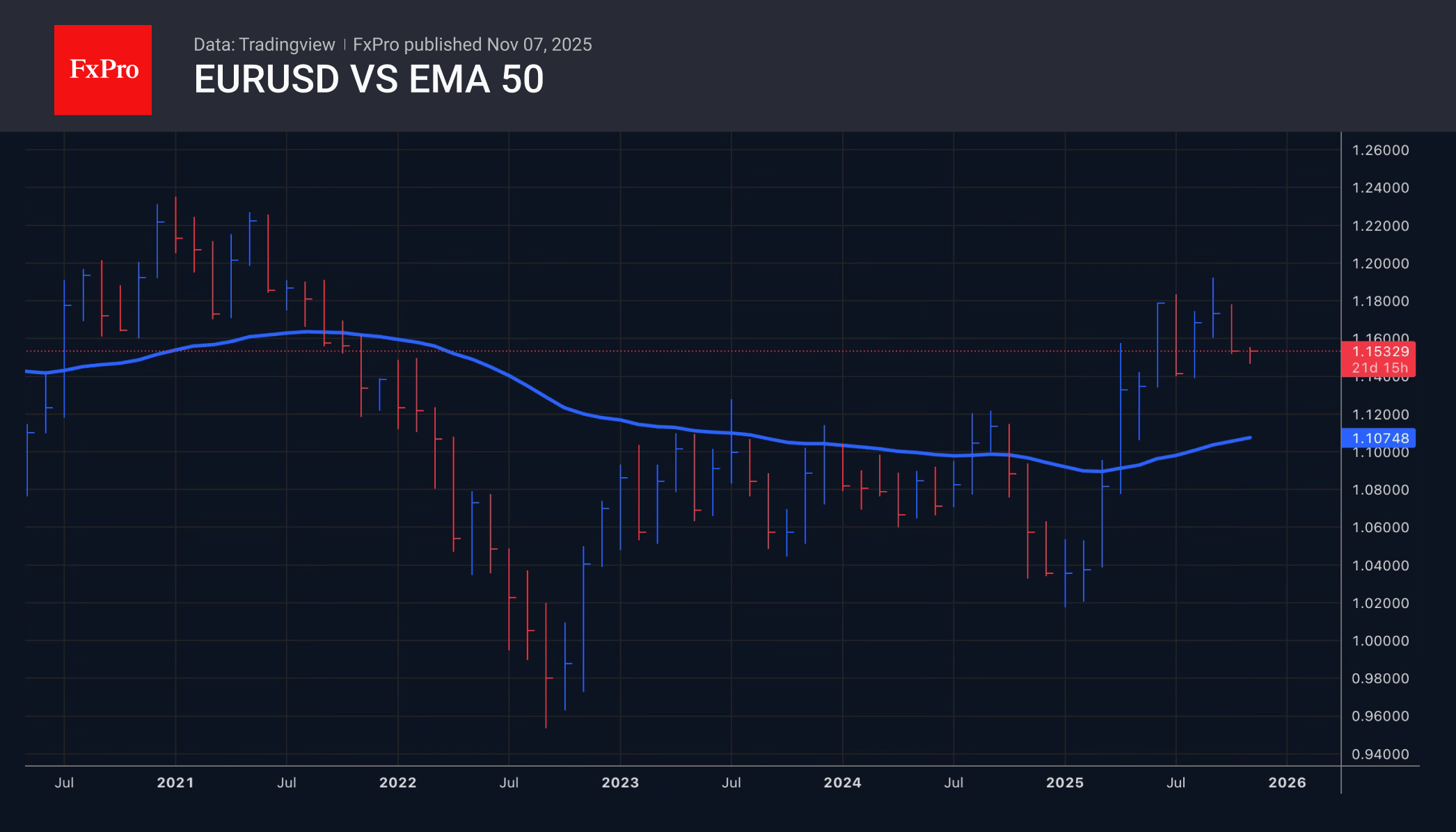

November 13, 2025

US shutdown ends, EURUSD rises on policy convergence, UK political turmoil hits pound, and Japan’s interventions fail to support yen.

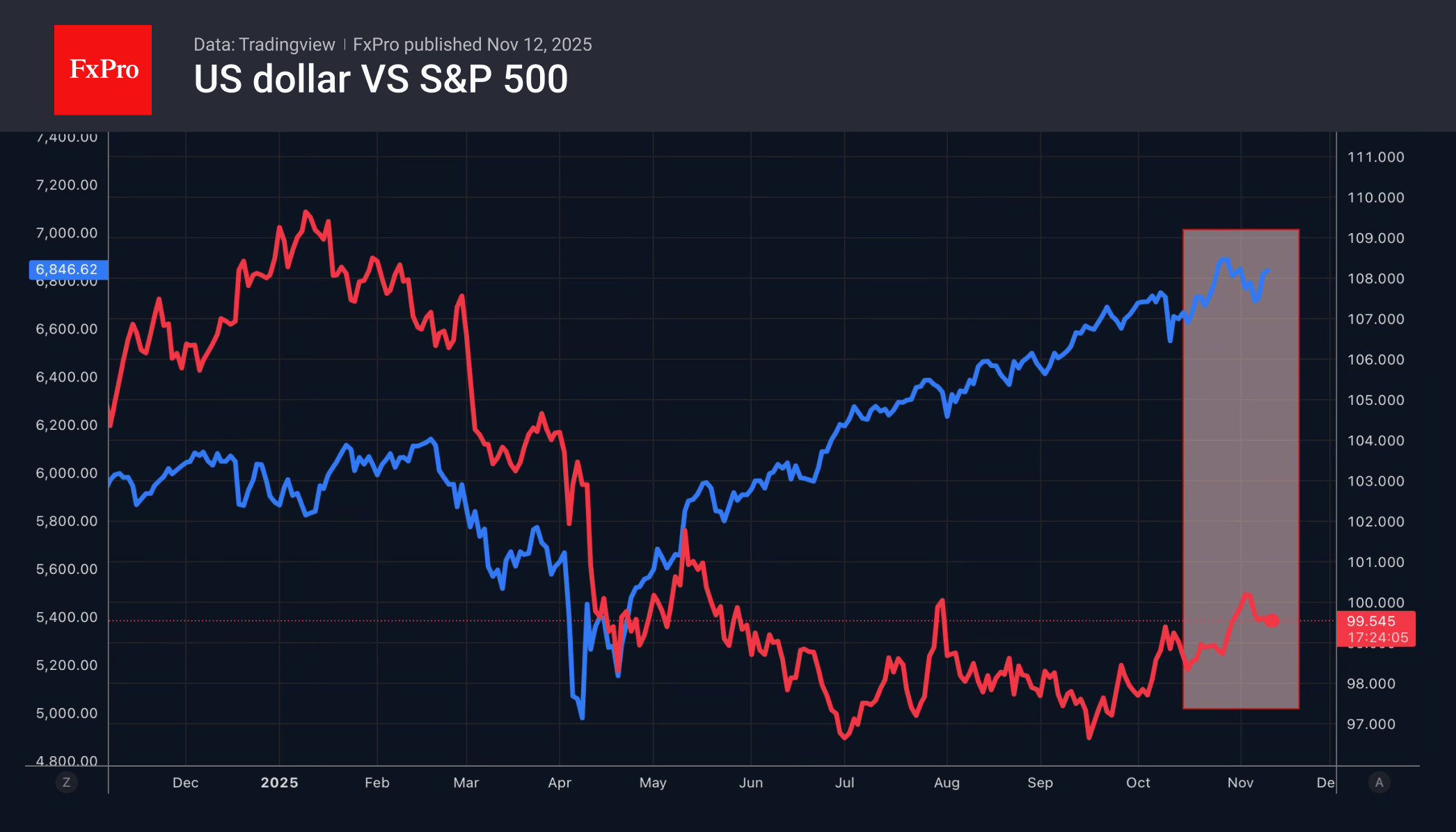

November 12, 2025

US dollar faces pressure from global growth and politics, pound hit by UK uncertainty, and yen remains weak despite interventions.

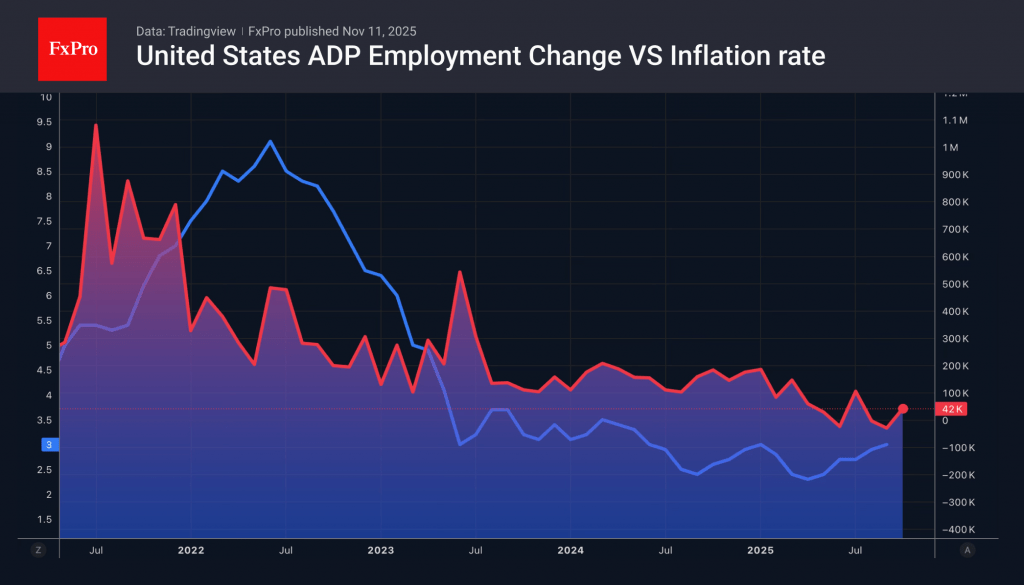

November 11, 2025

USD got support from the economy; CHF benefits from lower tariffs; AUD rises with risk appetite; JPY pressured by lower safe-haven demand.

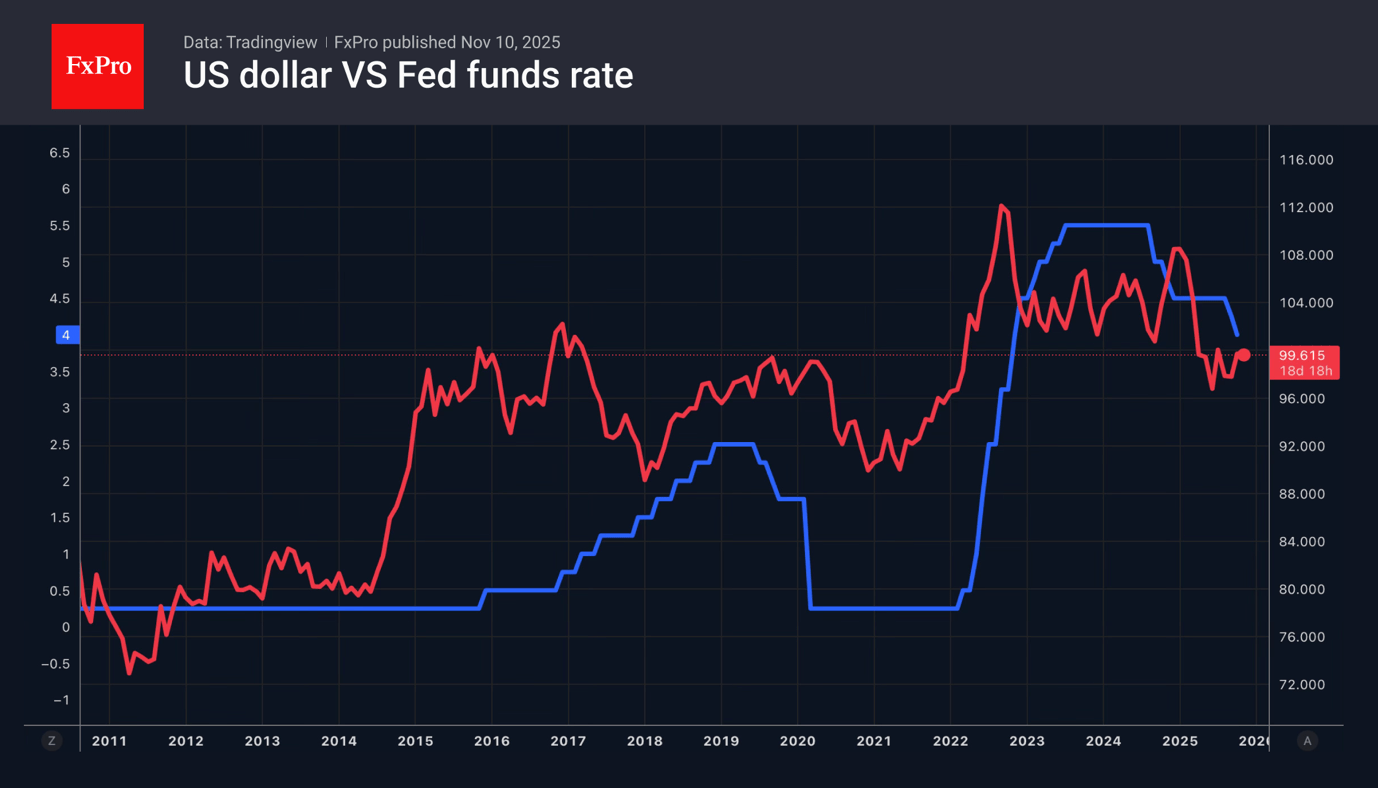

November 10, 2025

The US dollar faces uncertainty amid Fed rate doubts, legal tariff rulings, eurozone gains, and yen volatility due to policy shifts.

November 7, 2025

Gold has stabilised around the $4,000 mark over the last ten days, ending the week at roughly the same level as it started. Attempts by sellers to push the price below $3,900 are meeting with impressive buying interest. This is.

November 7, 2025

The US dollar retreated against major world currencies after further evidence of labour market weakness and a decline in Donald Trump’s chances of winning in the Supreme Court to 20%, according to Polymarket. There is a lot at stake. The.