Market Overview - Page 532

February 15, 2019

A record amount of money poured into China’s financial markets in 2018 — and analysts say that figure will likely increase as closely followed indexes raise their weightings for Chinese assets. China’s bond and stock markets experienced inflows of $120.

February 15, 2019

Important upcoming events and publications for February 15 (GMT): 09:30 U.K. Retail Sales fell sharply last month by 0.9%, and it is expected to show some rebound in January by 0.2%. British statistics for the past few weeks have been.

February 14, 2019

Britain’s economy slowed last year to its weakest growth rate since the global financial crisis as mounting uncertainty over Brexit weighed on businesses and kept a lid on their investments, official figures showed Monday. The Office for National Statistics said.

February 14, 2019

Ripple (XRP) is not a cryptocurrency, and it is heavily centralized in the hands of the corporate entity known as Ripple. That’s the opinion of a cryptocurrency exchange which listed XRP on its platform just one day ago. The Coinmotion.

February 14, 2019

European stocks climbed at the open and U.S. equity futures advanced after the White House was said to weigh postponing higher tariffs on China for 60 days. Treasuries were steady alongside the dollar, while oil advanced. Gains in industrial-goods and.

February 14, 2019

Whether or not you believe the Russian economy grew 2.3 percent last year, beating the most optimistic expectations, the Russian Economy Ministry doesn’t want anyone to expect a repeat in 2019. That doesn’t mean there will be no baffling statistical.

February 13, 2019

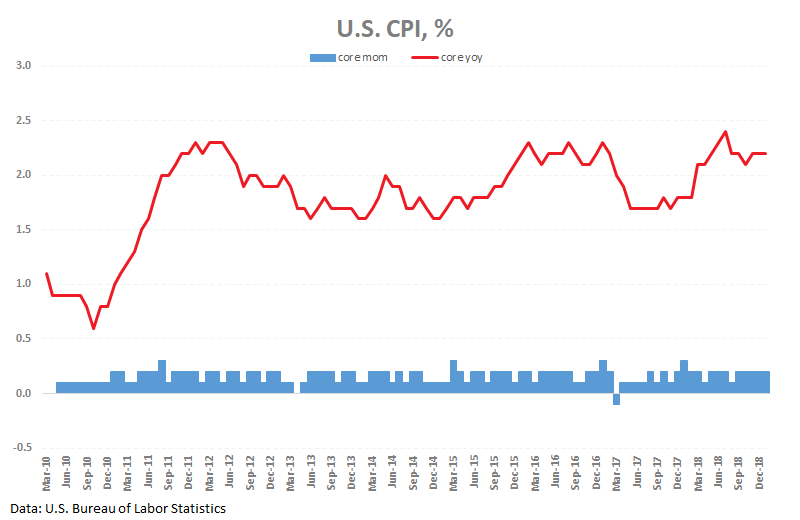

In contrast to the disappointing data from Europe, where the decline in industrial production is growing, and the U.K., which has been marked by weak inflation today, the US continues to surpass expectations. The US consumer price index slowed to.

February 13, 2019

Recent inflation data in the UK put pressure on the pound. GBPUSD has turned to decline from 1.29 after the release of disappointing inflation data for January. Official data from ONS noted overall consumer prices decline by 0.8% in January.

February 13, 2019

Important upcoming events and publications for February 13 (GMT): 09:30 U.K. Consumer price index is often seen as an important and timely indicator of economic activity. In January, prices are expected to drop by 0.7%, while in annual terms inflation.

February 13, 2019

In the last 24 hours, the EOS price has surged from $2.71 to $3.06 by more than 10 percent against the U.S. dollar, reclaiming its position as the 4th largest crypto behind Bitcoin, Ethereum, and Ripple. Last week, Litecoin overtook.

February 13, 2019

U.S. stock futures indicated major indexes could be headed for fresh highs on Wednesday, after President Donald Trump said he may let a China trade-deal deadline slide if the two sides were making enough progress. Dow Jones Industrial Average futures.