Market Overview - Page 528

February 27, 2019

The latest issue of Diar points out that Bitcoin miners and other crypto miners have made tens of millions of dollars without processing a single transaction. The major proof-of-work blockchains, Bitcoin, Ether, Litecoin, and Dash, have earned in excess of.

February 27, 2019

Asian shares were higher in muted trading Wednesday as investors awaited the second summit between President Donald Trump and North Korean leader Kim Jong Un in Vietnam. Japan’s benchmark Nikkei 225 added 0.5% in early trading. Australia’s S&P/ASX 200 gained.

February 27, 2019

Markets remain under moderate pressure, despite the Fed comments. Powell’s semi-annual speech in Congress reinforced expectations that the US Central Bank is ready to show more patience in the face of a slowing economy. In fact, it was a further.

February 26, 2019

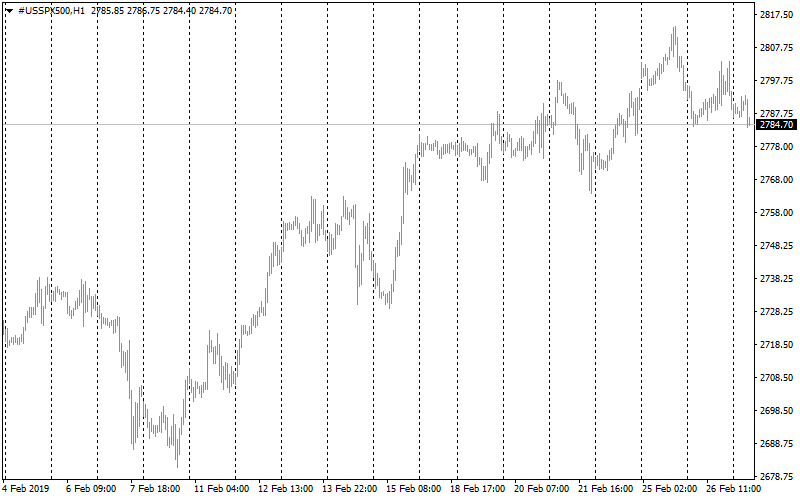

The Dow and U.S. stock market traded lower on Tuesday after government data showed housing starts tanked in December, highlighting extensive damage to the real estate sector since interest rates began to rise. All of Wall Street’s major indexes showed.

February 26, 2019

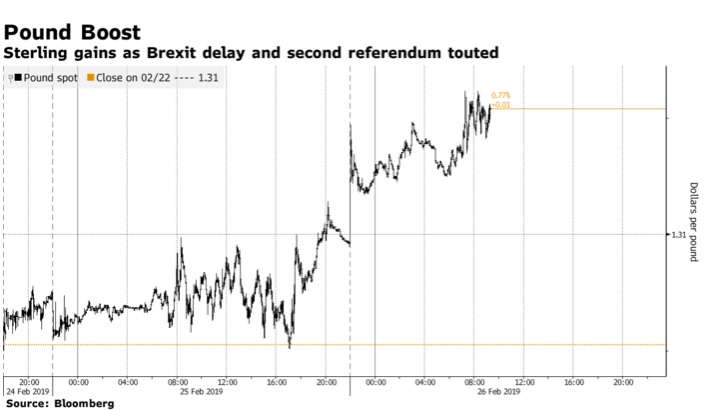

The pound jumped on the news that May intends to offer the cabinet to consider Brexit postponing if there is no deal with the EU. Markets always positively respond to news aligned with possible delays. As a result, GBPUSD rose.

February 26, 2019

The National Bank of Ukraine, the country’s central bank, has been working on a pilot project to test the usefulness of a digital version of its currency, the Hryvnia. The bank announced today that it had completed the pilot and.

February 26, 2019

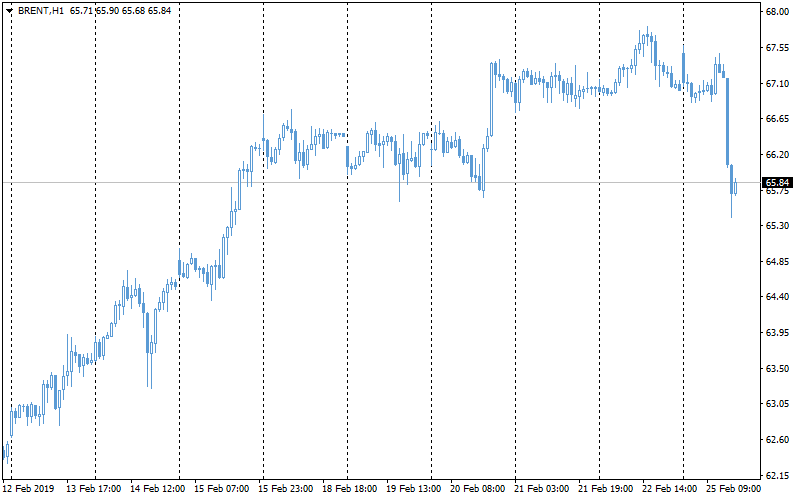

Donald Trump sent the oil market into a tailspin Monday with one tweet claiming oil prices are too high and blaming OPEC for it. Is Trump unaware that oil prices are a function of supply and demand? Or is he.

February 26, 2019

Stocks fell and bonds rose on Tuesday as the rush of optimism over U.S.-China trade talks from earlier in the week faded. The pound strengthened after U.K. Prime Minister Theresa May was said to be considering a plan to delay.

February 26, 2019

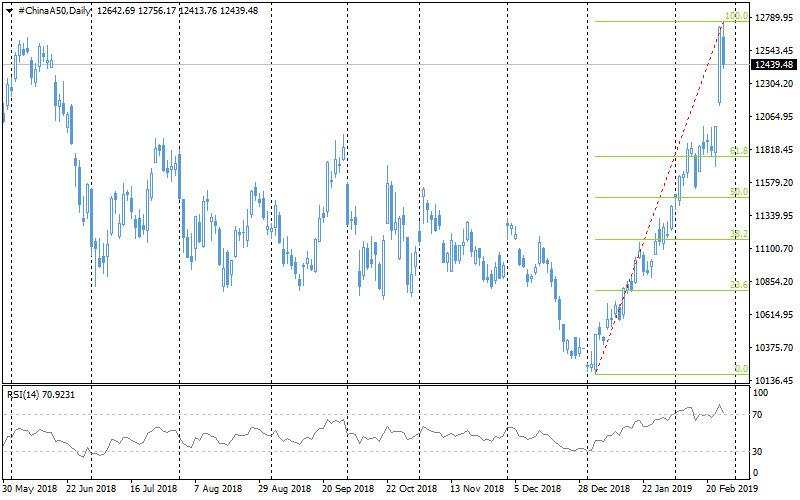

Asian and US markets turned to decline after a long rally. According to technical analysis, this may be the beginning of a long-term correction or even reversal. The dizzying rally on Monday turned into a hangover the next day. China’s.

February 25, 2019

U.S. equities climbed to almost four-month highs, tracking gains in Europe and Asia, after President Donald Trump postponed the date for boosting tariffs on Chinese imports, taken as a sign of progress in the trade talks. Bonds fell and oil.

February 25, 2019

Oil has lost 2.5% in the last two hours, after Trump’s next attempt to push it lower. On Twitter, he wrote that the “oil prices getting too high”. This is bad news for both Brent and WTI, because at the.

February 25, 2019

Bitmain has announced the BM1397, a new, more efficient cryptocurrency mining chip. The chip sports a 28% power efficiency improvement over its predecessor. The news brought with a mention of upcoming S17 and T17 models, about which very little other.