Market Overview - Page 480

July 24, 2019

Tax cuts could end up supporting economic growth in China, even if Beijing’s trade war with the U.S. doesn’t improve, according to the chief economist of a Chinese investment banking firm. The U.S. and China have been locked in a.

July 24, 2019

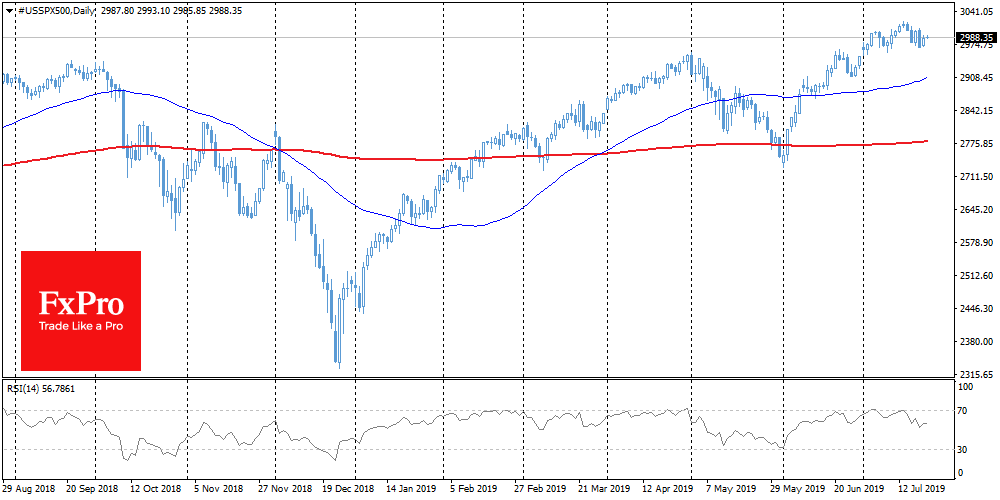

Market overview FX: USD is growing as more Central banks soften their policy stance Stocks: SPX adds due to news about trade negotiations and speculation around the reduction of rates by the world Central Bank. Commodities: Brent adds 1.8% overnight,.

July 24, 2019

Alex Jones was in full agreement with the Bitcoin crowd for about five seconds this week, when he proclaimed the slow death of fiat currencies. However, in the next breath, he warned that the replacement for the inflated fiat corpse.

July 23, 2019

BTC is developing a decline at the beginning of the week: there is a struggle for a threshold of $10,000. Crypto market always balances on the verge of optimism and pessimism: this time was no exception. Congress spoiled enough the.

July 23, 2019

European stocks advanced alongside shares in Asia and U.S. equity futures Tuesday amid a busy week of corporate earnings and potential developments in trade negotiations. Oil stabilized and the dollar climbed. The Stoxx Europe 600 gained after upbeat reports from.

July 23, 2019

Nearly 2.7 trillion won ($2.3 billion) have been lost to crimes involving cryptocurrency in the last two years, according to South Korean government data. Figures provided by the country’s justice ministry on Sunday indicate that losses from crypto scams, Ponzi.

July 23, 2019

Within less than three weeks, since July 9, the bitcoin price has fallen from over $13,000 to below $10,000, which many investors regard as a key psychological level for the crypto asset. While the dominant crypto asset initiated a strong.

July 23, 2019

President Donald Trump and congressional leaders announced Monday they had struck a critical debt and budget agreement. The deal amounts to an against-the-odds victory for Washington pragmatists seeking to avoid politically dangerous tumult over the possibility of a government shutdown.

July 23, 2019

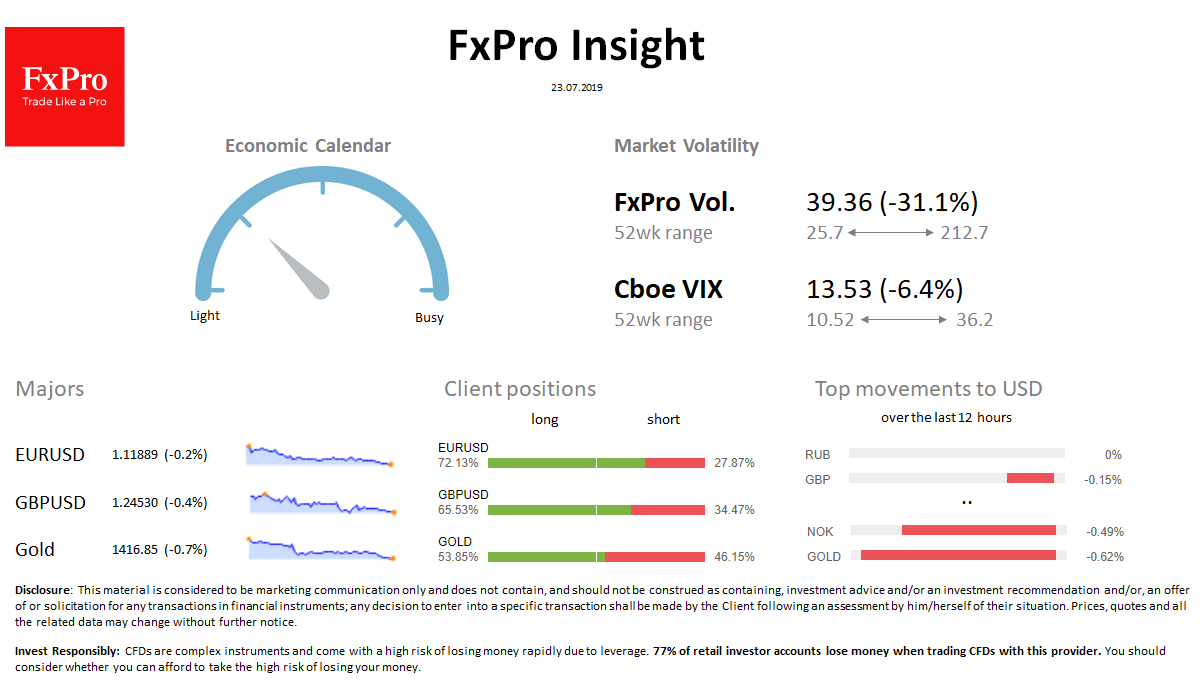

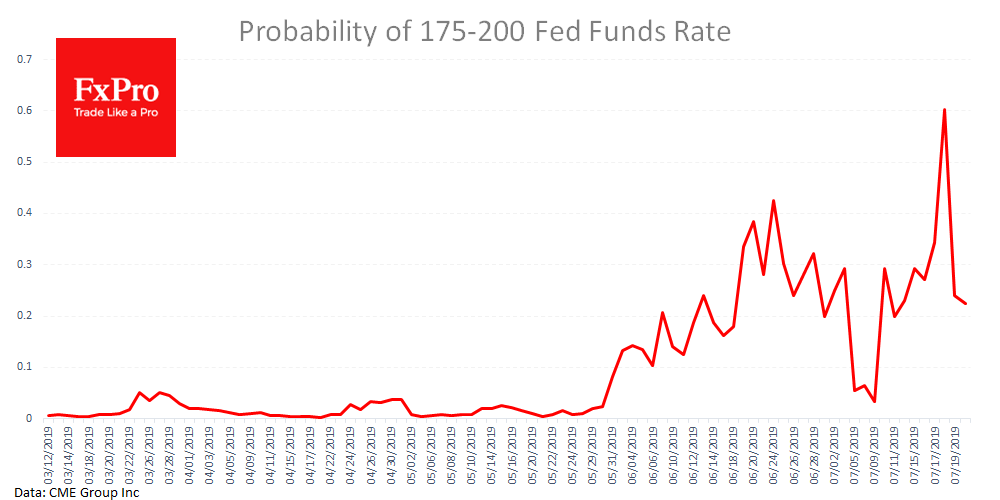

Market focus The expectations of easing are being strengthened among investors, not only due to the Fed’s meeting but also because of the ECB’s one. According to some estimates, the currency quotes are predicted to reduce ECB rates by 10.

July 23, 2019

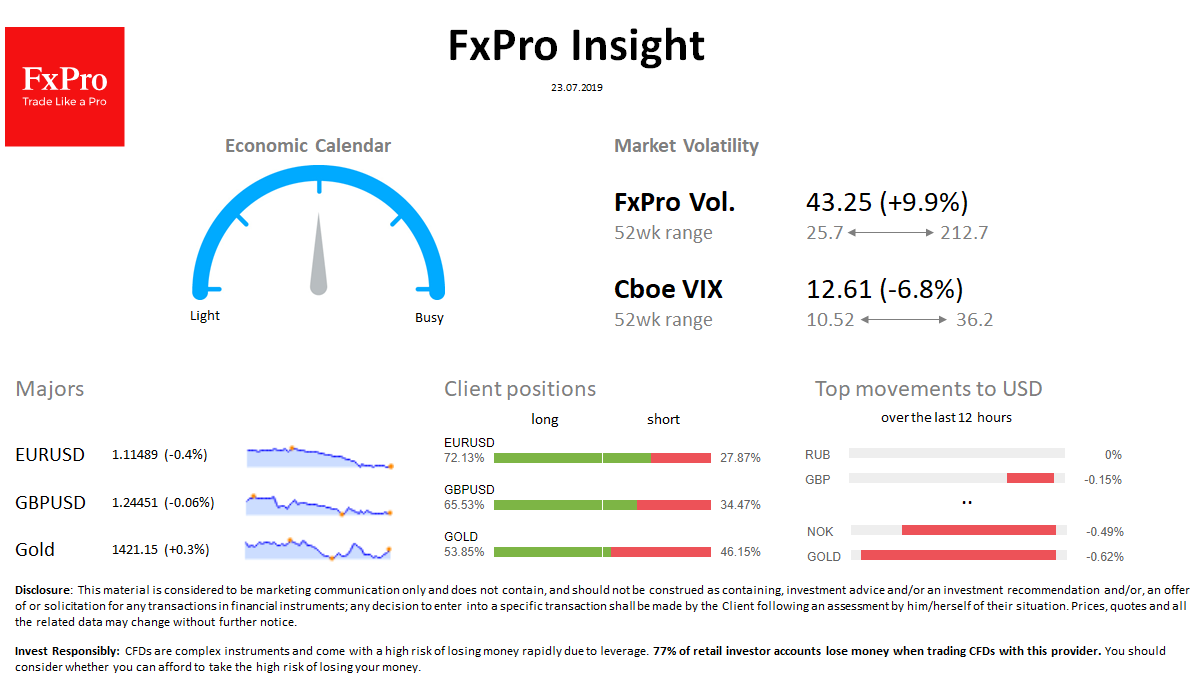

Market overview FX: USD strengthened against most major currencies: USDX near 2-month highs, EUR fell below 1.1200. Commodity currencies are retreating. Stocks: Indexes add 0.2%-0.5% on the speculations around global monetary easing. Commodities: Brent is growing in the wake of.

July 22, 2019

Market focus Markets have started the week under pressure. Expectations that the Federal Reserve will cut interest rates by 50 points in July collapsed from 60% to 23%. This occurred after the NY Fed clarified that the speech of John.