Market Overview - Page 436

December 5, 2019

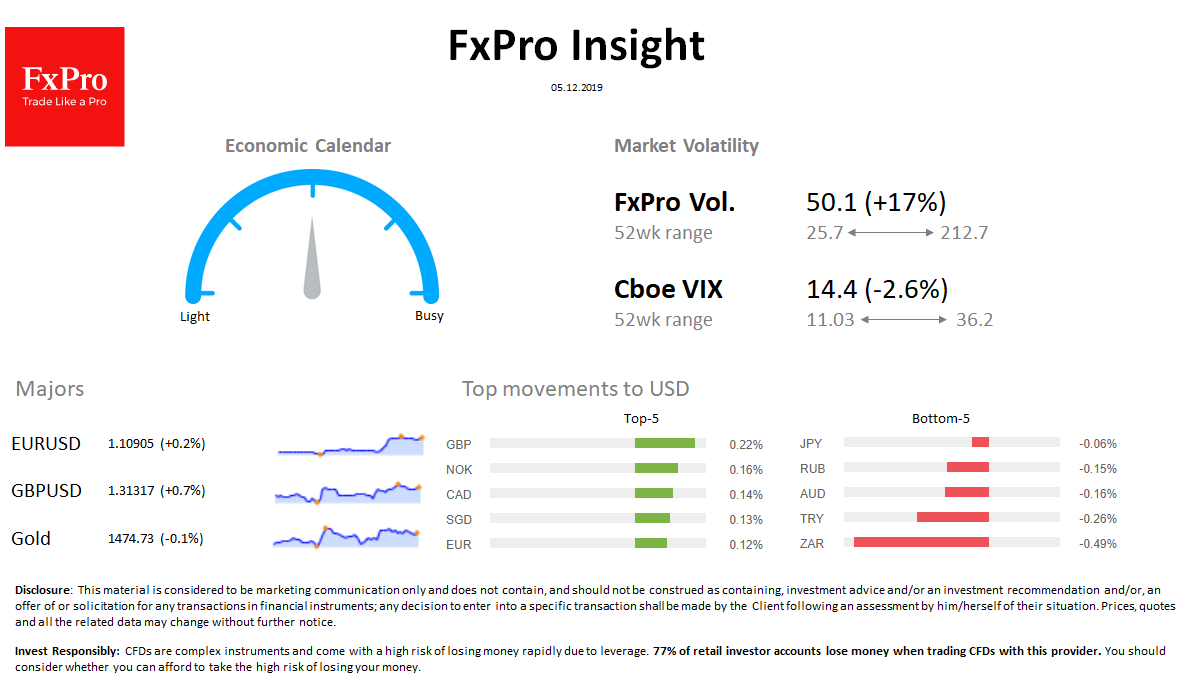

Market overview Forex: The dollar index is down for the fifth trading session, DXY sank to 97.5, the monthly lows, touched the 200-day average on Wednesday. EURUSD near 1.1090, changing slightly before the release of major employment US data on.

December 5, 2019

On Wednesday, the pressure in the financial markets has slightly decreased after Bloomberg reports that China and the U.S. are edged closer to their positions on trade and can avoid a new wave of escalation. The message is not very.

December 5, 2019

Cryptocurrency enthusiasts have been discussing a newly developed exchange ranking developed by the crypto portfolio and trading bot startup Bituniverse. According to a leaked screenshot of Bituniverse’s “Exchange Transparent Balance Rank,” there’s roughly 1.

December 5, 2019

Telecommunications stocks in Asia could be the next area of opportunity for investors in 2020, according to BlackRock. Turning the spotlight on the sector in its outlook report for 2020, BlackRock’s head of global emerging markets equities Andrew Swan wrote:.

December 5, 2019

The dollar wobbled on Thursday as an earlier boost from upbeat trade comments by U.S. President Donald Trump ran out of steam and investors remained on edge over Sino-U.S. tensions. In a fillip to sentiment overnight, Trump said talks to.

December 4, 2019

Despite the recent price struggles for bitcoin, Spencer Bogart says the top-ranked crypto will continue to see an upward growth trajectory in the next five years. The Blockchain Capital partner also doesn’t see Chinese policies as having a significantly negative.

December 4, 2019

Bitcoin has lost almost 2% in the last 24 hours and trades near $7,150. The inability to develop a confident rebound for the BTC practically always ended in a decline. The altcoin market demonstrates the same dynamics. In contrast, Tether.

December 4, 2019

The majority of the Ripple (XRP) holders were waiting for the yearly Swell conference to bring some excitement to XRP price. However, the price didn’t move at all and now Ripple is searching for annual lows on its USD pair. .

December 4, 2019

The gold price has critically avoided a steep drop below a crucial support level at $1,450. In the short-term, warnings of a further stock market sell-off by strategists position the safe haven for a relief rally. According to UBS director.

December 4, 2019

Volatility returns to the financial markets. In the previous two days, investors had to return to the expectation that trade wars may widen and deepen in the coming months. Hopes for a soon-to-be-signed phase one trade deal began to melt.

December 4, 2019

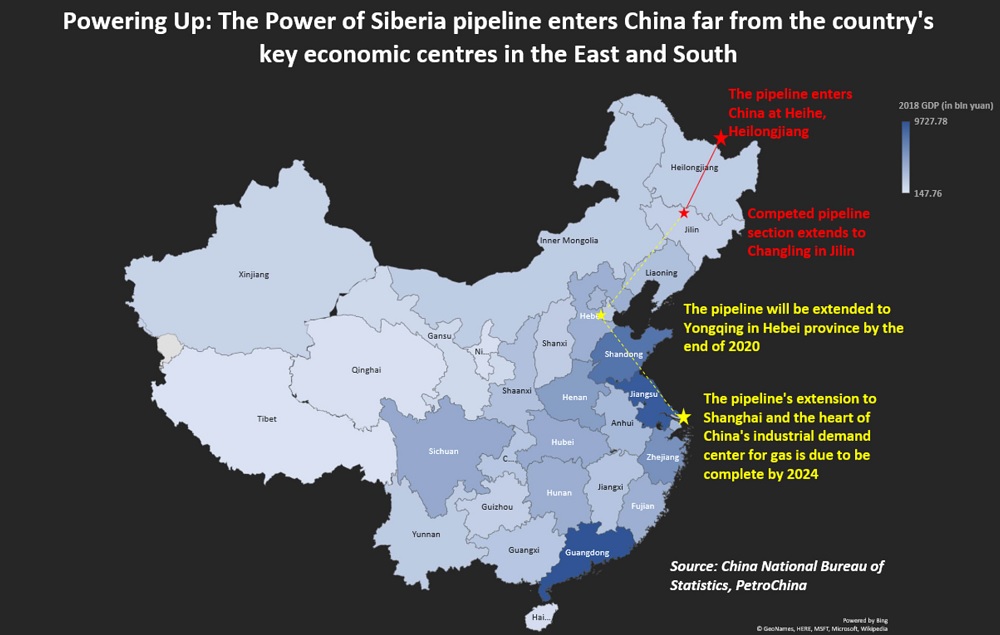

A new natural gas pipeline connecting Russia and China is the latest example of increasing collaboration between Moscow and Beijing in the Arctic Circle. The pipeline comes after China unveiled a plan nearly two years ago called the “Polar Silk.