Market Overview - Page 413

February 20, 2020

China called for solidarity on Thursday in a special meeting to discuss the coronavirus outbreak with Southeast Asian nations as it faces criticism for its handling of the epidemic. The hastily called summit in Laos signaled China is seeking support.

February 20, 2020

Where will the money come from? This is the contentious question that the EU needs to answer every seven years — and this time around, the issue is even more complicated. The U.K., which has been one of the EU’s.

February 20, 2020

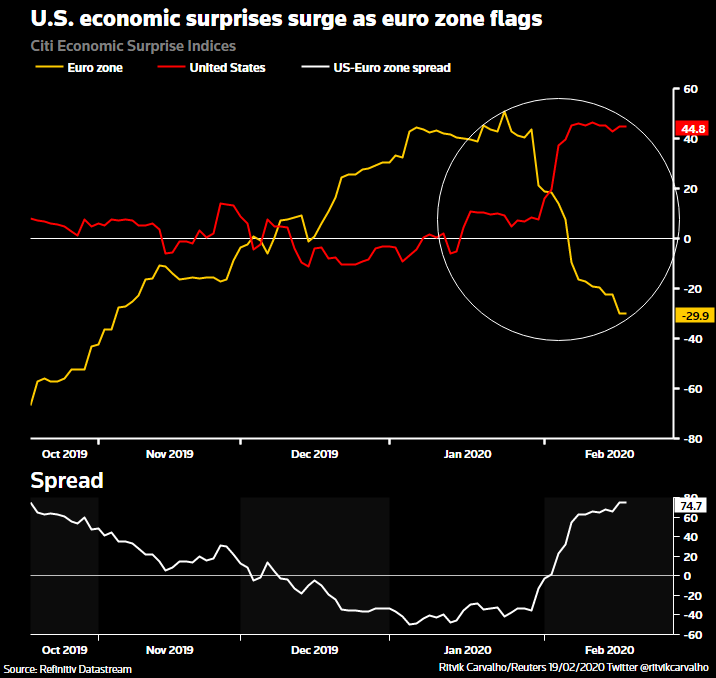

The dollar index has been growing almost daily in February, adding 2.5% from the beginning of the month to its peaks from May 2017. The dollar index tracks the USD against the six most popular world currencies, where the yen.

February 19, 2020

Having surpassed the key $1,600 mark, gold prices were flirting with a seven-year high on Wednesday, as investors continue to shore up their positions amid the coronavirus outbreak. The precious metal was up a further 0.5% to trade at around.

February 19, 2020

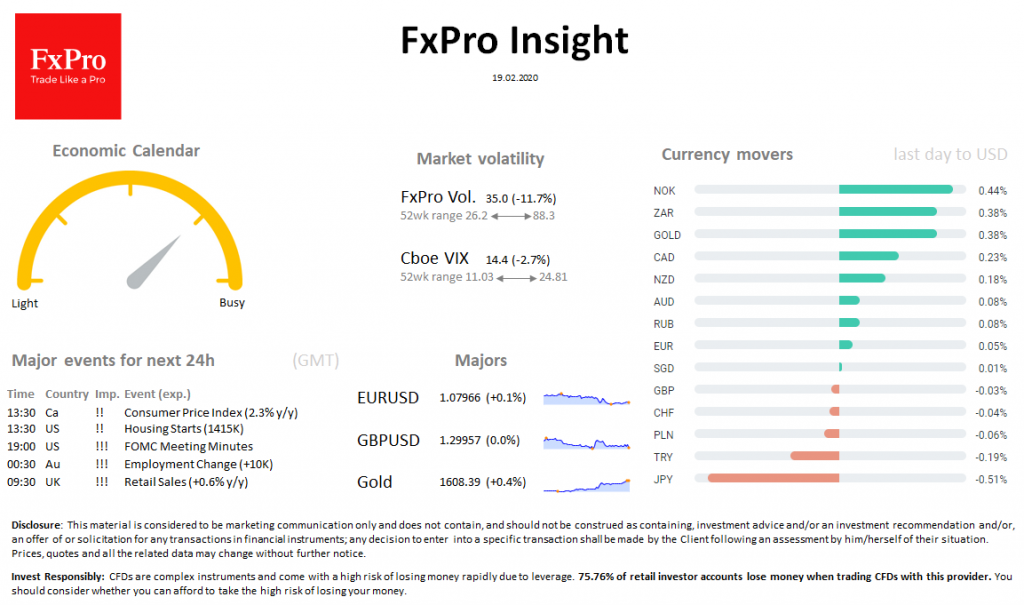

Market overview US and Asian indices are slightly changing over the past day in anticipation of new signals from the Fed in the minutes of the last meeting published later today. European indices fell marginally better than competitors due to.

February 19, 2020

Bitcoin, cryptocurrencies, blockchain, decentralization, China’s digital yuan, Facebook’s libra—the U.S. is understandably worried about the dominance of the almighty dollar. Last year, U.S.

February 19, 2020

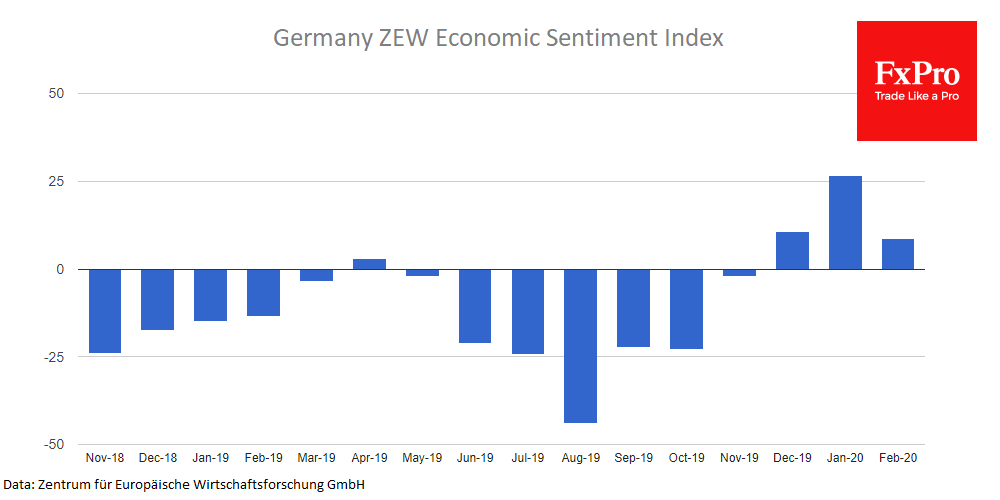

The euro rose on Wednesday as improving risk sentiment in global markets paused the dollar’s rally, providing relief to the single currency, which had earlier fallen to three-year lows after a survey showed weakening confidence in Germany. The euro has.

February 19, 2020

China’s economic growth in the first quarter could fall to as low as 3.5% if the spread of the new coronavirus is not contained fast enough for manufacturing production to resume to normal levels, Morgan Stanley analysts wrote in a.

February 19, 2020

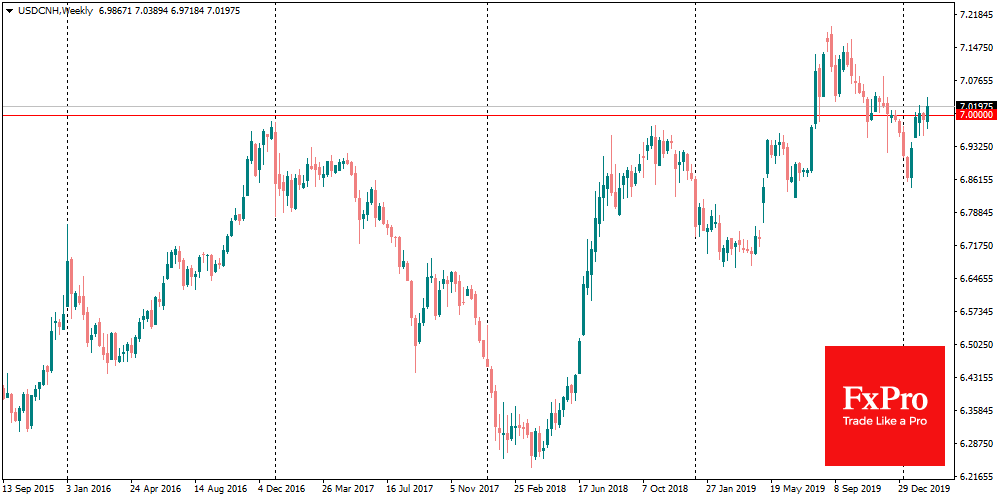

The single currency fell to 3-year lows against the dollar as indices of German and US business sentiment published the day before sharply contrasted with expectations. The ZEW Indicator for Germany is referred to as a leading economic indicator. This.

February 18, 2020

American consumers expect their household spending to increase more slowly over the next year, according to a report released by the Federal Reserve Bank of New York on Tuesday. Overall, the median forecast was for household spending to grow by.

February 18, 2020

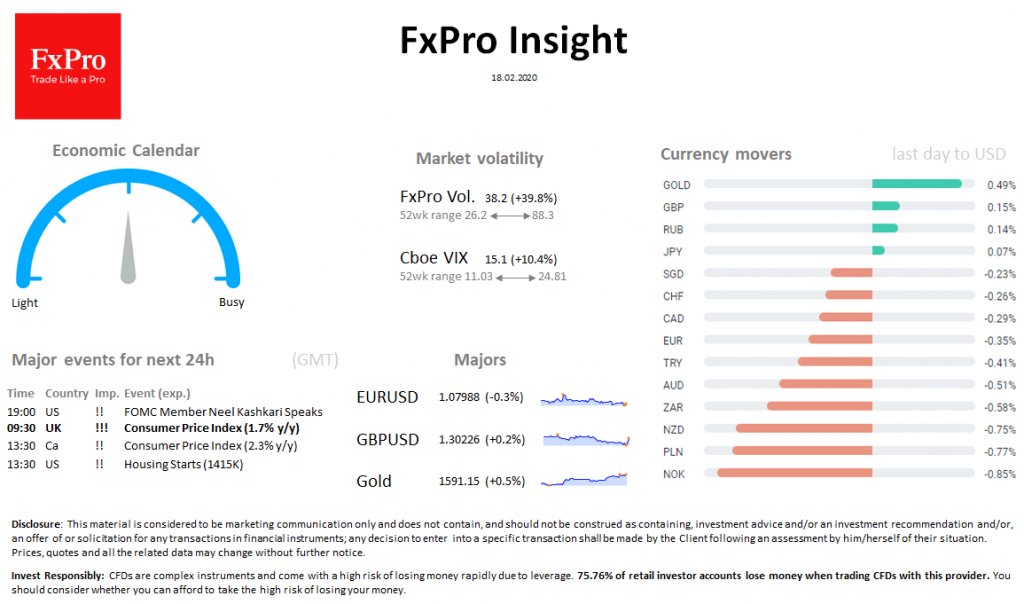

Market overview Equity markets are declining after Apple said it would not meet the revenue guidance for the March quarter. This report returned to the market the fear of the impact of the virus. On FX, the dollar index jumped.