Market Overview - Page 401

March 11, 2020

Bitcoin (BTC) continued choppy trading behavior on March 11 as analysts revealed that the “black swan” state of the markets could produce fresh losses. Data from Coin360 and Cointelegraph Markets painted a precarious picture of BTC/USD strength on Wednesday. $7,750.

March 11, 2020

OPEC kingpin Saudi Arabia unveiled plans Wednesday to dramatically ramp up oil production, raising the stakes of an all-out price war with non-OPEC leader Russia. State-owned oil behemoth Saudi Aramco said Wednesday that it had been asked by the Saudi.

March 11, 2020

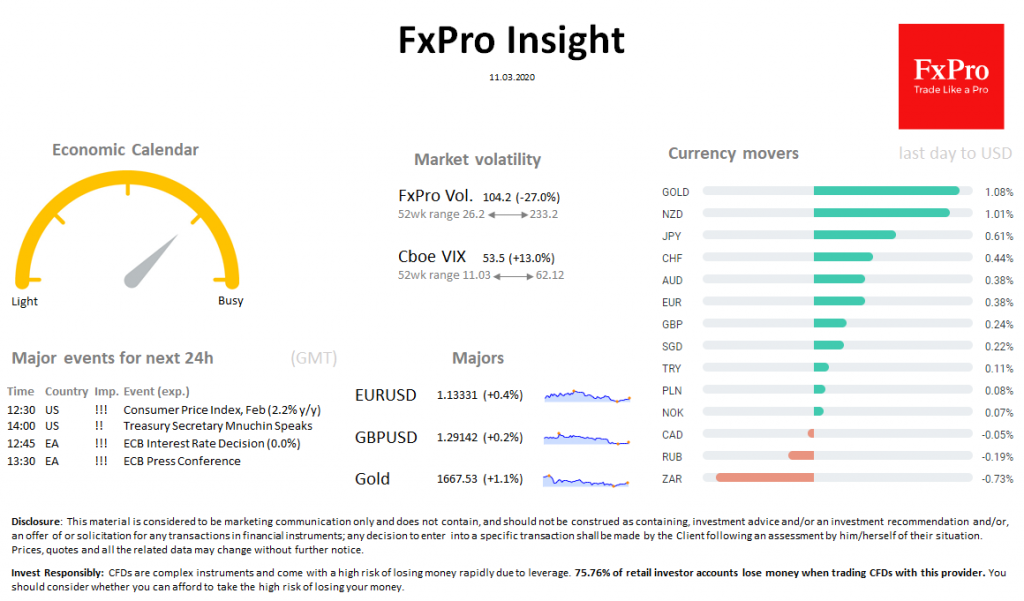

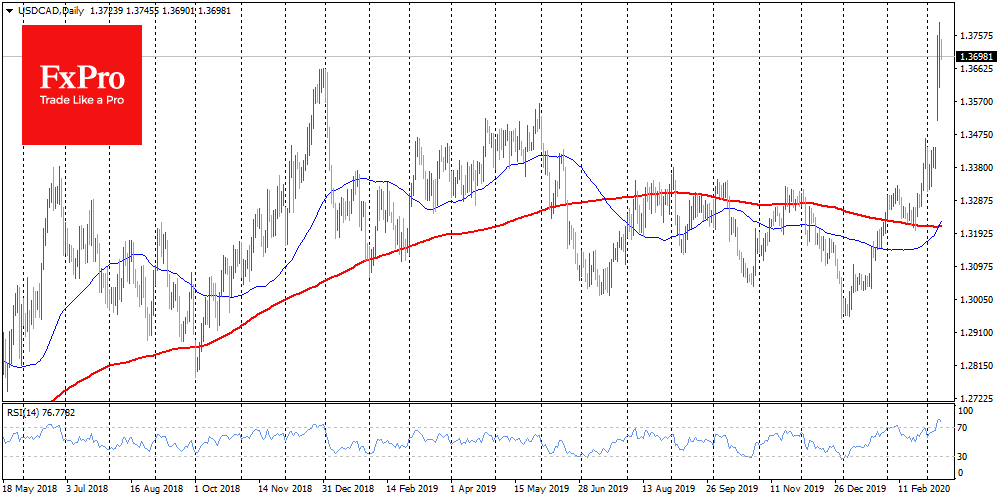

Market overview Stock volatility remains extremely high. Futures for S&P500 losing 2.7% on Wednesday after 4.9% jump the day before. EuroStoxx50 grows by 0.8%, FTSE100 – by 0.3%. Earlier today, Nikkei 225 closed at the lowest level since December 2018..

March 11, 2020

The traditional markets’ recent sell-off drove cryptocurrency prices down, but the way it did so was more complicated than even many of the most sophisticated players in crypto were able to grasp. That’s because crypto’s drop was staged in the.

March 11, 2020

Australia announced on Wednesday a health package worth A$2.4 billion ($1.56 billion) that proposes setting up fever clinics, among other measures to rein in the spread of a coronavirus, as it prepares to announce further stimulus. Australia has been struggling.

March 11, 2020

Saudi Arabia said on Tuesday it would boost its oil supplies to a record high in April, raising the stakes in a standoff with Russia and effectively rebuffing Moscow’s suggestion for new talks. The clash of oil titans Saudi Arabia.

March 11, 2020

The dynamics of stocks and currencies on Tuesday were comparable in amplitude, but in the opposite direction to Monday. Investors and traders seemed to be buying beaten shares, expecting stimulus from central banks and governments. The rush of early buyers.

March 11, 2020

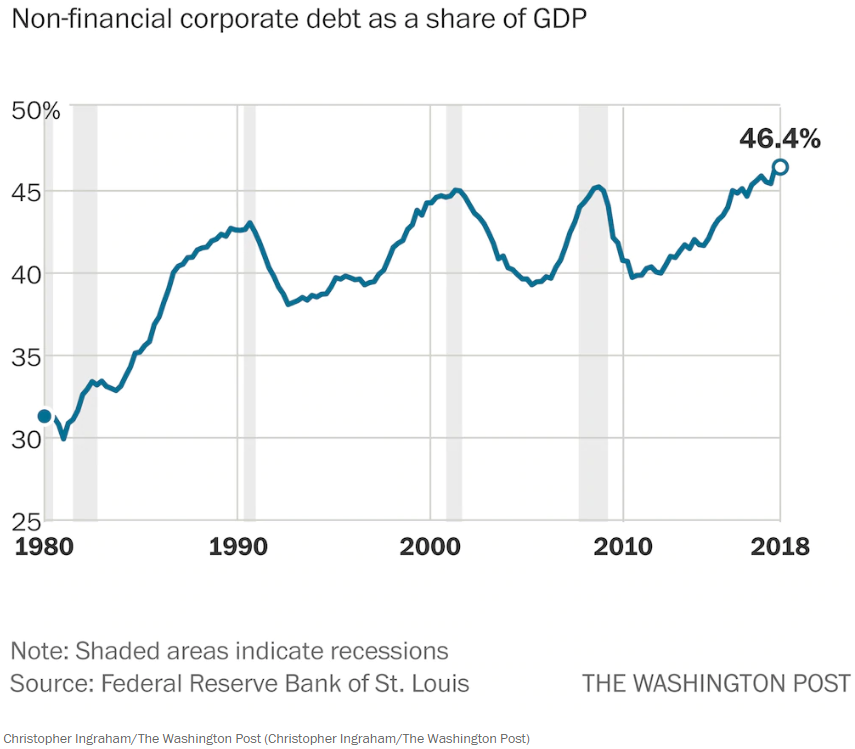

The spread of coronavirus could blow the lid on the next financial crisis and push the U.S. economy into recession. That’s according to an analysis of corporate debt relative to GDP, one of the most reliable indicators of recession. The.

March 11, 2020

U.S. stock futures fell sharply on Wednesday morning stateside, pointing to another volatile session on Wall Street. As of 3:48 a.m. ET Wednesday, Dow Jones Industrial Average futures were down 494 points, indicating a loss of 636 points at the.

March 11, 2020

The Bank of England (BOE) announced Wednesday an emergency cut to interest rates in an attempt to limit the economic impact from the new coronavirus. The announcement follows a similar decision by the U.S. Federal Reserve last week. The virus.

March 10, 2020

Russia has refused to rule out talks with OPEC to stabilize energy markets, according to reports, after oil prices registered their worst declines in almost 30 years on Monday. International benchmark Brent crude traded at $37.32 Tuesday afternoon, up over.