Market Overview - Page 4

January 20, 2026

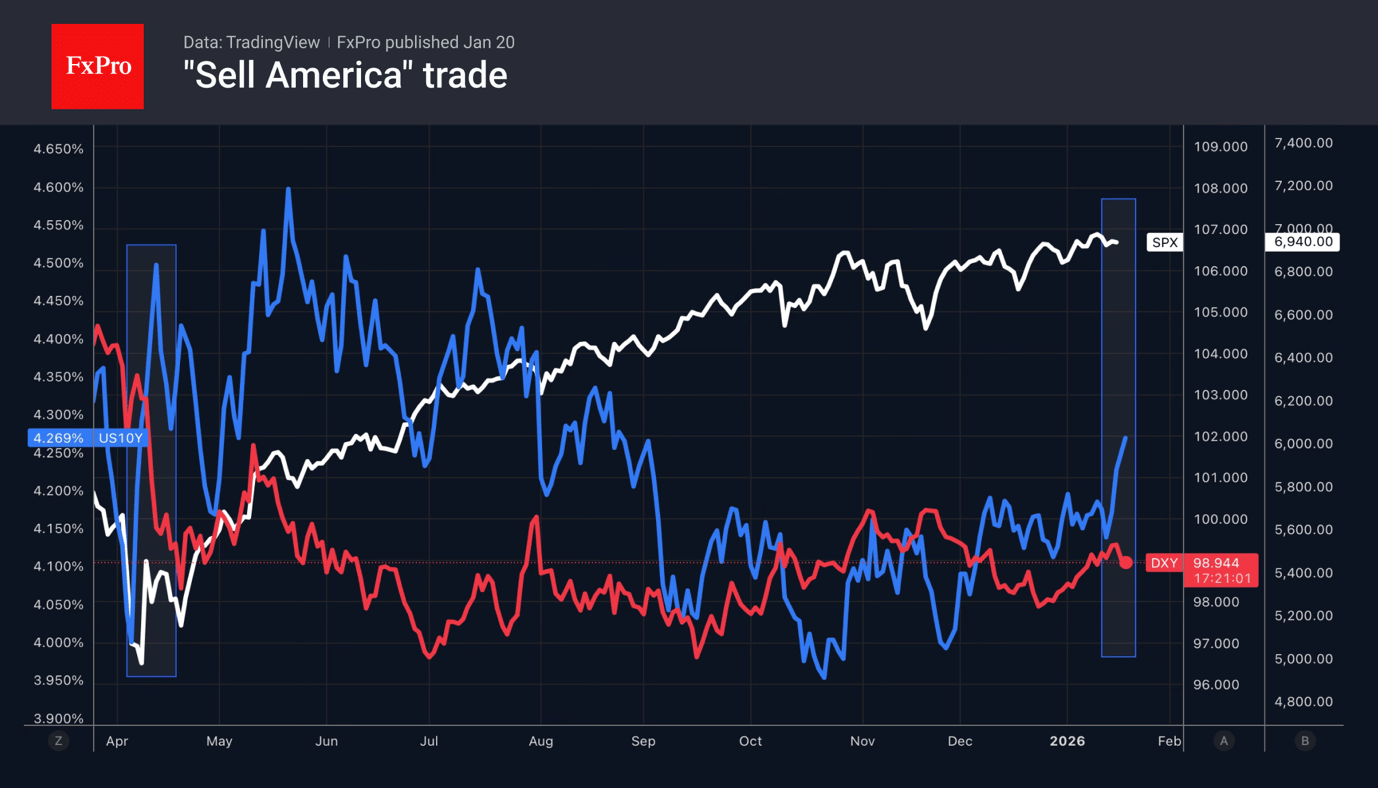

Trade tensions weaken the dollar, boost the euro, and leave the yen vulnerable amid political manoeuvres and global economic shifts.

January 19, 2026

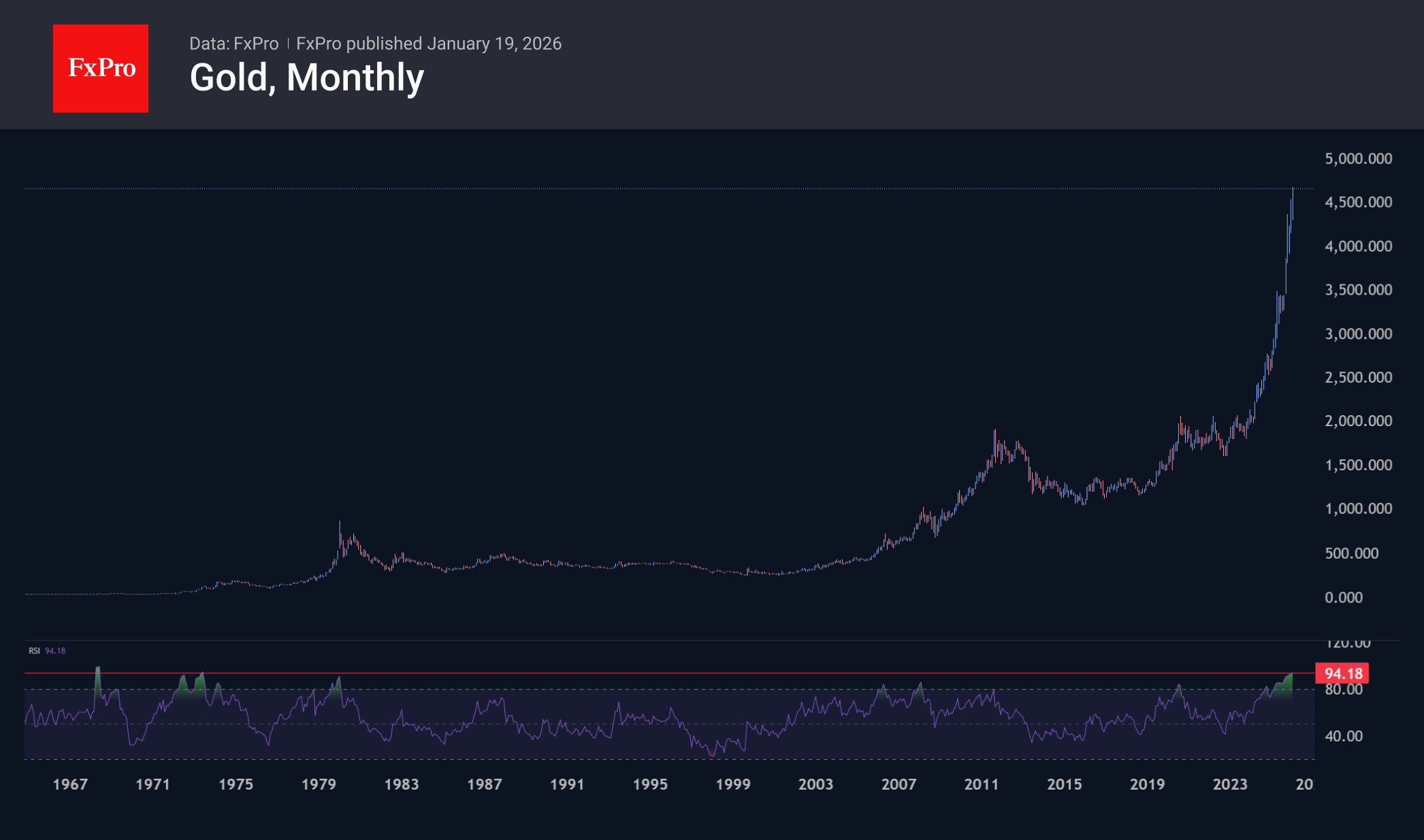

Gold hits historic highs amid tariffs and global tensions; volatility and risk of sharp correction remain elevated.

January 19, 2026

US-EU trade tensions spark tariffs, impacting economic forecasts, boosting gold prices, and threatening a renewed trade war.

January 16, 2026

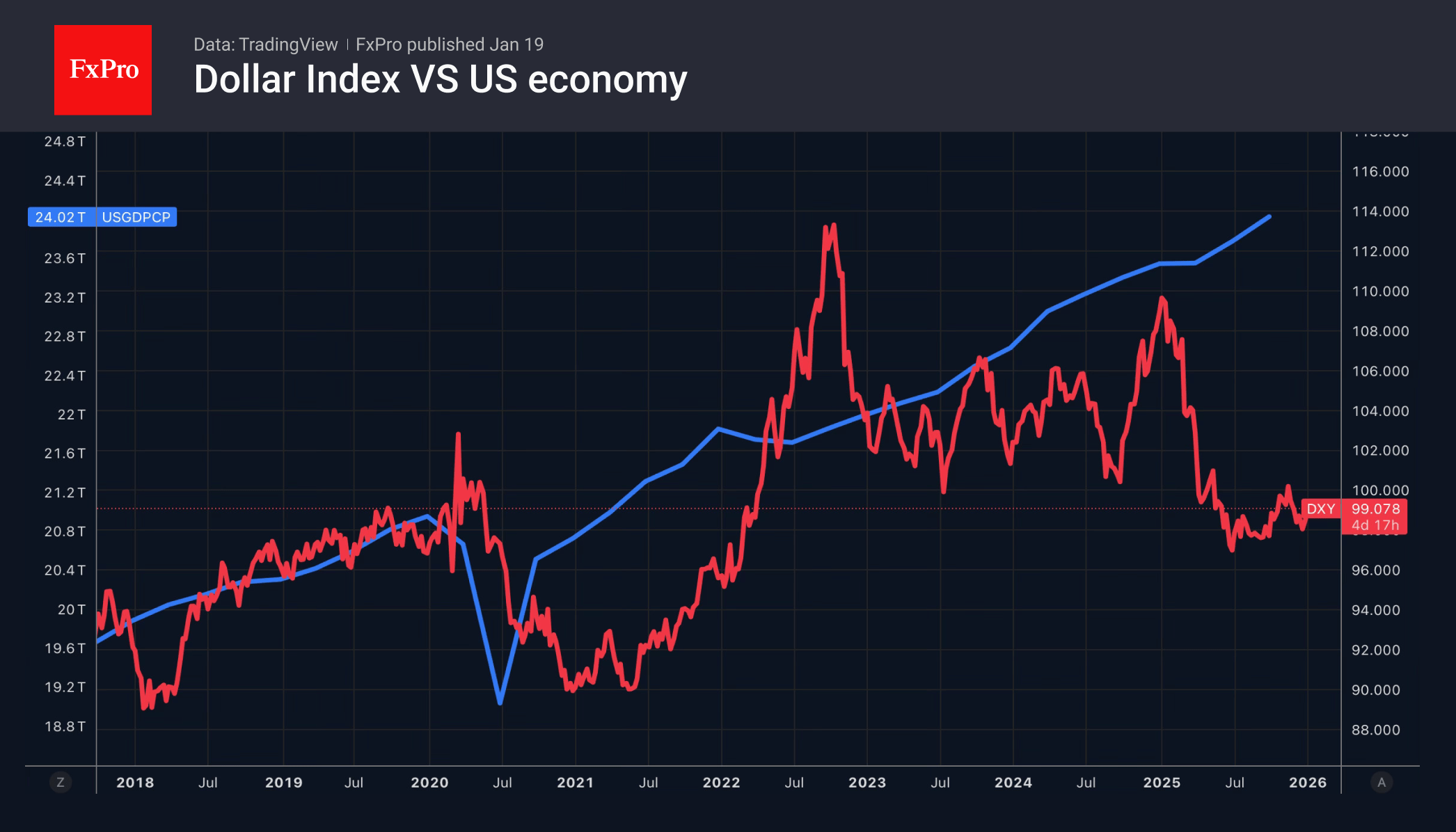

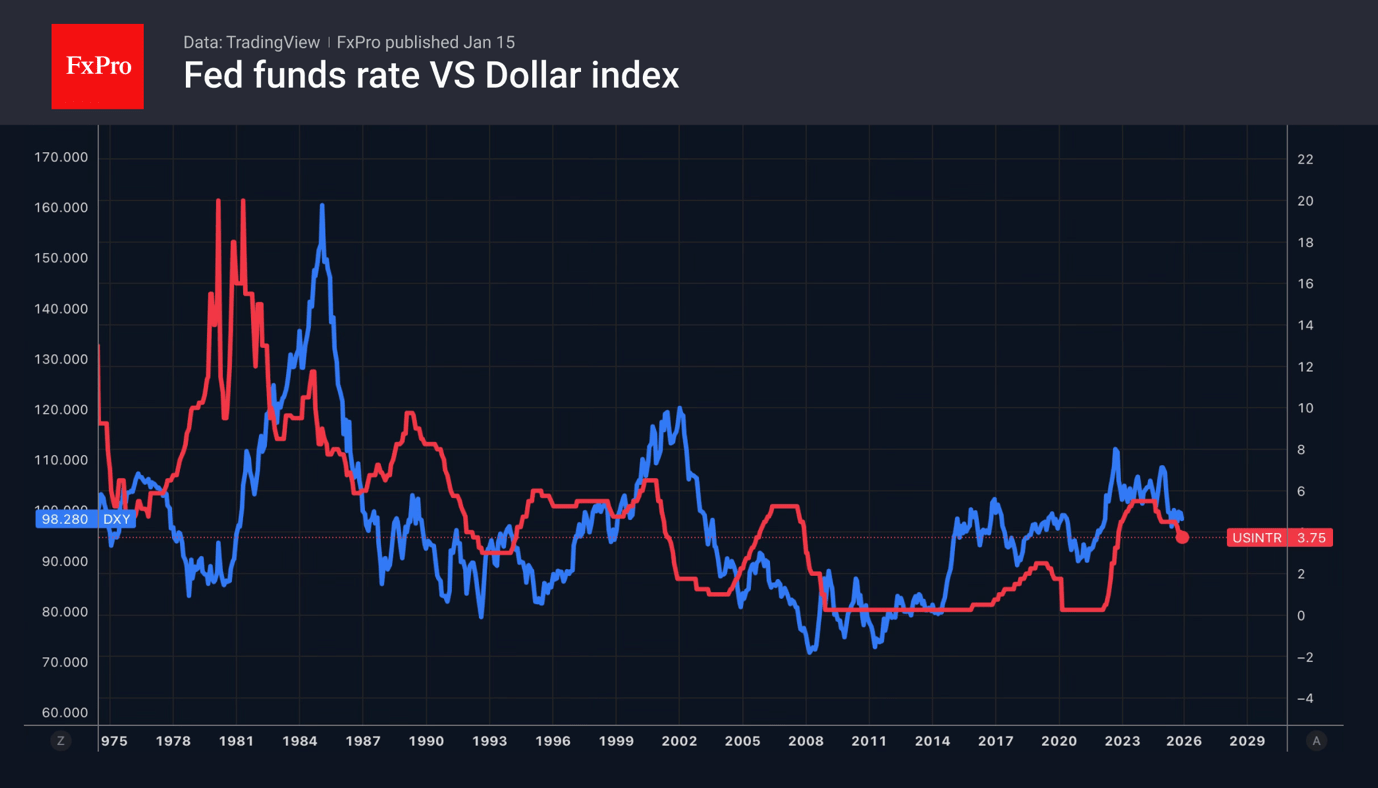

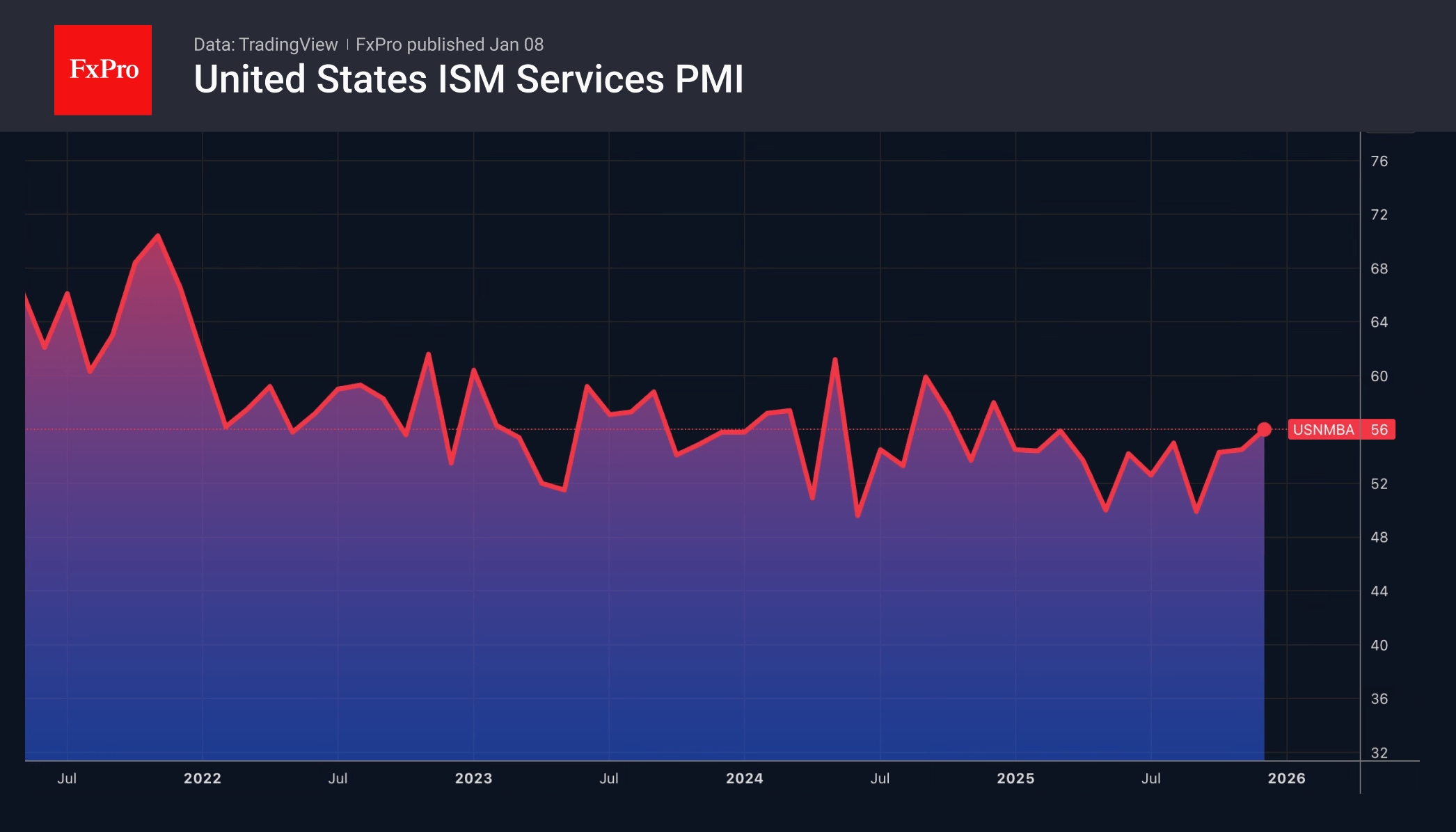

Strong US macro data and wide rate spreads boost the dollar, pressuring EURUSD and gold; yen outperforms on policy signals.

January 15, 2026

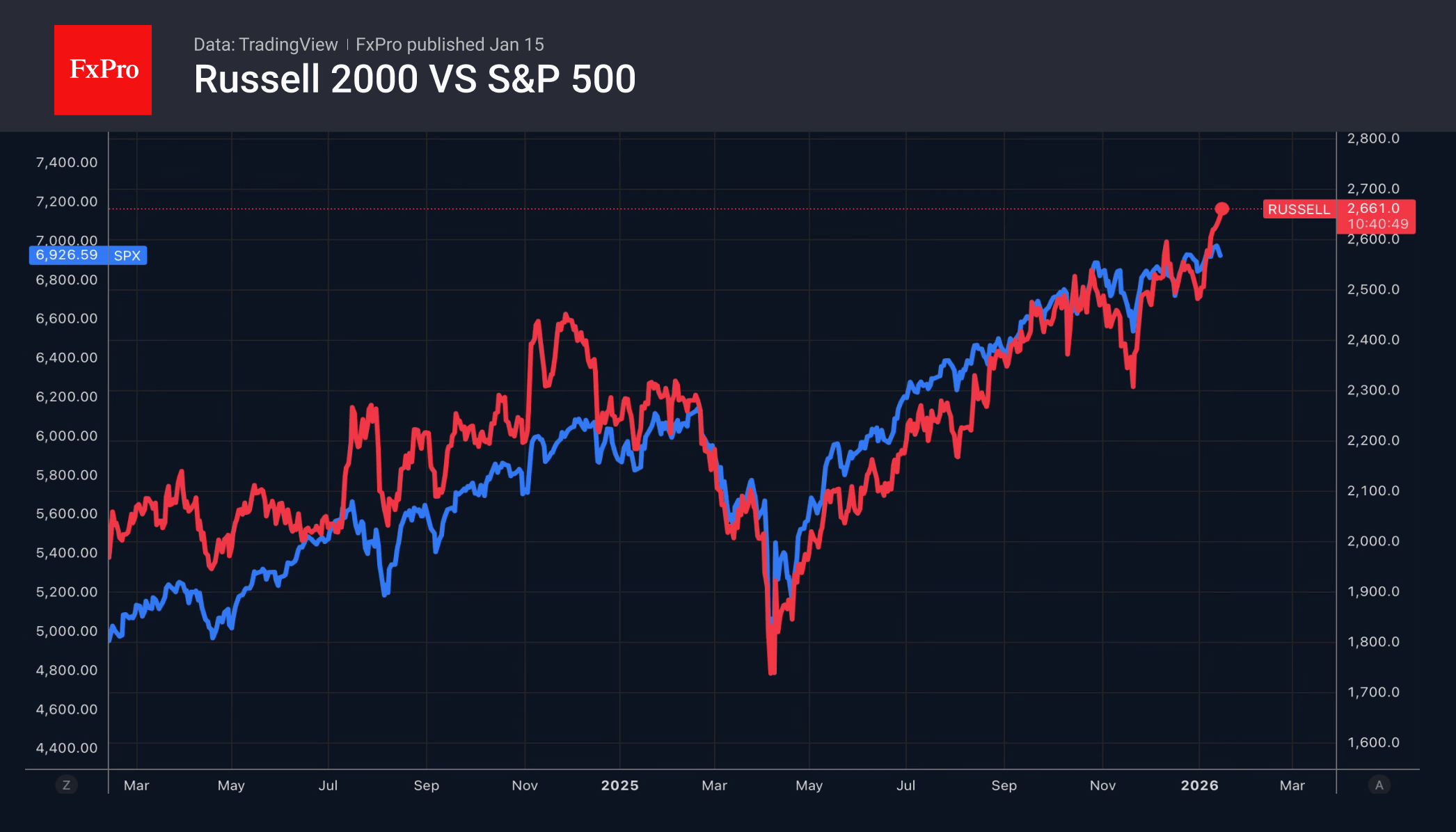

Tech sell-off and high Q4 forecasts put the S&P 500 at risk; the Russell 2000 outperforms, and earnings expectations challenge.

January 15, 2026

Donald Trump has no intention of dismissing Jerome Powell. The White House's decision to postpone tariffs on minerals has dealt a blow to precious metals.

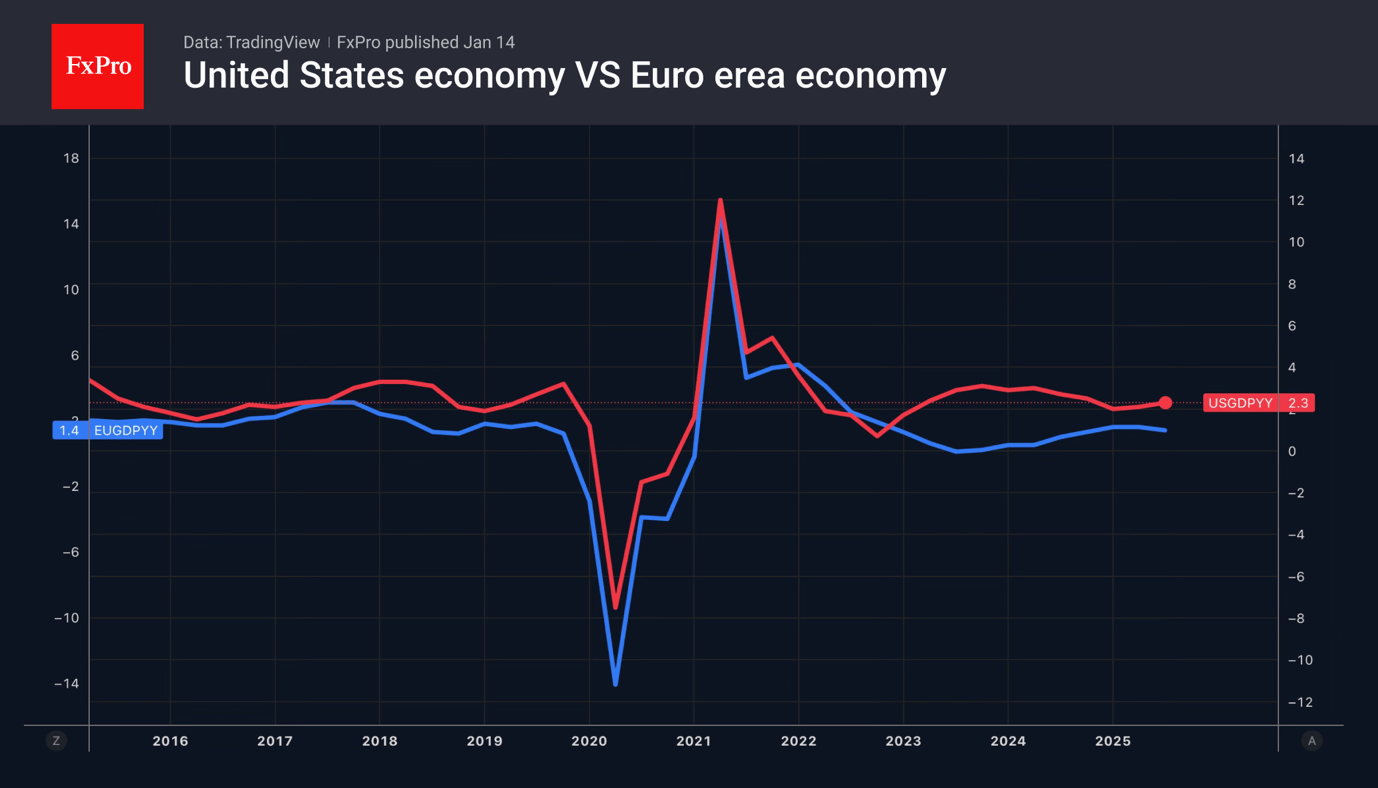

January 14, 2026

US GDP growth is driven not by the White House, but by AI. The Bank of Japan's sluggishness is weighing on the yen.

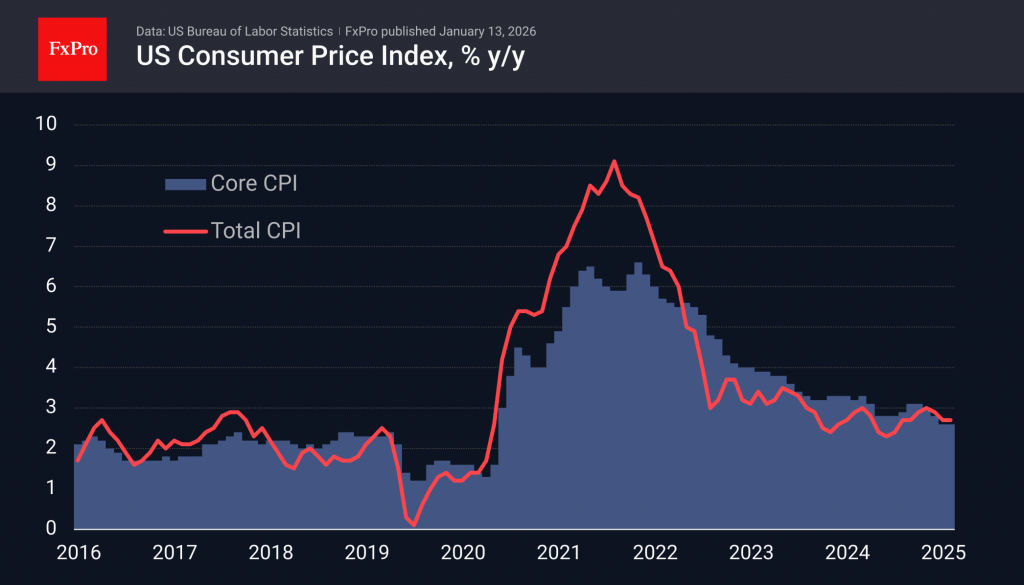

January 13, 2026

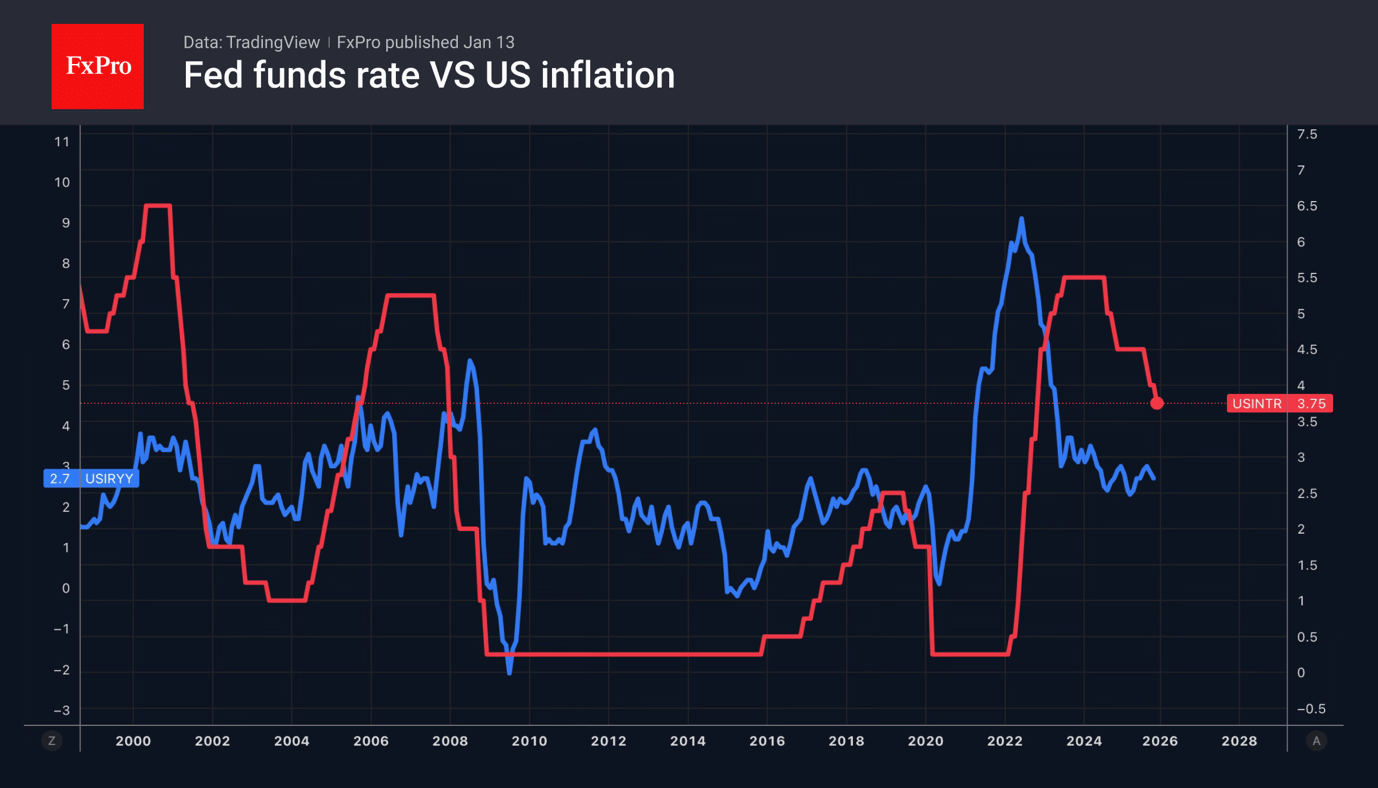

US CPI data a bit softer than forecasts, sparking brief market optimism, but resistance remains. Focus shifts to retail sales and Fed updates.

January 13, 2026

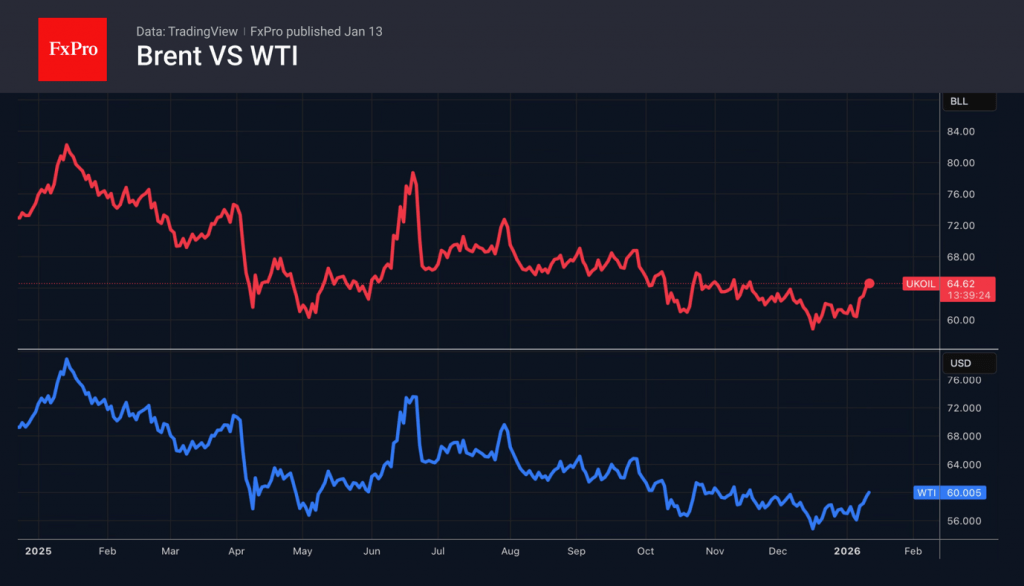

Middle East tensions and Venezuelan supply shifts drive Brent crude volatility, with geopolitical risks and trade war threats shaping oil markets.

January 13, 2026

The dollar resumed its growth after the lawsuit against the Fed chairman. Rumours of early elections in Japan drove up USDJPY quotes.

January 9, 2026

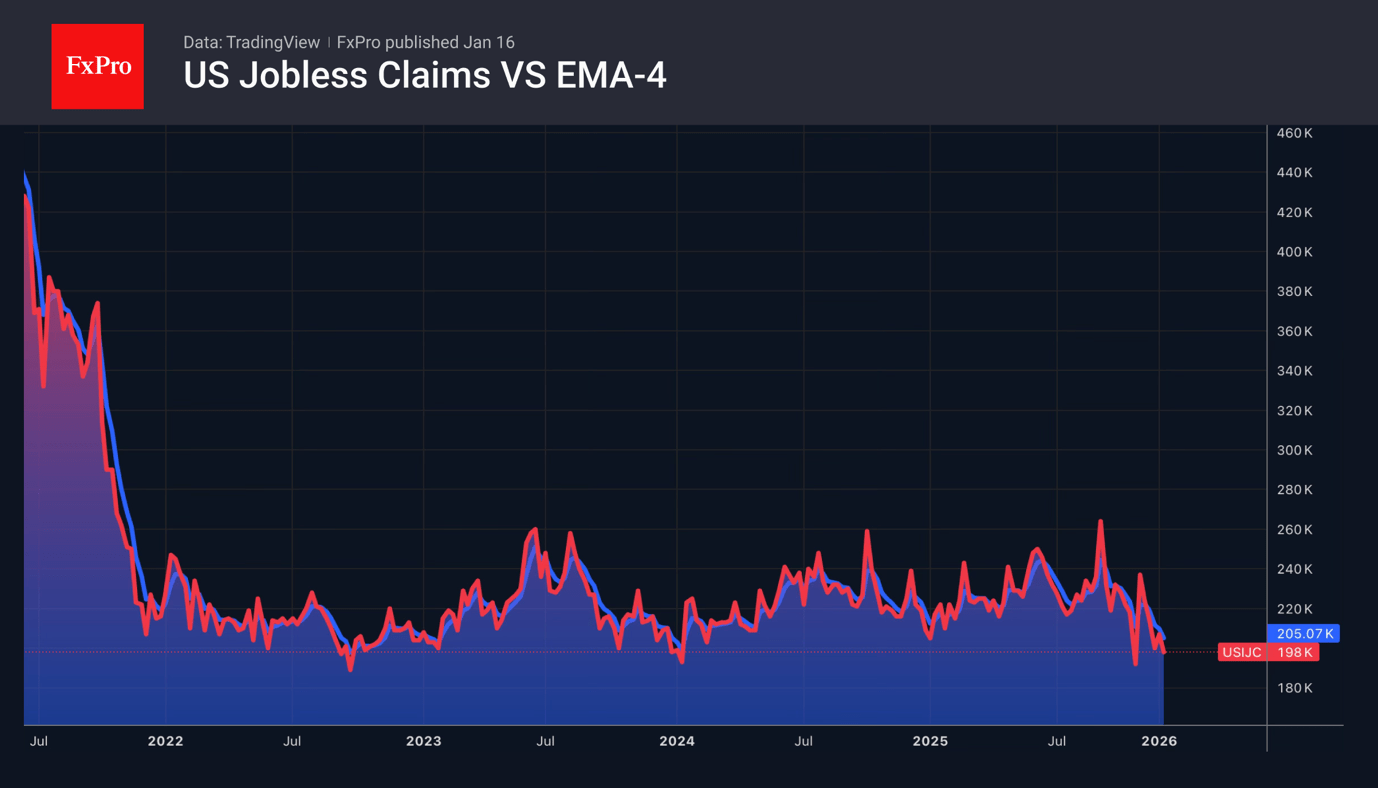

• EURUSD falls due to geopolitics and expectations of tariff removal • Gold returns to debasement trading. The US dollar continued its advance on Forex thanks to a new batch of strong macro statistics. Jobless claims rose less than expected..