Market Overview - Page 398

March 17, 2020

The Federal Reserve’s decision to cut interest rates may indirectly push mortgage rates lower — but Americans aren’t likely to see 0% mortgages in the near future. The Fed announced late Sunday that it was cutting its benchmark federal funds.

March 17, 2020

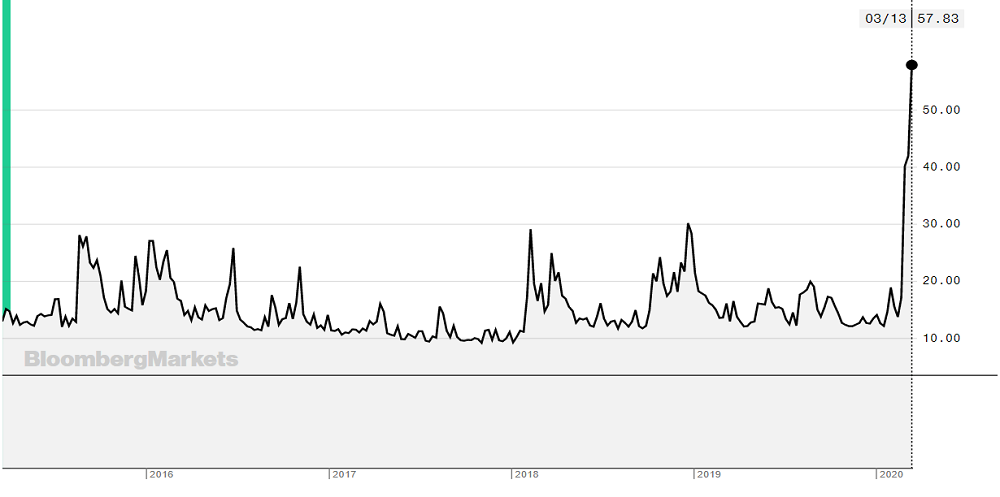

A new market meltdown marked Monday. American Dow Jones collapsed by 12.9%, surpassing last Thursday’s decline (-9.9%). It was the third biggest one-day decline in the index after 1987’s Black Monday (-20.5%) and October 1929 crash (-13%). The Volatility Index,.

March 17, 2020

Oil rose more than $1 on Tuesday as bargain hunters emerged after recent sharp falls due to the coronavirus pandemic and the price war between Saudi Arabia and Russia, but fears of a recession still dragged on the market. Brent.

March 17, 2020

Futures on the Dow and broader U.S. stock market rebounded late Monday, as investors reacted to encouraging signs from world governments that stopping coronavirus had become a top priority. Just a few weeks ago, many politicians including President Trump had.

March 17, 2020

Amazon.com on Monday said it would hire 100,000 warehouse and delivery workers in the United States to deal with a surge in online orders, as many consumers have turned to the web to meet their needs during the coronavirus outbreak..

March 17, 2020

At around 3:00 a.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, was higher at around 0.7843%, while the yield on the 30-year Treasury bond was up slightly at 1.3482%. The Dow and S&P.

March 17, 2020

Roughly 5 million people in China lost their jobs amid the outbreak of the new coronavirus in the first two months of this year, according to data published Monday. China’s official, but highly doubted, urban unemployment rate jumped in February.

March 16, 2020

Coronavirus has been with us for longer than you think. According to documents seen by the South China Morning Post (SCMP), the Chinese government first detected a case of COVID-19 on Nov. 17. Yet it still hasn’t been able to.

March 16, 2020

The president of the European Commission on Monday proposed a ban on nonessential incoming, foreign travel for a month, the latest drastic measure to cut off the flow of people as the coronavirus spreads around the world. It would cover.

March 16, 2020

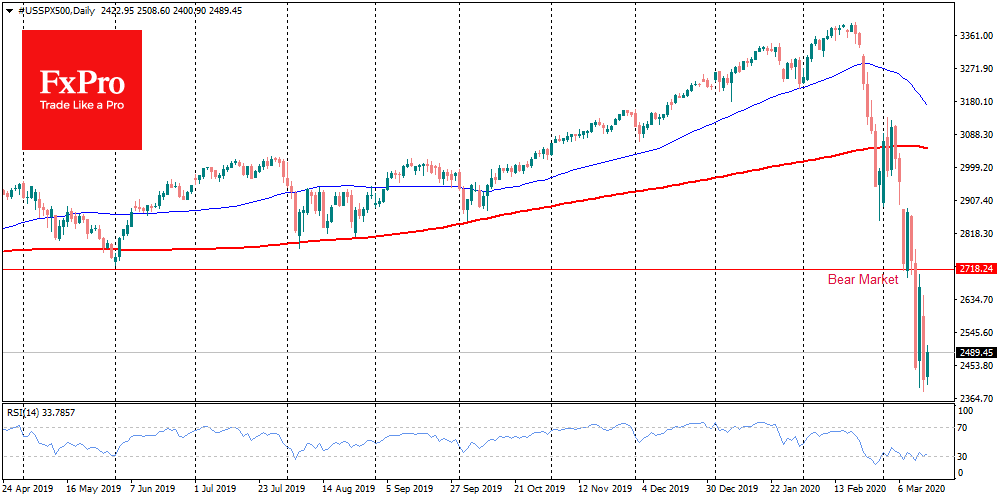

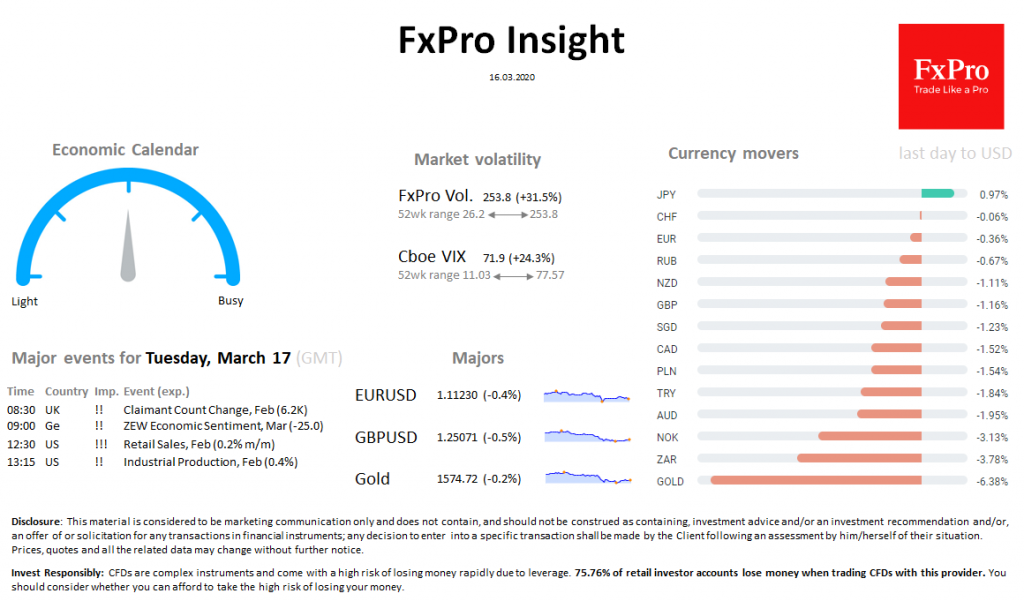

Market overview Friday’s bounce gave way to a collapse comparable to what we saw on Thursday. At the time of writing, the Dow Jones is losing 12% – the worst intraday drop since 1987. The FTSE100 has fallen to 4840.

March 16, 2020

Russia’s central bank is expected to keep its key interest rate unchanged on Friday, putting its monetary easing cycle on hold after a rapid slump in the rouble amid mounting economic risks, a Reuters poll showed on Monday. The Bank.