Market Overview - Page 397

March 19, 2020

U.S. stocks finished sharply lower again Wednesday, but off session lows after Congress passed the first of two planned bills providing some relief from the economic damage the coronavirus pandemic is inflicting on businesses and consumers. The Dow Jones Industrial.

March 18, 2020

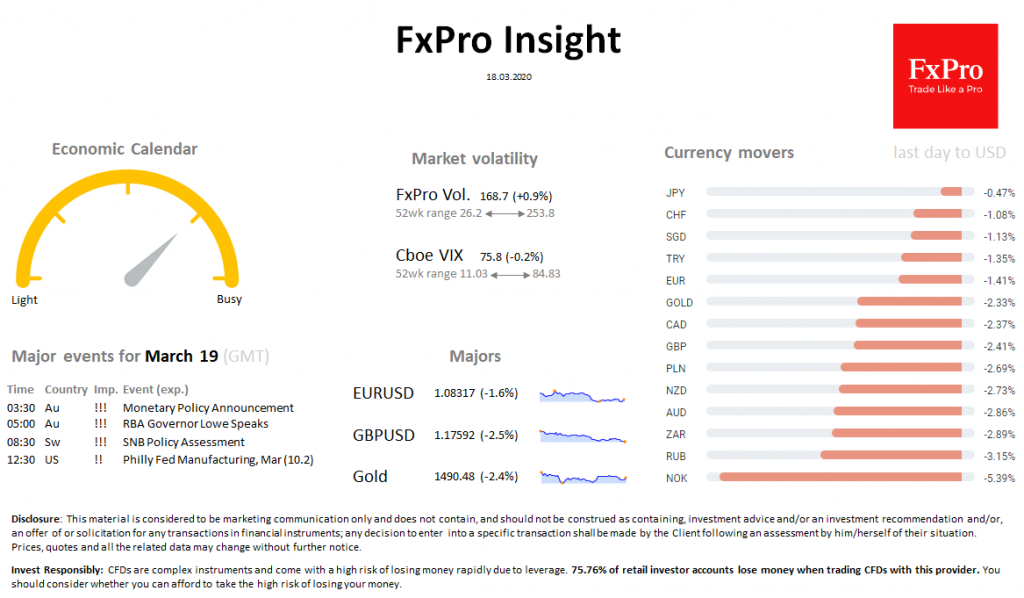

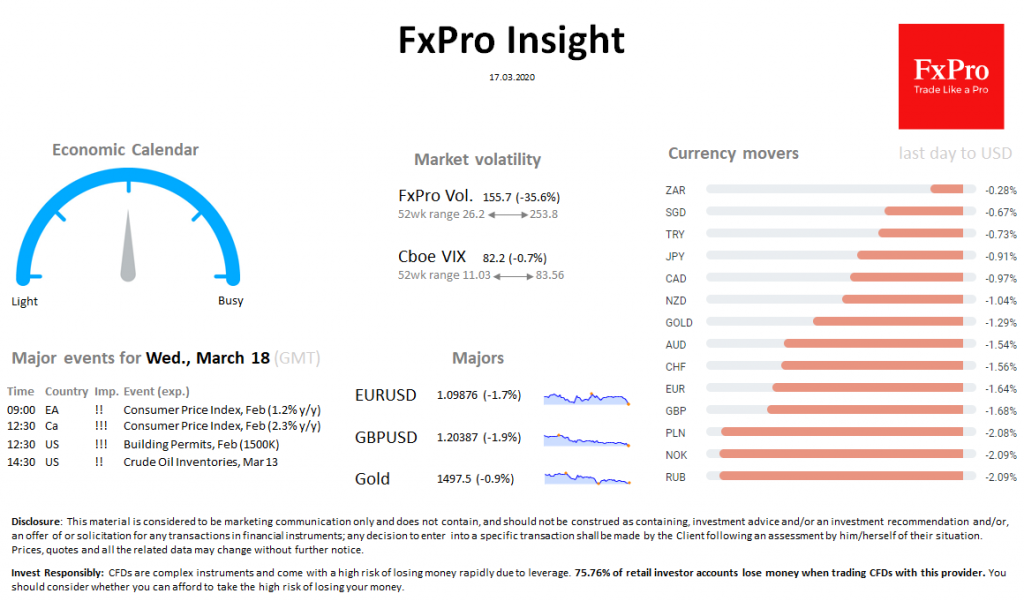

Market overview Almost unprecedented volatility remains in the stock markets: DJI’s 6% growth following Tuesday’s results alternates with a 5.5% failure at the start of trading on Wednesday. FTSE100 lost 4.1%, Dax – 4.9%. The Fed is stepping up its.

March 18, 2020

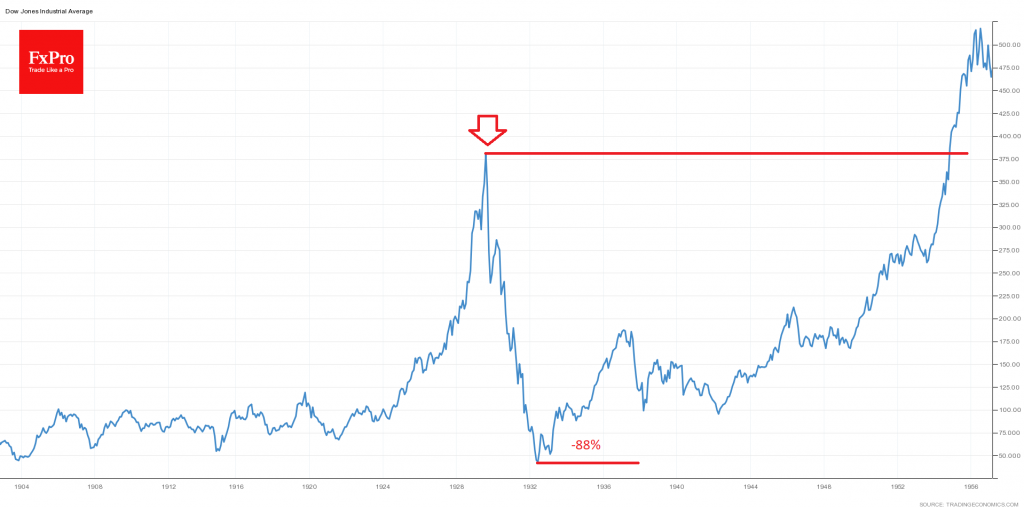

World markets remain extremely volatile, which was last observed by investors before the Great Depression. Of the six most significant one-day declines in the US market, three occurred in October-November 1929, two (probably two, so far) in March 2020, and.

March 18, 2020

Oil prices fell for a third session on Wednesday with U.S. crude futures tumbling to a 17-year low as travel and social lockdowns sparked by the coronavirus epidemic knocked the outlook for demand. U.S. crude was down $1.77 cents, or.

March 18, 2020

The U.S. stock market is set to drop 5% at open, as the Dow Jones Industrial Average (DJIA) futures indicate a 1,000-point drop. The gloomy pre-market data comes after analysts issued a stark warning that China will not be the.

March 18, 2020

Global stocks stumbled back into the red on Wednesday with Wall Street futures pointing to more losses ahead as fears over the coronavirus fallout eclipsed large-scale support measures rolled out by policymakers around the globe. Some traditional safe-haven assets such.

March 18, 2020

The Trump administration pressed on Tuesday for enactment of a $1 trillion stimulus package, possibly to include $1,000 direct payments to individual Americans, to blunt the economic pain from a coronavirus outbreak that has killed over 100 people in the.

March 18, 2020

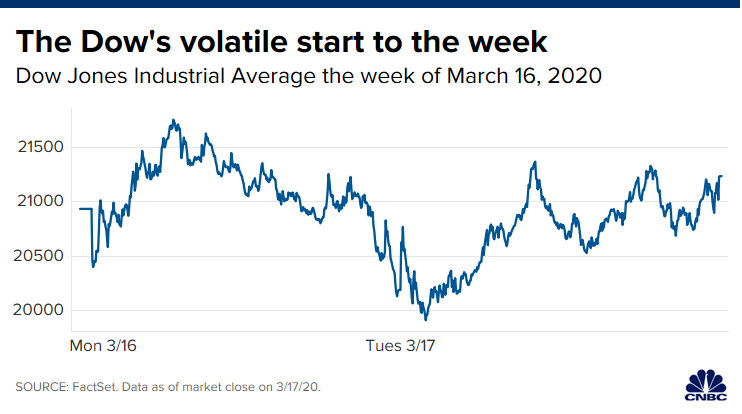

The Dow Jones Industrial Average (DJIA) briefly dropped below 20,000 on Tuesday for the first time in nearly three years. The Trump administration’s latest stimulus package proposal rescued the stock market, at least temporarily. But according to Chantico Global founder.

March 18, 2020

Stock futures fell in early morning trading on Wednesday as the markets remained highly volatile with the government response to the coronavirus fallout still unfolding. As of around 1 a.m. ET, futures on the Dow Jones Industrial Average fell 821.

March 17, 2020

1. Thirty-day revived supply Based on the gathered data, the analysts concluded that: -some BTC 281,000 (USD 1.5 billion) that haven’t been touched for thirty days, were revived on March 11 – meaning, they returned into circulation; -this day saw.

March 17, 2020

The rapid-fire selloff in stock markets and dire economic forecasts due to the coronavirus have rattled investors and spurred a dash for cash, a BofA fund manager survey showed on Tuesday. Cash holdings in March surged to an average 5.1%,.