Market Overview - Page 395

March 23, 2020

A report published by research firm CB Insights has found that equity funding has dramatically overtaken initial coin offerings (ICOs) as the dominant means of finance in the blockchain space. While the largely unregulated ICO boom of 2018 raised $7.8.

March 23, 2020

The U.S. stock market is set to drop by around 4% on the day’s open, as Dow futures indicate a 720-point drop. It comes after the World Health Organization (WHO)’s unexpectedly warning the coronavirus has the ability to survive in.

March 23, 2020

Already being ravaged by the worst infestation of desert locusts in 70 years, East African economies are now staring down the barrel of the coronavirus pandemic. The region was the standout performer for economic growth in the subcontinent prior to.

March 23, 2020

The world markets start the week with a decline. Futures on US indices were again close to the limit-down, losing about 5% against Friday’s closing levels, but subsequently reduced the decline to 2.2%. Democrats bloc new emergency stimulus package by.

March 21, 2020

The U.S. unemployment benefits program, a key part of the safety net for the labor market, is facing its biggest test in more than a decade. More than 2 million applications could be filed this week, economists said, as people.

March 20, 2020

U.K. Prime Minister Boris Johnson announced nationwide lockdown measures Friday, telling cafes, bars and restaurants to close. “We are collectively telling cafes, pubs, bars and restaurants to close tonight as soon as they reasonably can and not to open tomorrow,”.

March 20, 2020

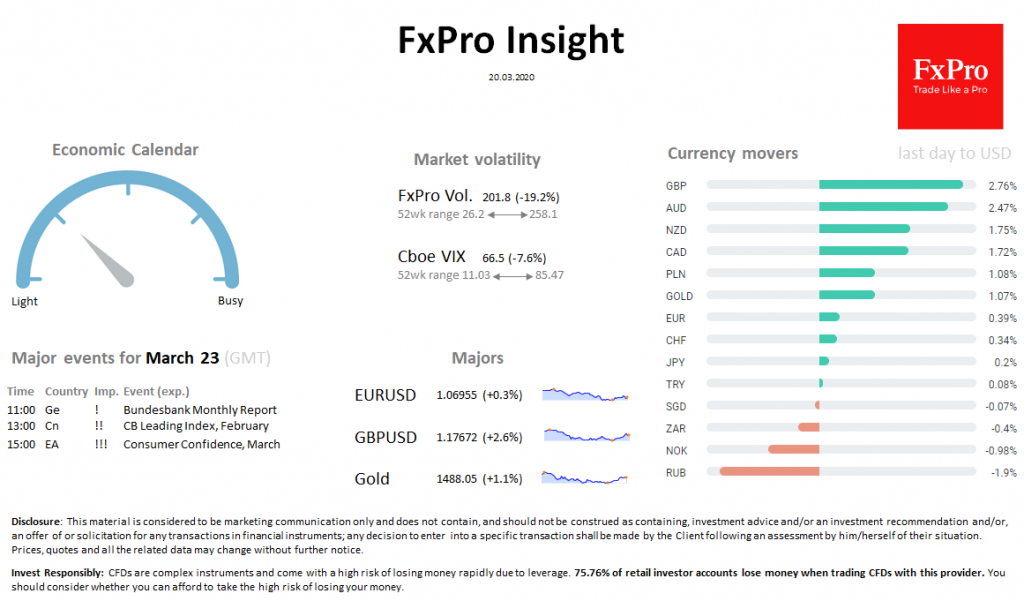

Market overview Stock markets show gains on Friday. However, it is yet based on expectations that central banks managed to contain the liquidity crisis. Without spreading coronavirus contagion, such bounces can be unstable. DJI is adding 0.9% after 0.4% growth.

March 20, 2020

In the last few weeks, the currency market proved to be a reliable sentiment barometer. Back in early March, we talked about warning signals that the worst might be ahead. Now, if we can still rely on these signals, there.

March 20, 2020

Bitcoin, which surprised markets with a sudden surge yesterday, has continued to climb today. The bitcoin price is fast approaching $7,000 per bitcoin, reaching $6,749 on the Luxembourg-based Bitstamp exchange earlier today after starting the week at under $5,000. Bitcoin.

March 20, 2020

One might reasonably posit that when Crown Prince Mohammed bin Salman (MbS) signalled that Saudi Arabia was once again going to produce oil to the maximum to crash oil prices in a full-scale oil price war, Russian President Vladimir Putin.

March 20, 2020

Apple Inc is limiting customer purchases of iPhones over its online stores in many countries including the United States and China to a maximum of two handsets per person, checks on its website on Friday revealed. The purchase caps come.