Market Overview - Page 393

March 26, 2020

The Senate passed a historic $2 trillion coronavirus relief package Wednesday night, as it tries to stem the destruction the pandemic has brought to American lives and wallets. The chamber approved the mammoth bill in a unanimous 96-0 vote after.

March 26, 2020

In a bewildering sign of economic danger ahead, buying U.S. government debt now yields negative rates. The bond yield on one-month and three-month U.S. Treasury bills dropped below zero Wednesday. It’s another ominous first for U.S. financial markets in the.

March 25, 2020

Investors are likely to look past what promises to be one of the worst U.S. jobless claims reports in history as they maintain a focus on the coronavirus’ spread and details of the government’s stimulus measures. Most investors have already.

March 25, 2020

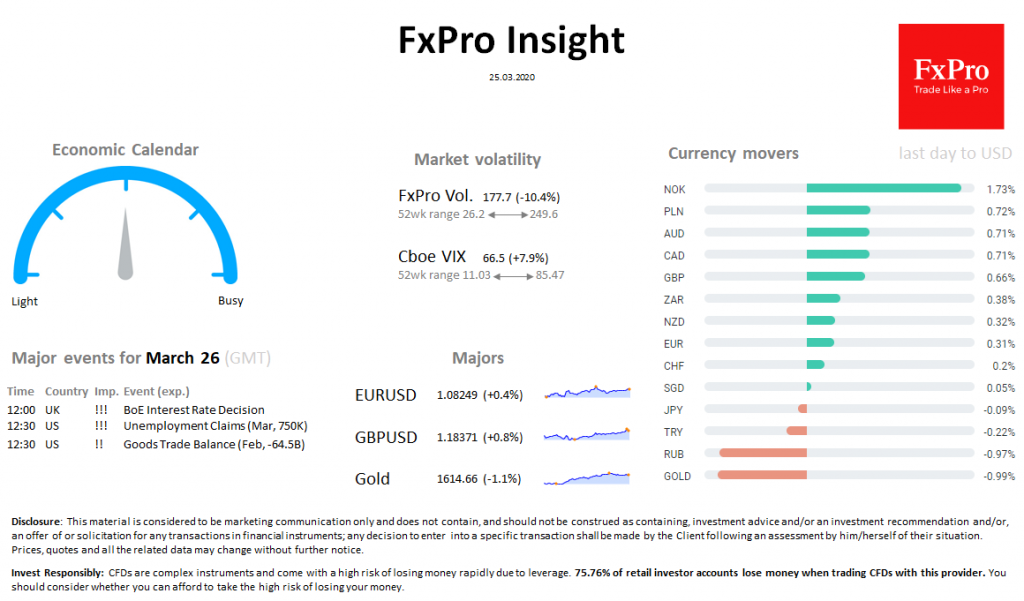

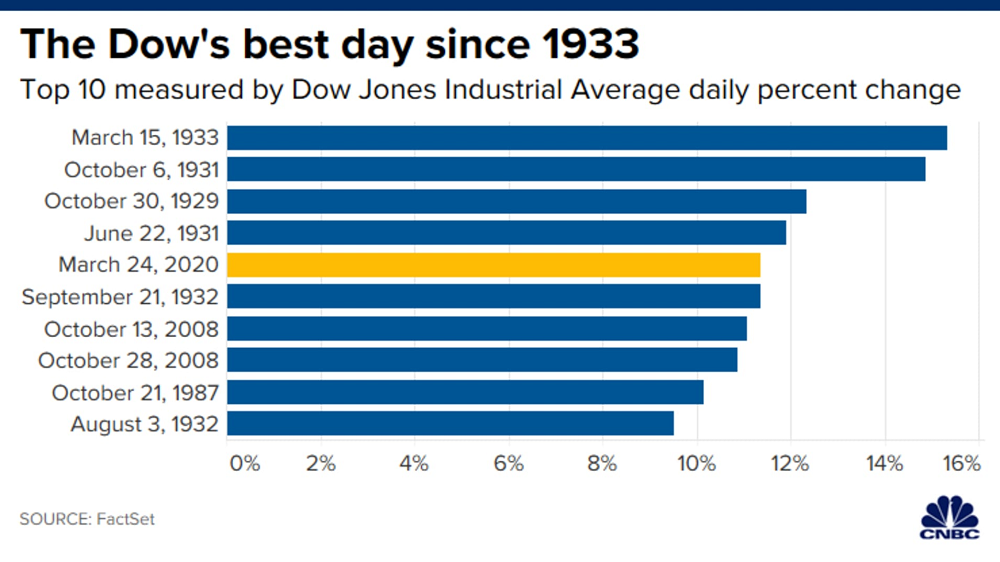

Market overview US markets paused growth on Wednesday after jumping 9.4% SPX on Tuesday (strongest since 2008). Despite large-scale stimulus, it is difficult for major indexes to demonstrate back-to-back growth. SPX -1.0%, FTSE100 + 2.0%, EuroStoxx50 -0.4%. DXY is falling.

March 25, 2020

The analogies with the times of the Great Depression are still with us. The American market spiked yesterday by 9.4% on the S&P 500 and by 11.4% on Dow Jones. Dow showed its largest one-day gain since 1933. It took.

March 25, 2020

Oil prices extended gains for a third session on Wednesday, rising alongside broader financial markets on hopes Washington will soon approve a massive aid package to stem the economic impact of the coronavirus pandemic. U.S. crude touched a high of.

March 25, 2020

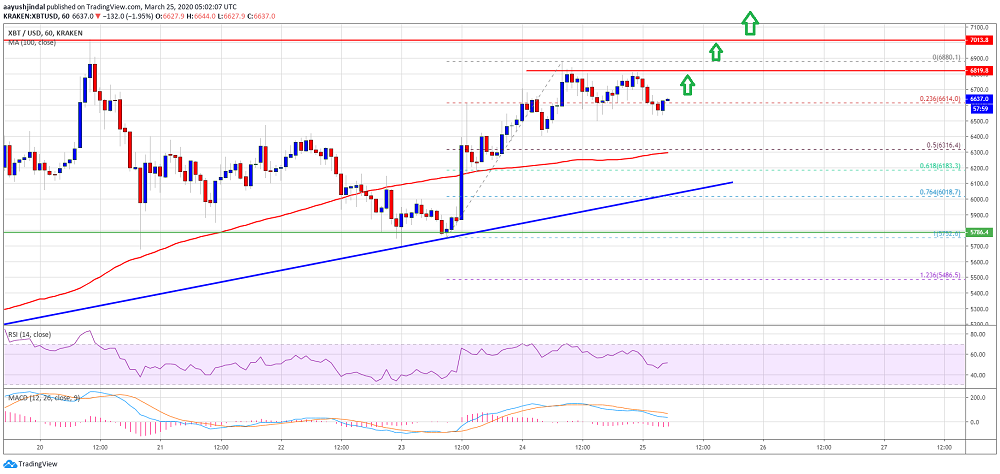

After a successful break above the $6,500 resistance, bitcoin extended its rise above $6,700 against the US Dollar. BTC price broke the $6,800 resistance and settled above the 100 hourly simple moving average. A high is formed near $6,880 and.

March 25, 2020

Traders around the world dumped the dollar in favor of risk assets as moves by U.S. leaders to support the world’s largest economy spurred relief across markets hampered by liquidity strains. The Bloomberg Dollar Spot Index declined 0.6%, ending a.

March 25, 2020

The United States could become the global epicenter of the coronavirus pandemic, the World Health Organization said on Tuesday, as India announced a full 24-hour, nationwide lockdown in the world’s second-most populous country. India joined the ranks of Britain and.

March 25, 2020

Investors hunting for safe spots to park their money should look to Asia now amid the current pandemic, analysts said, highlighting that the region is much more prepared economically to ride out the current crisis compared to the West. Additionally,.

March 25, 2020

Stock futures were positive in early Wednesday morning trading, following Tuesday’s historic rally, as the White House and Senate reached a deal on a coronavirus stimulus bill. As of around 2:43 a.m. ET, futures on the Dow Jones Industrial Average.